Question: select number 5 2. Value at Risk 15 marks a) Using the last digit of your student number, select the correct two-asset portfolio from the

select number 5

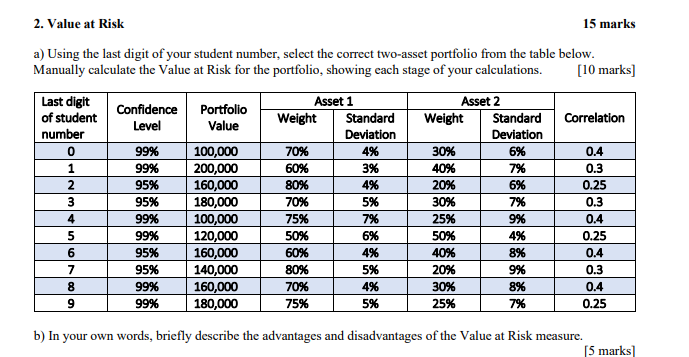

2. Value at Risk 15 marks a) Using the last digit of your student number, select the correct two-asset portfolio from the table below. Manually calculate the Value at Risk for the portfolio, showing each stage of your calculations. [10 marks] Last digit Asset 1 Portfolio Confidence Asset 2 of student Level Weight Standard Standard Weight Value Correlation number Deviation Deviation 0 99% 100,000 70% 4% 30% 6% 0.4 1 99% 200,000 60% 3% 40% 7% 0.3 2 95% 160,000 80% 4% 20% 6% 0.25 3 95% 180,000 70% 5% 30% 7% 0.3 4 99% 100,000 75% 7% 25% 9% 0.4 5 99% 120,000 50% 6% 50% 4% 0.25 6 95% 160,000 60% 4% 40% 8% 0.4 7 95% 140,000 80% 5% 20% 9% 0.3 8 99% 160,000 70% 4% 30% 8% 0.4 9 99% 180,000 75% 5% 25% 7% 0.25 b) In your own words, briefly describe the advantages and disadvantages of the Value at Risk measure. [5 marks] 2. Value at Risk 15 marks a) Using the last digit of your student number, select the correct two-asset portfolio from the table below. Manually calculate the Value at Risk for the portfolio, showing each stage of your calculations. [10 marks] Last digit Asset 1 Portfolio Confidence Asset 2 of student Level Weight Standard Standard Weight Value Correlation number Deviation Deviation 0 99% 100,000 70% 4% 30% 6% 0.4 1 99% 200,000 60% 3% 40% 7% 0.3 2 95% 160,000 80% 4% 20% 6% 0.25 3 95% 180,000 70% 5% 30% 7% 0.3 4 99% 100,000 75% 7% 25% 9% 0.4 5 99% 120,000 50% 6% 50% 4% 0.25 6 95% 160,000 60% 4% 40% 8% 0.4 7 95% 140,000 80% 5% 20% 9% 0.3 8 99% 160,000 70% 4% 30% 8% 0.4 9 99% 180,000 75% 5% 25% 7% 0.25 b) In your own words, briefly describe the advantages and disadvantages of the Value at Risk measure. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts