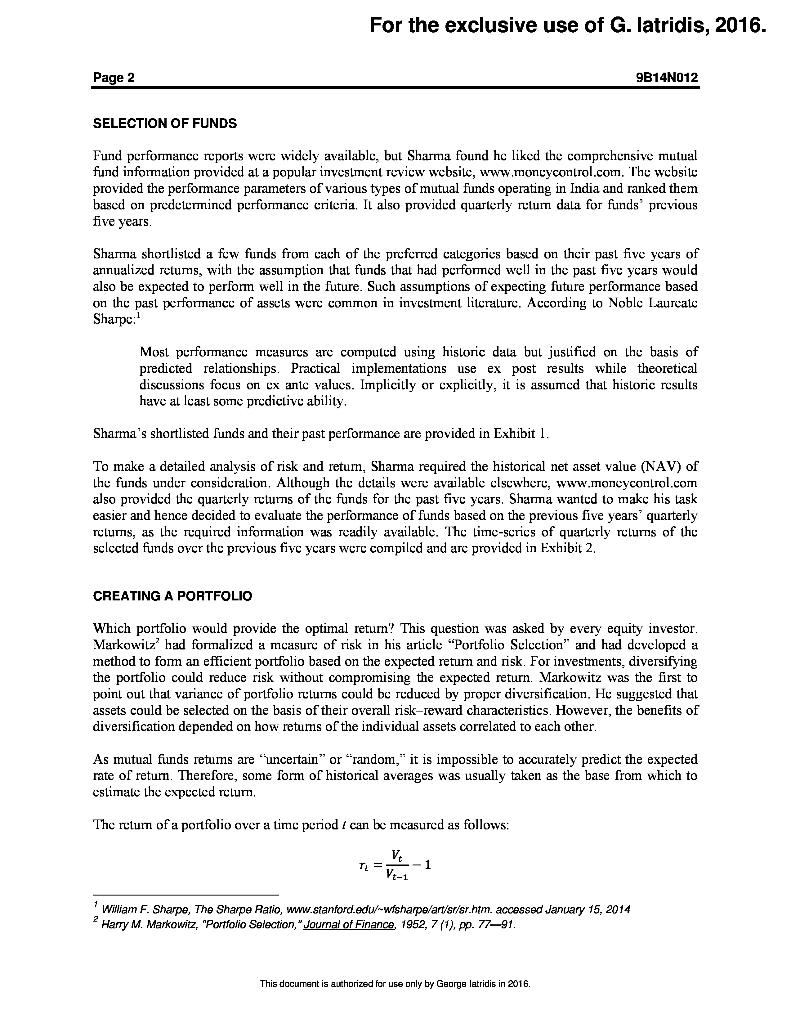

Question: Students should read the Harvard Business School case study entitled 'Investments: Delineating an Efficient Portfolio' and answer the following questions. Students should note that the

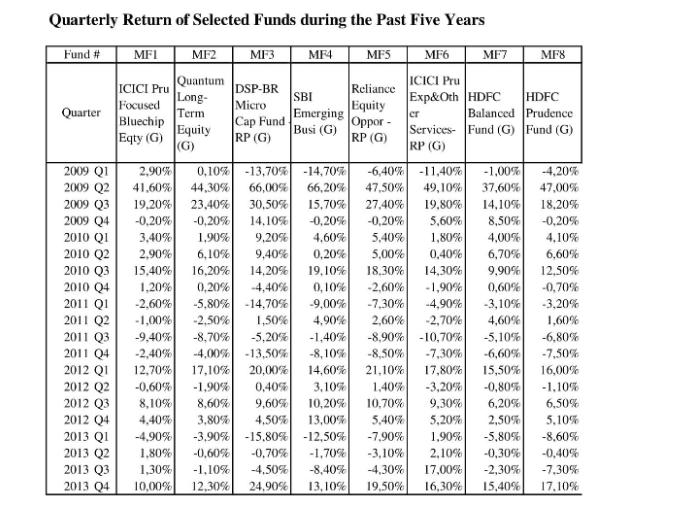

Students should read the Harvard Business School case study entitled 'Investments: Delineating an Efficient Portfolio' and answer the following questions. Students should note that the risk of the portfolio should not be more than 10% per year. Students should use the dataset in the Stock Spreadsheet for their calculations.

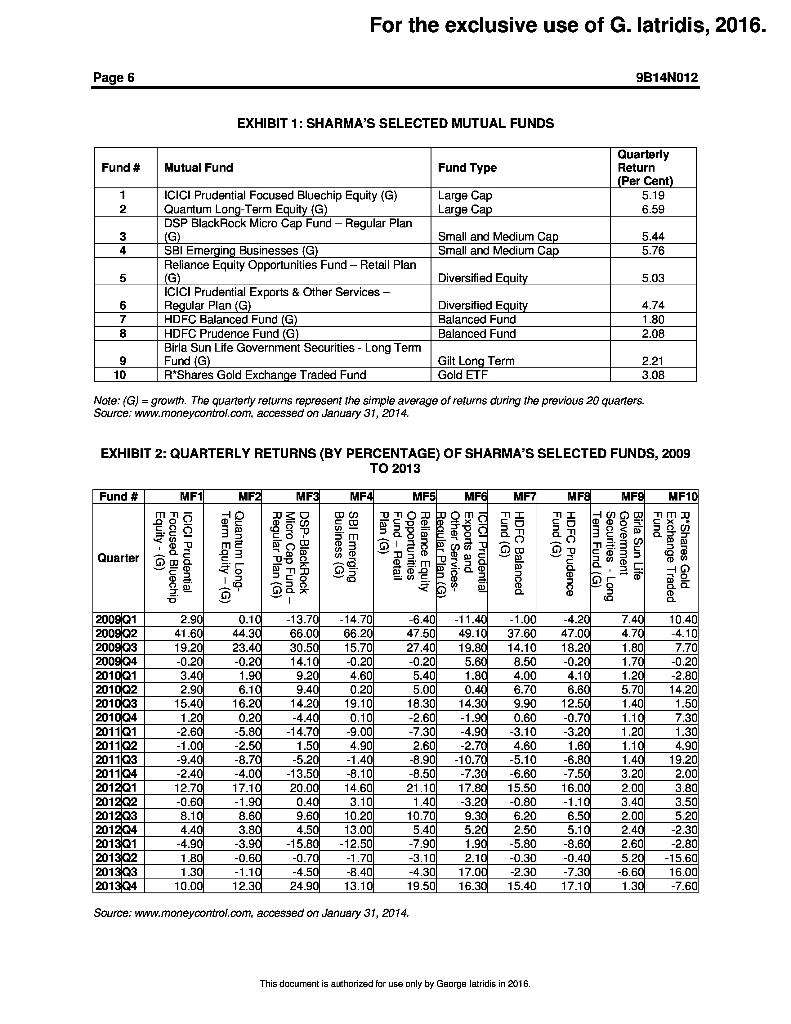

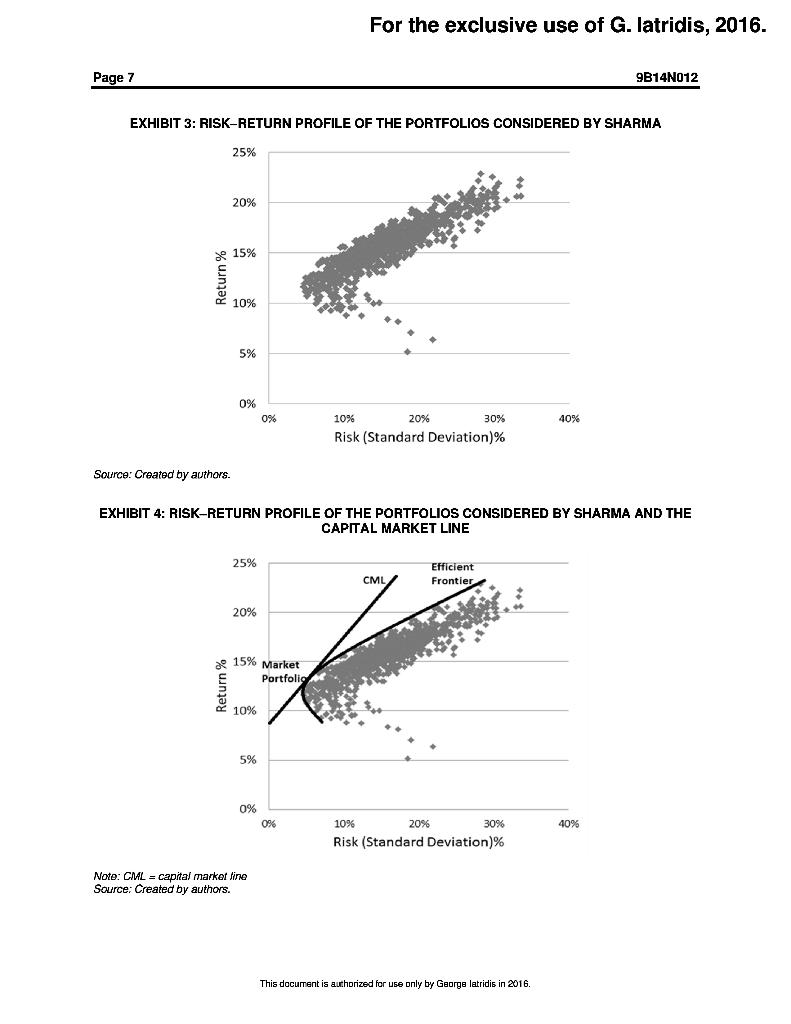

Key contextual elements should include risk diversification, portfolio theory, efficient frontier, Sharpe ratio, correlation analysis, risk and return.

General instructions:

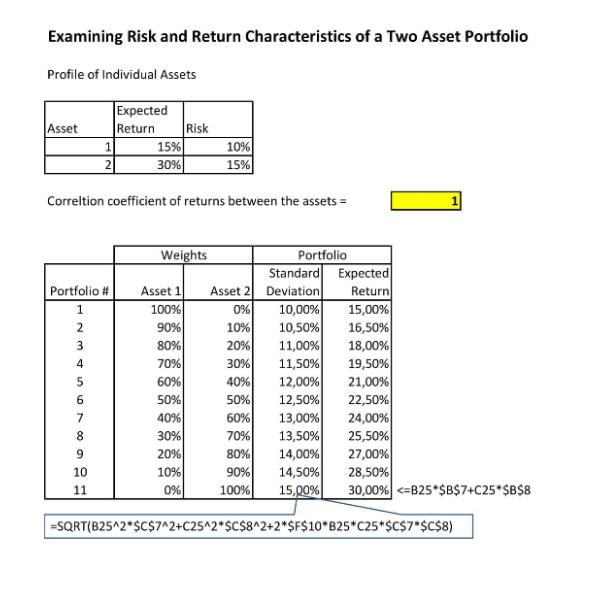

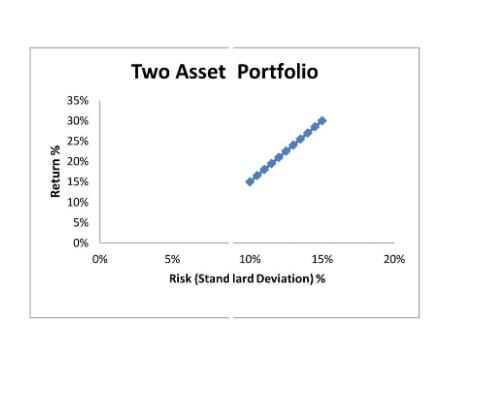

o Make a two-asset portfolio and examine how risk is diversified.

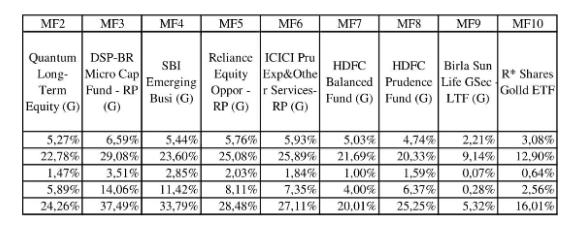

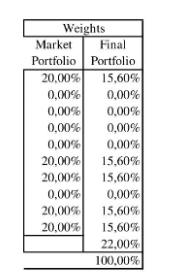

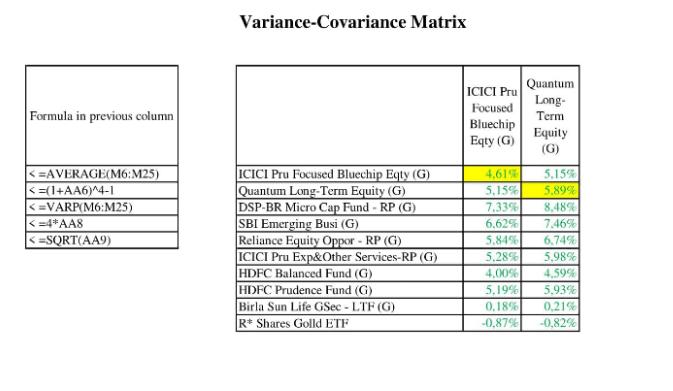

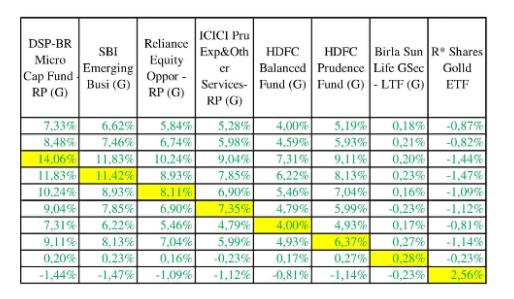

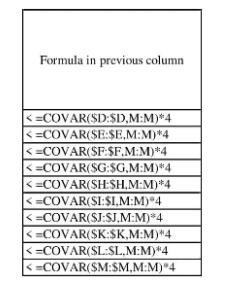

o Make an efficient multiple-asset portfolio.

o Make an efficient multiple-asset portfolio and analyze the effect of adding a risk-free asset to a portfolio containing risky assets.

Examining Risk and Return Characteristics of a Two Asset Portfolio Profile of Individual Assets Asset Portfolio # 1 NI 2 Correltion coefficient of returns between the assets = HHLAS5E 1 10 11 Expected Return Risk 15% 30% Weights 10% 15% Asset 1 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Portfolio Standard Expected Asset 2 Deviation Return 0% 10,00% 15,00% 10% 10,50% 16,50% 20% 11,00% 18,00% 30% 11,50% 19,50% 40% 12,00% 21,00% 50% 12,50% 22,50% 60% 13,00% 24,00% 70% 13,50% 25,50% 80% 14,00% 27,00% 90% 14,50% 28,50% 100% 15,00% 30,00%

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Make a twoasset put folis and examine how risk is diversified x and Xe will be the ... View full answer

Get step-by-step solutions from verified subject matter experts