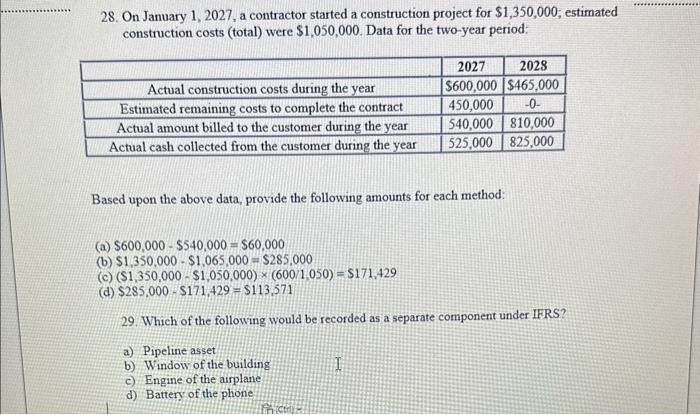

Question: 28. On January 1, 2027, a contractor started a construction project for $1,350,000; estimated construction costs (total) were $1,050,000. Data for the two-year period: Based

28. On January 1, 2027, a contractor started a construction project for $1,350,000; estimated construction costs (total) were $1,050,000. Data for the two-year period: Based upon the above data, provide the following amounts for each method: (a) $600,000$540,000=$60,000 (b) $1,350,000$1,065,000=$285,000 (c) ($1,350,000$1,050,000)(600/1,050)=$171,429 (d) $285,000$171,429=$113,571 29. Which of the following would be recorded as a separate component under IFRS? a) Pipeline asset b) Window of the building c) Engine of the airplane d) Battery of the phone

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock