Question: stuck on this question, any help is appreciated! Exercise 4-10A (Algo) Effect of product cost and period cost: Horizontal financial statements model LO 4.2, 4.4

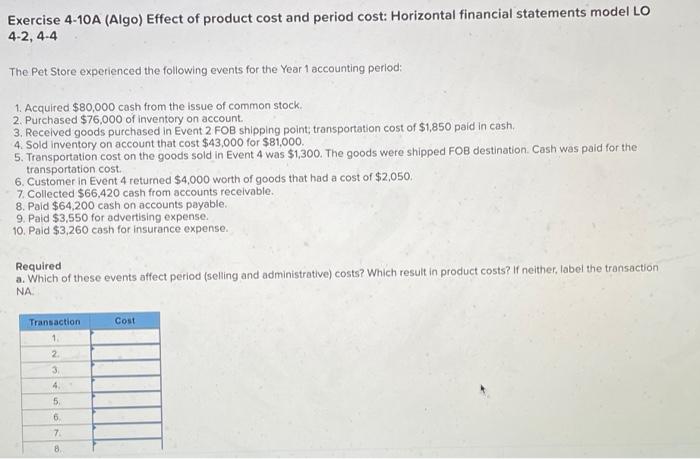

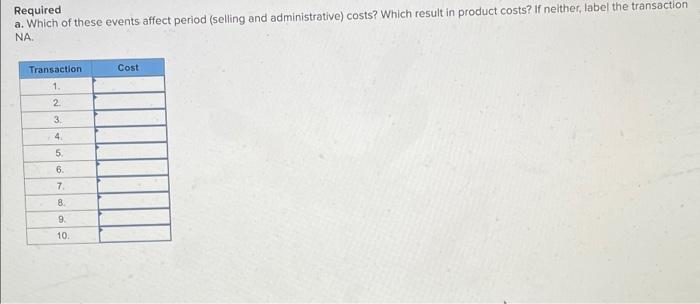

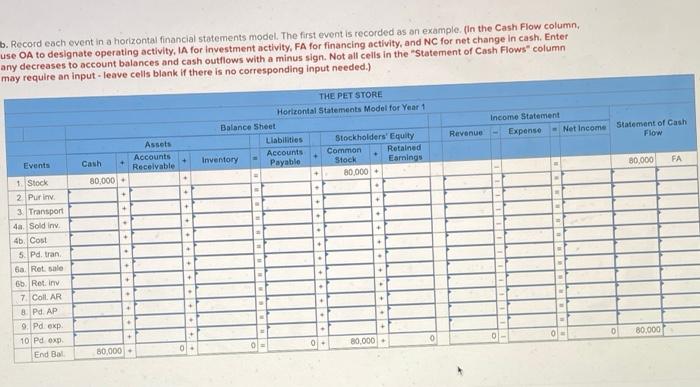

Exercise 4-10A (Algo) Effect of product cost and period cost: Horizontal financial statements model LO 4.2, 4.4 The Pet Store experienced the following events for the Year 1 accounting period: 1. Acquired $80,000 cash from the issue of common stock, 2. Purchased $76,000 of inventory on account. 3. Received goods purchased in Event 2 FOB shipping point, transportation cost of $1,850 pold in cash, 4. Sold inventory on account that cost $43,000 for $81,000. 5. Transportation cost on the goods sold in Event 4 was $1,300. The goods were shipped FOB destination. Cash was paid for the transportation cost. 6. Customer in Event 4 returned $4,000 worth of goods that had a cost of $2,050. 7. Collected $66,420 cash from accounts receivable. 8. Pald $64,200 cash on accounts payable, 9. Paid $3,550 for advertising expense. 10. Paid $3,260 cash for insurance expense. Required a. Which of these events affect period (selling and administrative) costs? Which result in product costs? If neither, label the transaction NA Cost Transaction 1 2 3 4 5 6 7 8 Required a. Which of these events affect period (selling and administrative) costs? Which result in product costs? If neither, label the transaction NA Transaction Cost 1. 2 3 4. 5 6 7 8 9 10 b. Record each event in a horizontal financial statements model. The first event is recorded as an example (In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity, and NC for net change in cash. Enter any decreases to account balances and cash outflows with a minus sign. Not all cells in the Statement of Cash Flows column may require an input - leave cells blank if there is no corresponding Input needed.) THE PET STORE Horizontal Statements Model for Year 1 Balance Sheet Llabilities Stockholders' Equity Accounts Common Retained Inventory Payable Stock Earnings 80.000 Income Statement - Expense - Net Income Statement of Cash Flow Revenue Assets Accounts Receivable Events FA Cash 80,000 80.000 + 1. Stock 2 Purin 3. Transport 4a. Sold in 4. Cost 5.Pd. tran sa Ret sale 6. Retiny 7 Coll. AR 8. Pd. AP 9. Pd exp 10 Pd op End Bal + + 0 80,000 0 80,000+ 80.000 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts