Question: Stuck on this. Need help understanding how it is found as well. Erica, who has no other sales or exchanges and no non ecaptured Sec

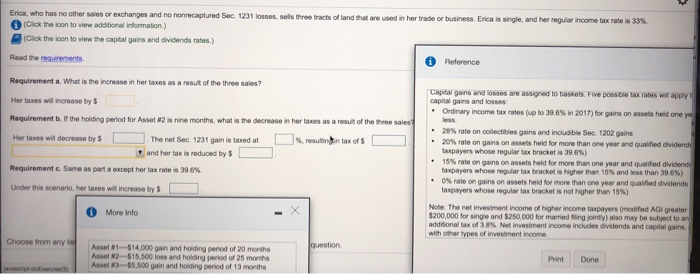

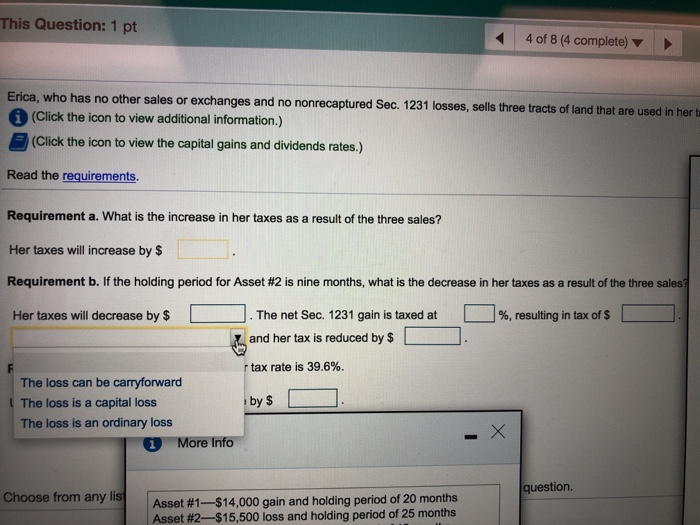

Erica, who has no other sales or exchanges and no non ecaptured Sec 1231 losses. sets three tadsofland that are and n her trade or busness Enca a srpesa her segur non anasss (Click the icon to view additional information.) (Click the icon to view the capital gains and dividends rates) Read the requirements Requirement a. What is the increase in her taxes as a result of the three sales? Her taxes wll ncrease by T Reference Captal gans and losses are assigned to baskets. Five possible tax rates will apply capta gains and losses: Ordnary income tax rates (up to 39 6% in 2017)for gains on assets held one ye Requirement b. If the holding penod for Asset #2 is nne months, what is the decrease in her taxes as a resuit of the three sales 26% rate on collectities gans ard neu stie Sec 1202 gains 20% rate on gans on assets held for more than on, yoar and qualfied dividend taxpayers whose regular tax bracket is 39 6%) 15% rate on gans on assets held for more than one year and qualifed dividend taxpayers whose lar tax bracket is higher than 15% and less than 39 6%) 0%rate on gains on assets held for more than one year and oane dosends taxpayers whose regular tax bracket is not ngher than 15%) . . The net Sec. 1231 gain is taxed atresulin in tax of s and her tax is reduced by $ Her taxes will decrease by " * Requirement c. Sarme as part a encept her ta rate is 39 6%, . Under this scenario, her taxes will increase by Note: The net investment income of higher income taxpayers (modified AGI greater $200,000 for single and S25COO for manned Sing jointy) also may be subject to ar additonal tax of 3 8% Net r vesment iore includes dividends and capital gains, with other types of investment income More Info question sset 1-$14,000 gain and hoiding period of 20 months Asset N2-$15,500 loss and holding period of 25 months Asset 3-55,500 gain and holding period of 13 months Print Done This Question: 1 pt 4018(4 complete) Erica, who has no other sales or exchanges and no nonrecaptured Sec. 1231 losses, sel i (Click the icon to view additional information.) s three tracts of land that are used in her t (Click the icon to view the capital gains and dividends rates.) Read the requirements Requirement a. What is the increase in her taxes as a result of the three sales? Her taxes will increase by $ Requirement b. If the holding period for Asset #2 is nine months, what is the decrease in her taxes as a result of the three sales Her taxes will decrease by $ The net Sec. 1231 gain is taxed at and her tax is reduced by $ r tax rate is 39.6%. by $ 96, resulting in tax of $ The loss can be carryforward The loss is a capital loss The loss is an ordinary loss ore InfO question. Choose from any lis| | Asset #1-$14,000 gain and holding period of 20 months Asset #2-$15,500 loss and holding period of 25 months Erica, who has no other sales or exchanges and no non ecaptured Sec 1231 losses. sets three tadsofland that are and n her trade or busness Enca a srpesa her segur non anasss (Click the icon to view additional information.) (Click the icon to view the capital gains and dividends rates) Read the requirements Requirement a. What is the increase in her taxes as a result of the three sales? Her taxes wll ncrease by T Reference Captal gans and losses are assigned to baskets. Five possible tax rates will apply capta gains and losses: Ordnary income tax rates (up to 39 6% in 2017)for gains on assets held one ye Requirement b. If the holding penod for Asset #2 is nne months, what is the decrease in her taxes as a resuit of the three sales 26% rate on collectities gans ard neu stie Sec 1202 gains 20% rate on gans on assets held for more than on, yoar and qualfied dividend taxpayers whose regular tax bracket is 39 6%) 15% rate on gans on assets held for more than one year and qualifed dividend taxpayers whose lar tax bracket is higher than 15% and less than 39 6%) 0%rate on gains on assets held for more than one year and oane dosends taxpayers whose regular tax bracket is not ngher than 15%) . . The net Sec. 1231 gain is taxed atresulin in tax of s and her tax is reduced by $ Her taxes will decrease by " * Requirement c. Sarme as part a encept her ta rate is 39 6%, . Under this scenario, her taxes will increase by Note: The net investment income of higher income taxpayers (modified AGI greater $200,000 for single and S25COO for manned Sing jointy) also may be subject to ar additonal tax of 3 8% Net r vesment iore includes dividends and capital gains, with other types of investment income More Info question sset 1-$14,000 gain and hoiding period of 20 months Asset N2-$15,500 loss and holding period of 25 months Asset 3-55,500 gain and holding period of 13 months Print Done This Question: 1 pt 4018(4 complete) Erica, who has no other sales or exchanges and no nonrecaptured Sec. 1231 losses, sel i (Click the icon to view additional information.) s three tracts of land that are used in her t (Click the icon to view the capital gains and dividends rates.) Read the requirements Requirement a. What is the increase in her taxes as a result of the three sales? Her taxes will increase by $ Requirement b. If the holding period for Asset #2 is nine months, what is the decrease in her taxes as a result of the three sales Her taxes will decrease by $ The net Sec. 1231 gain is taxed at and her tax is reduced by $ r tax rate is 39.6%. by $ 96, resulting in tax of $ The loss can be carryforward The loss is a capital loss The loss is an ordinary loss ore InfO question. Choose from any lis| | Asset #1-$14,000 gain and holding period of 20 months Asset #2-$15,500 loss and holding period of 25 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts