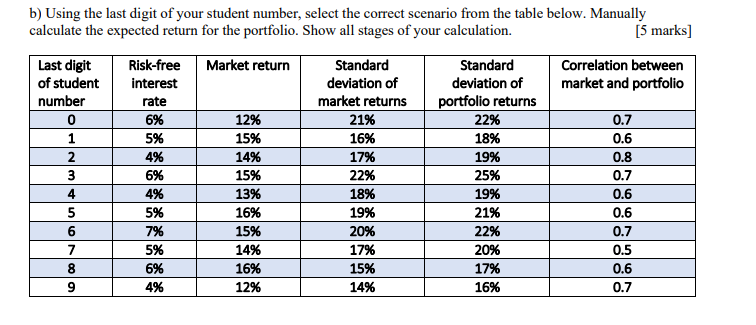

Question: student number is 5 0.7 b) Using the last digit of your student number, select the correct scenario from the table below. Manually calculate the

student number is 5

![calculation. [5 marks] Last digit Risk-free Market return Standard Standard Correlation between](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6700dbf742c4f_5586700dbf6e636b.jpg)

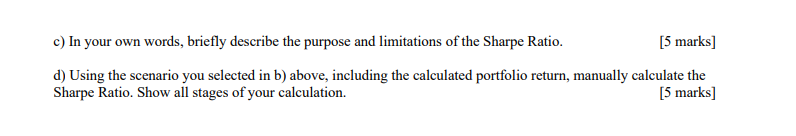

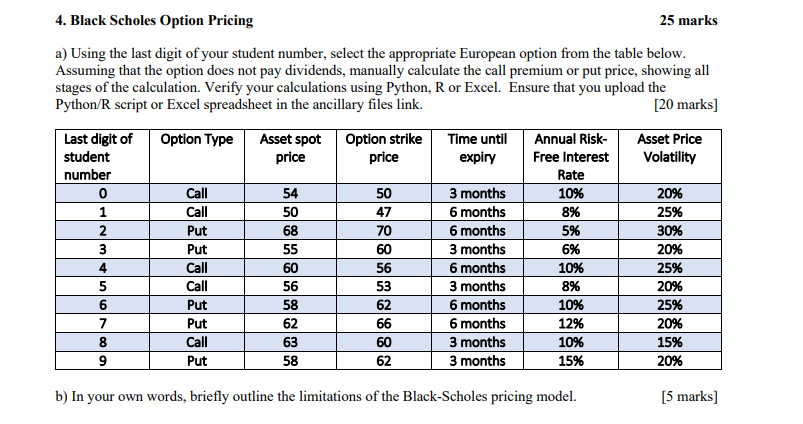

0.7 b) Using the last digit of your student number, select the correct scenario from the table below. Manually calculate the expected return for the portfolio. Show all stages of your calculation. [5 marks] Last digit Risk-free Market return Standard Standard Correlation between of student interest deviation of deviation of market and portfolio number rate market returns portfolio returns 0 6% 12% 21% 22% 1 5% 15% 16% 18% 0.6 2 4% 14% 17% 19% 0.8 3 6% 15% 22% 25% 0.7 4 4% 13% 18% 19% 0.6 5 5% 16% 19% 21% 0.6 6 7% 15% 209 22% 0.7 7 5% 14% 17% 20% 0.5 8 6% 16% 15% 17% 0.6 9 4% 12% 14% 16% 0.7 c) In your own words, briefly describe the purpose and limitations of the Sharpe Ratio. [5 marks] d) Using the scenario you selected in b) above, including the calculated portfolio return, manually calculate the Sharpe Ratio. Show all stages of your calculation. [5 marks] 4. Black Scholes Option Pricing 25 marks a) Using the last digit of your student number, select the appropriate European option from the table below. Assuming that the option does not pay dividends, manually calculate the call premium or put price, showing all stages of the calculation. Verify your calculations using Python, R or Excel. Ensure that you upload the Python/R script or Excel spreadsheet in the ancillary files link. [20 marks] Option Type Asset spot price Option strike price Time until expiry Annual Risk- Free Interest Rate 10% Asset Price Volatility Call Call 8% Last digit of student number 0 1 2 3 4 5 6 7 8 9 Put Put Call 54 50 68 55 60 56 58 62 63 58 50 47 70 60 56 53 62 66 60 62 3 months 6 months 6 months 3 months 6 months 3 months 6 months 6 months 3 months 3 months Call 20% 25% 30% 20% 25% 20% 25% 20% 15% 20% 5% 6% 10% 8% 10% 12% 10% 15% Put Put Call Put b) In your own words, briefly outline the limitations of the Black-Scholes pricing model. [5 marks) Ticker Symbol Ticker Symbol Last digit of student number 0 1 2 3 4 MSFT JNJ PRU NXT TSLA Last digit of student number 5 6 7 8 9 ABBV NVDA OCDO ULVR AMZN 0.7 b) Using the last digit of your student number, select the correct scenario from the table below. Manually calculate the expected return for the portfolio. Show all stages of your calculation. [5 marks] Last digit Risk-free Market return Standard Standard Correlation between of student interest deviation of deviation of market and portfolio number rate market returns portfolio returns 0 6% 12% 21% 22% 1 5% 15% 16% 18% 0.6 2 4% 14% 17% 19% 0.8 3 6% 15% 22% 25% 0.7 4 4% 13% 18% 19% 0.6 5 5% 16% 19% 21% 0.6 6 7% 15% 209 22% 0.7 7 5% 14% 17% 20% 0.5 8 6% 16% 15% 17% 0.6 9 4% 12% 14% 16% 0.7 c) In your own words, briefly describe the purpose and limitations of the Sharpe Ratio. [5 marks] d) Using the scenario you selected in b) above, including the calculated portfolio return, manually calculate the Sharpe Ratio. Show all stages of your calculation. [5 marks] 4. Black Scholes Option Pricing 25 marks a) Using the last digit of your student number, select the appropriate European option from the table below. Assuming that the option does not pay dividends, manually calculate the call premium or put price, showing all stages of the calculation. Verify your calculations using Python, R or Excel. Ensure that you upload the Python/R script or Excel spreadsheet in the ancillary files link. [20 marks] Option Type Asset spot price Option strike price Time until expiry Annual Risk- Free Interest Rate 10% Asset Price Volatility Call Call 8% Last digit of student number 0 1 2 3 4 5 6 7 8 9 Put Put Call 54 50 68 55 60 56 58 62 63 58 50 47 70 60 56 53 62 66 60 62 3 months 6 months 6 months 3 months 6 months 3 months 6 months 6 months 3 months 3 months Call 20% 25% 30% 20% 25% 20% 25% 20% 15% 20% 5% 6% 10% 8% 10% 12% 10% 15% Put Put Call Put b) In your own words, briefly outline the limitations of the Black-Scholes pricing model. [5 marks) Ticker Symbol Ticker Symbol Last digit of student number 0 1 2 3 4 MSFT JNJ PRU NXT TSLA Last digit of student number 5 6 7 8 9 ABBV NVDA OCDO ULVR AMZN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts