Question: Stuck on the red boxes. Need help finding them please. Will rate! (1 pt) Consider a European-style call option with price given by the Black-Scholes

Stuck on the red boxes. Need help finding them please. Will rate!

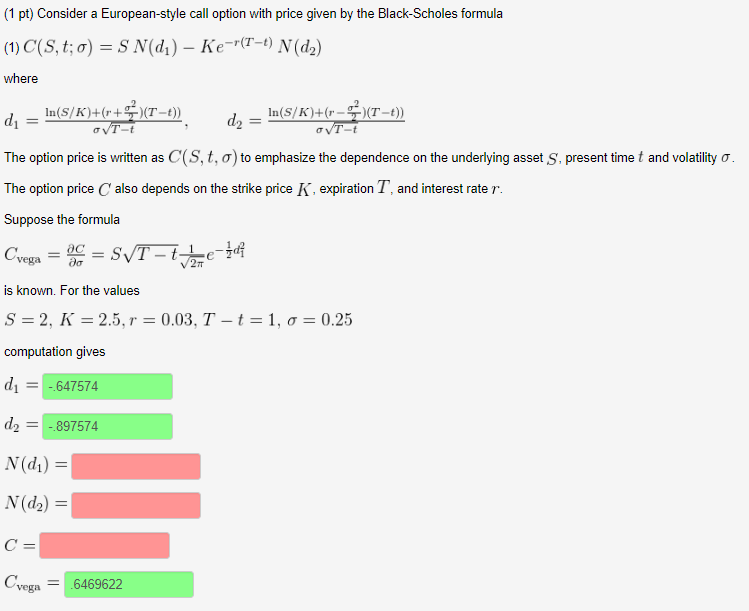

(1 pt) Consider a European-style call option with price given by the Black-Scholes formula (1) C(S, t; ?)-SN(4)-Ke-r(T-t) N (d2) where d, = In(S/ K)+(r+ -)(T-t)) The option price is written as C(S, t, ? to emphasize the dependence on the underlying asset S, present time t and volatility ? The option price C also depends on the strike price K, expiration T, and interest rate r Suppose the formula In(S/K)+(r-(T-t)) vega-do is known. For the values S-2, K = 2.5, r-0.03, T-t-1, ? computation gives d647574 d2 897574 N (d) = N(d2) c= Cvega6469622 0.25

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock