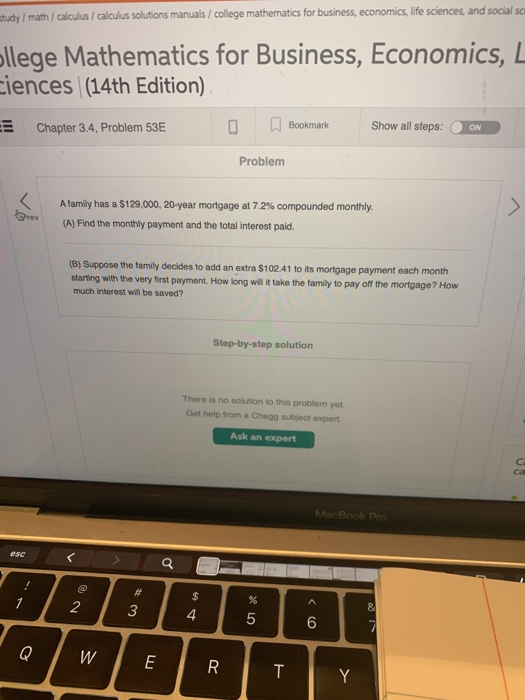

Question: study / math / calculus / calculus solutions manuals/college mathematics for business, economics, life sciences, and social scu bllege Mathematics for Business, Economics, L iences

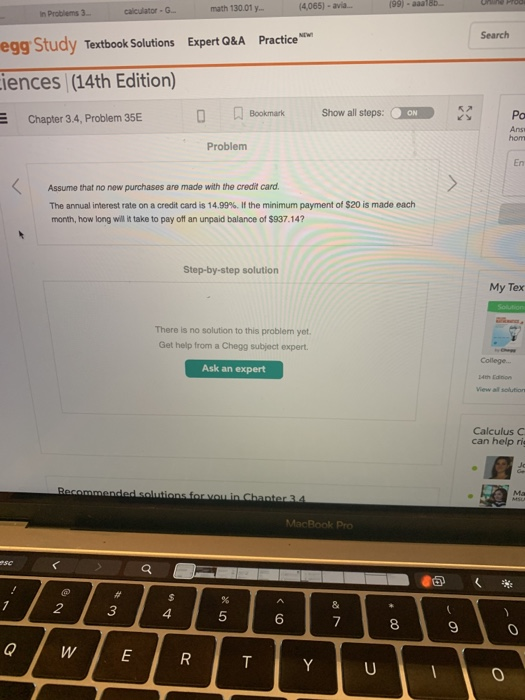

study / math / calculus / calculus solutions manuals/college mathematics for business, economics, life sciences, and social scu bllege Mathematics for Business, Economics, L iences (14th Edition) Show all steps: ON Bookmark Chapter 3.4, Problem 53E Problem A family has a $129,000, 20-year mortgage at 7.2 % compounded monthly. (A) Find the monthly payment and the total interest paid. (B) Suppose the family decides to add an extra $102.41 to its mortgage payment each month starting with the very first payment. How long will it take the family to pay off the mortgage? How much interest will be saved? Step-by-step solution There is no solution to this problem yet. Get help from a Chegg subject expert Ask an expert C ca MacBook Pro esc $ % 2 3 4 5 Q W R Y CO T (99)-aaal8b. Online Pr0 (4,065)-avia.. math 130.01 y... calculator- G In Problems 3 Search Expert Q&A Practice egg Study Textbook Solutions iences (14th Edition) Show all steps: O Bookmark ON Po Chapter 3.4, Problem 35E Answ hom Problem En Assume that no new purchases are made with the credit card The annual interest rate on a credit card is 14.99 %. If the minimum payment of $20 is made each month, how long will it take to pay off an unpaid balance of $937.14? Step-by-step solution My Tex Solutions There is no solution to this problem yet Get help from a Chegg subject expert College.. Ask an expert 14th Edinions View all solutione Calculus C can help rie Recommended solutions for you in MSLA Chanter 3 4 MacBook Pro se # & 2 3 5 6 7 Q W R Y CO st

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts