Question: Struggling with the standard deviation. - O X cob-principles_of_managerial_finance_14e (4).pdf (SECURED) - Adobe Acrobat Reader DC File Edit View Window Help Home Tools cob-principles_of_.. *

Struggling with the standard deviation.

Struggling with the standard deviation.

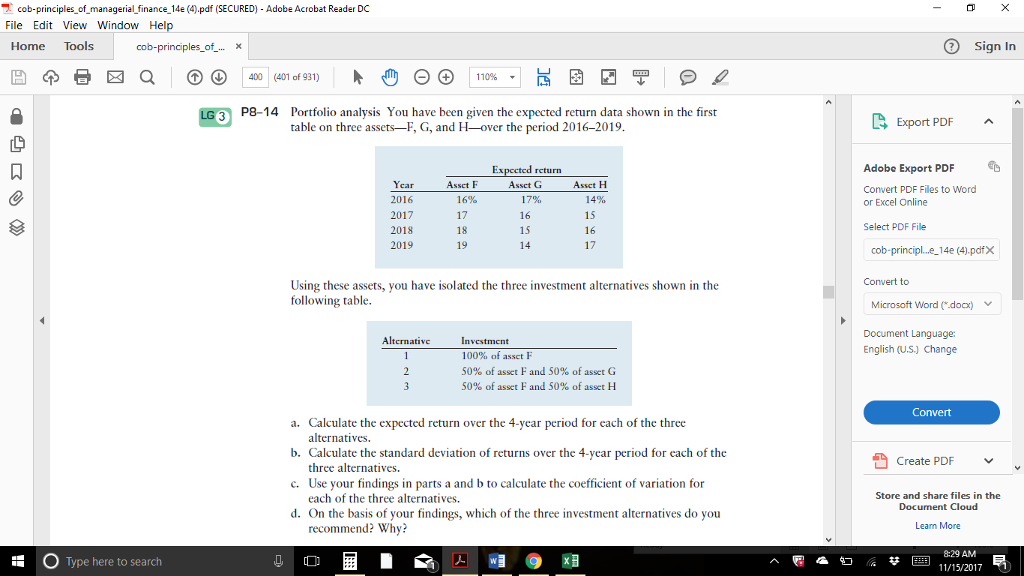

- O X cob-principles_of_managerial_finance_14e (4).pdf (SECURED) - Adobe Acrobat Reader DC File Edit View Window Help Home Tools cob-principles_of_.. * A + B P Q O 400 1401 of 931) * M @ @ 10% - 9 3 = 9 g O Sign In LG 3 P814 Portfolio analysis You have been given the expected return data shown in the first table on three assetsF, G, and Hover the period 20162019. A Export PDF a 0 a 0 M Assct F 16% Adobe Export PDF Convert PDF files to word or Excel Online Ycar 2016 2017 2018 2019 Expected return Assct G Assct H 17% 14% 15 16 14 17 Select PDF file 19 cob-principle_14e (4).pdf X Using these assets, you have isolated the three investment alternatives shown in the following table. Convert to Microsoft Word (*.docx) v Document Language: English (U.S.) Change Alternative Investment 100% of assct F 50% of asset F and 50% of asset G 50% of asset F and 50% of asset H Convert a Create PDF a. Calculate the expected return over the 4-year period for each of the three alternatives. b. Calculate the standard deviation of returns over the 4-year period for each of the three alternatives. c. Use your findings in parts a and b to calculate the coefficient of variation for each of the three alternatives. d. On the basis of your findings, which of the three investment alternatives do you recommend? Why? O E I SAMA O XA Store and share files in the Document Cloud Learn More O Type here to search 8:29 AMI a e a 40 % # 3 11/15/2017 R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts