Question: Stuck on question #4 BBB's uhimate cost basis for the property would be: A) $220,000 B) $240,000 C) $260,000 D) $290,000 E) None of the

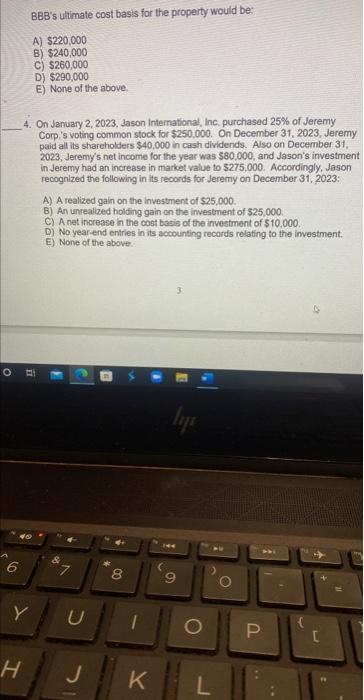

BBB's uhimate cost basis for the property would be: A) $220,000 B) $240,000 C) $260,000 D) $290,000 E) None of the above. 4. On January 2, 2023, Jason International, Inc, purchased 25% of Jeremy Corp's voting common stock for $250,000. On December 31, 2023, Jeremy paid all its shareholders $40,000 in cash dividends. Also on December 31 , 2023 , Jeremy's net income for the year was $80,000, and Jason's investment in Jeremy had an increase in market value to $275,000. Accordingly, Jason recognized the following in its records for Jeremy on December 31, 2023: A) A realized gain on the investment of $25,000. B) An unrealized hoiding gain on the imvestment of $25,000. C) A net increase in the cost basis of the investment of $10,000. D) No year-end entries in its accounting records relating to the investment. E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts