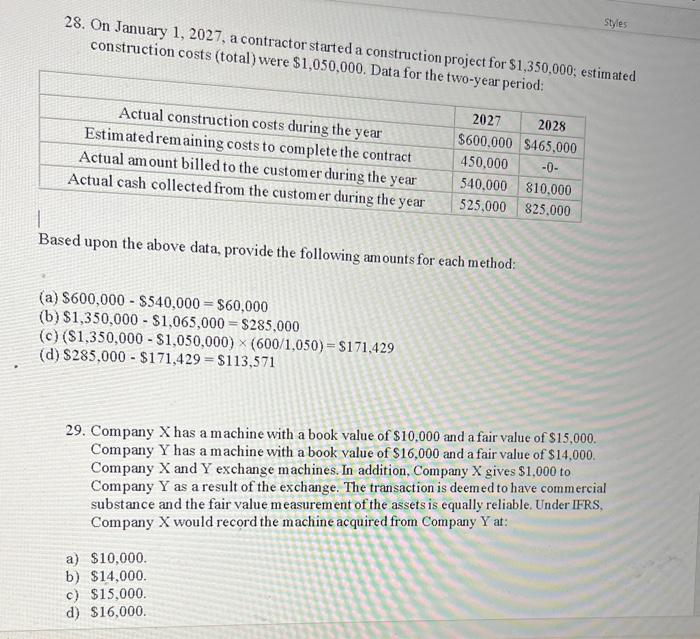

Question: Styles 28. On January 1, 2027, a contractor started a construction project for $1,350,000; estimated construction costs (total) were $1,050,000. Data for the two-year

Styles 28. On January 1, 2027, a contractor started a construction project for $1,350,000; estimated construction costs (total) were $1,050,000. Data for the two-year period: Actual construction costs during the year Estimated remaining costs to complete the contract Actual amount billed to the customer during the year Actual cash collected from the customer during the year 2027 2028 $600,000 $465,000 -0- 450,000 540,000 810,000 525,000 825,000 Based upon the above data, provide the following amounts for each method: (a) $600,000 $540,000 $60,000 (b) $1,350,000-$1,065,000 = $285,000 (c) ($1,350,000-$1,050,000) x (600/1,050) $171,429 (d) $285,000-$171,429 $113,571 29. Company X has a machine with a book value of $10,000 and a fair value of $15,000. Company Y has a machine with a book value of $16,000 and a fair value of $14,000. Company X and Y exchange machines. In addition, Company X gives $1,000 to Company Y as a result of the exchange. The transaction is deemed to have commercial substance and the fair value measurement of the assets is equally reliable. Under IFRS, Company X would record the machine acquired from Company Y at: a) $10,000. b) $14,000. c) $15,000. d) $16,000.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts