Question: Study the caselet below and answer all questions in this section. An investment analyst is conducting a study with the aim of examining the relationship

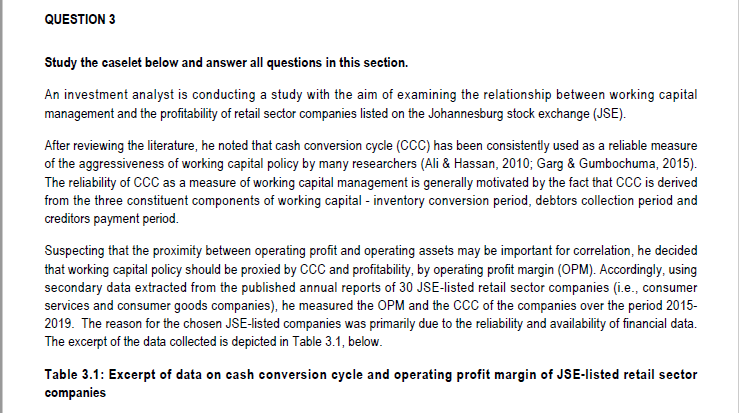

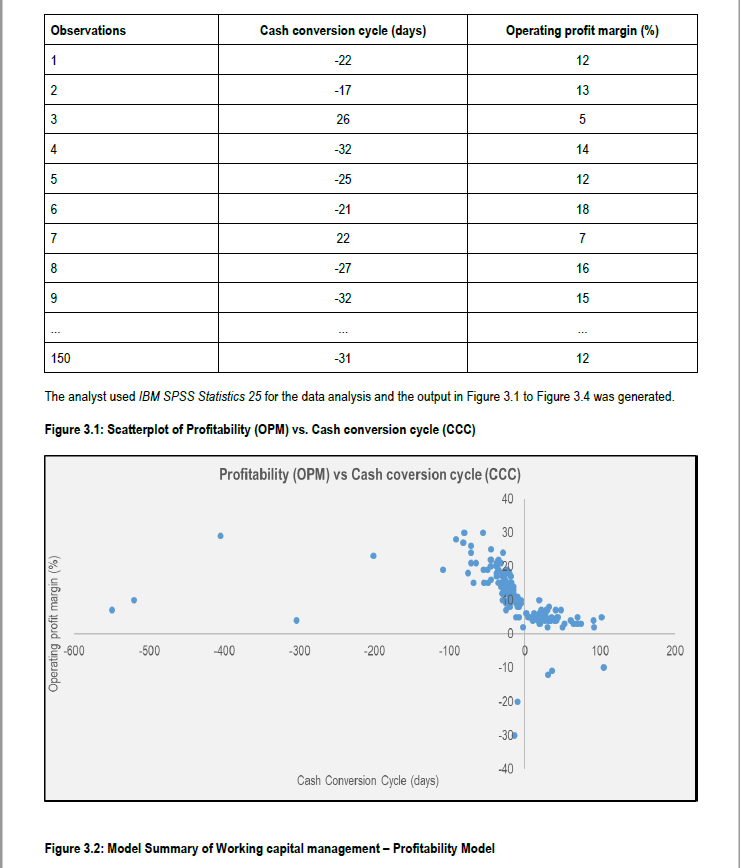

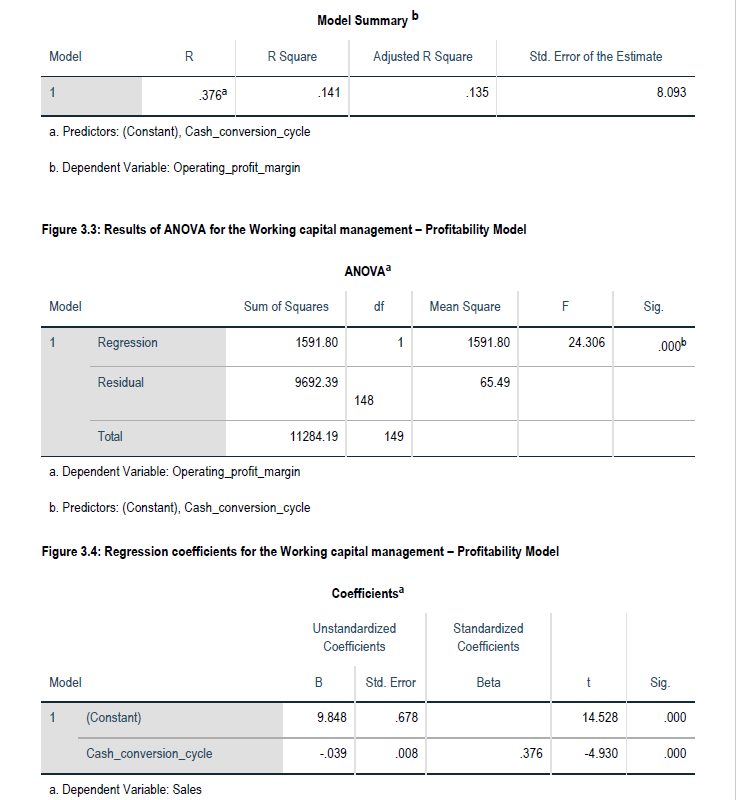

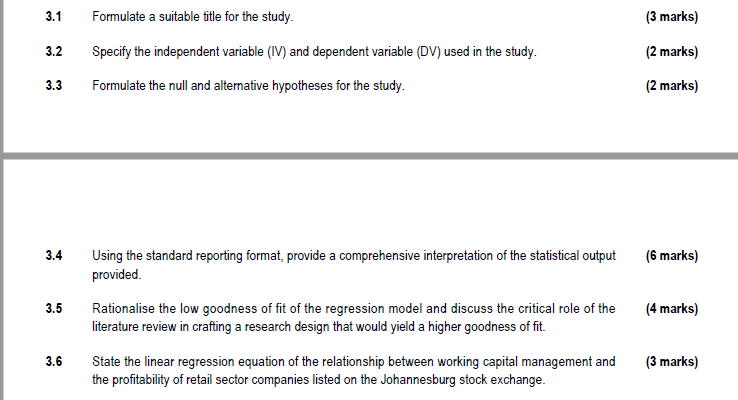

Study the caselet below and answer all questions in this section. An investment analyst is conducting a study with the aim of examining the relationship between working capital management and the profitability of retail sector companies listed on the Johannesburg stock exchange (JSE). After reviewing the literature, he noted that cash conversion cycle (CCC) has been consistently used as a reliable measure of the aggressiveness of working capital policy by many researchers (Ali \& Hassan, 2010; Garg \& Gumbochuma, 2015). The reliability of CCC as a measure of working capital management is generally motivated by the fact that CCC is derived from the three constituent components of working capital - inventory conversion period, debtors collection period and creditors payment period. Suspecting that the proximity between operating profit and operating assets may be important for correlation, he decided that working capital policy should be proxied by CCC and profitability, by operating profit margin (OPM). Accordingly, using secondary data extracted from the published annual reports of 30 JSE-listed retail sector companies (i.e., consumer services and consumer goods companies), he measured the OPM and the CCC of the companies over the period 2015 2019. The reason for the chosen JSE-listed companies was primarily due to the reliability and availability of financial data. The excerpt of the data collected is depicted in Table 3.1 , below. Table 3.1: Excerpt of data on cash conversion cycle and operating profit margin of JSE-listed retail sector companies The analyst used IBM SPSS Statistics 25 for the data analysis and the output in Figure 3.1 to Figure 3.4 was generated. Figure 3.1: Scatterplot of Profitability (OPM) vs. Cash conversion cycle (CCC) Figure 3.2: Model Summary of Working capital management - Profitability Model Model Summary b a. Predictors: (Constant), Cash_conversion_cycle b. Dependent Variable: Operating_profit_margin Figure 3.3: Results of ANOVA for the Working capital management - Profitability Model a. Dependent Variable: Operating_profit_margin b. Predictors: (Constant), Cash_conversion_cycle Figure 3.4: Regression coefficients for the Working capital management - Profitability Model 3.1 Formulate a suitable title for the study. (3 marks) 3.2 Specify the independent variable (IV) and dependent variable (DV) used in the study. (2 marks) 3.3 Formulate the null and alternative hypotheses for the study. (2 marks) 3.4 Using the standard reporting format, provide a comprehensive interpretation of the statistical output (6 marks) provided. 3.5 Rationalise the low goodness of fit of the regression model and discuss the critical role of the (4 marks) literature review in crafting a research design that would yield a higher goodness of fit. 3.6 State the linear regression equation of the relationship between working capital management and (3 marks) the profitability of retail sector companies listed on the Johannesburg stock exchange

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts