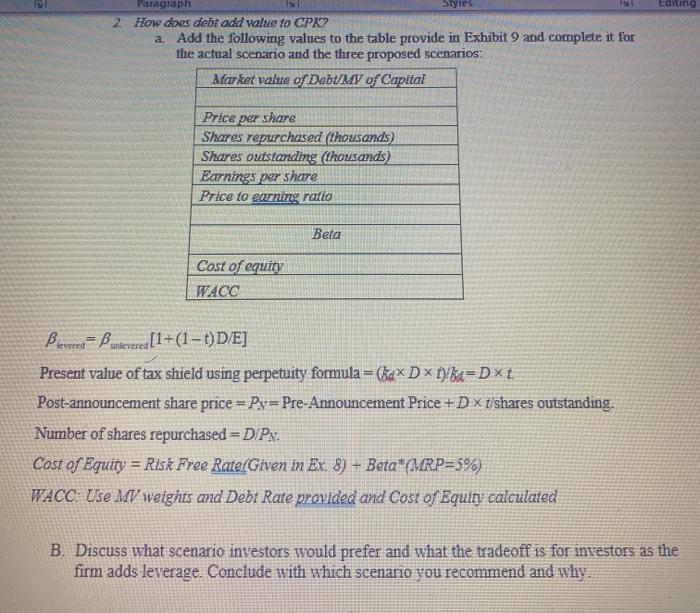

Question: Styles Editing Paragraph 2. How does debt add walue to CPKY a Add the following values to the table provide in Exhibit 9 and complete

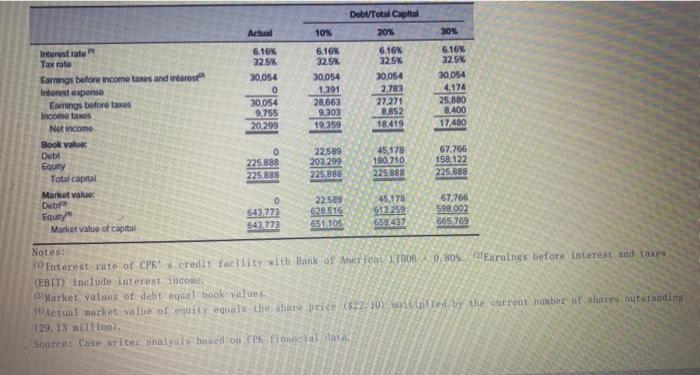

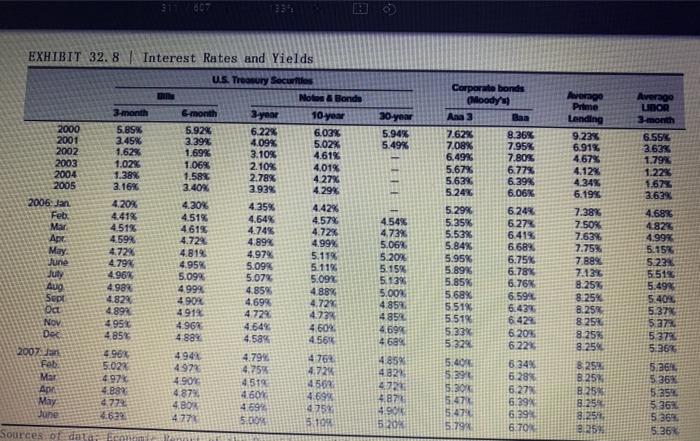

Styles Editing Paragraph 2. How does debt add walue to CPKY a Add the following values to the table provide in Exhibit 9 and complete it for the actual scenario and the three proposed scenarios: Market value of Debt/MV of Capital Price per share Shares repurchased (thousands) Shares outstanding thousands) Earnings per share Price to earning ratio Beta Cost of equity WACC Blevered= Bantevere [1+(1-1) D/E] Present value of tax shield using perpetuity formula = (ka* D* t&a=D XL Post-announcement share price = Pv=Pre-Announcement Price + D x t/shares outstanding. Number of shares repurchased = D/PN. Cost of Equity = Risk Free Rate(Given in Ex 8) - Beta*(MRP=5%) WACC. Use M weights and Debt Rate provided and Cost of Equity calculated B. Discuss what scenario investors would prefer and what the tradeoff is for investors as the firm adds leverage. Conclude with which scenario vou recommend and why Actu 10% 20 6.16 32.5% 30.054 0 30,054 9.755 20.290 6.16% 32.5% 30,054 1,191 28,663 9.303 19.359 Debt/Total Capital 20% 6.16% 32.5% 30.054 2.783 27.271 8.852 18.419 6.167 225% 30,054 4,174 25,880 8.400 17480 Interest rate Tax rate Earrings before income taxes and interest Interest expense Earnings before taxes Income Taxos Net income Book value Dobt Equity Total catal Market value Debra Equity Market value of capital 0 225 888 225.888 22.689 203.299 225888 45,178 180,210 225 888 67.766 158122 225 388 642772 643, 272 22.589 628.516 651.105 45,78 612 259 658427 67.766 598002 565769 Notes: ( Interest rate of CPR's credit facility with Bank of American ITBOR 0,80 Earnings before interest and taxes (EBIT) include interest income Market values of debt equal book values. Actual market valbe of equity quals the care price ($2210) lied by the current number of sures outstanding (29. 13 million Source: Case writer analysis based on CPK final data 07 30 year 5.94% 5.49% III1831 Avenge Prime Landing 9.23% 6.91% 4.67% 4.12% 4.34% 6.19% Averago UNOR 3-month 6.55% 3.63% 1.79% 1.22% 1.67% 3.63% EXHIBIT 32.8 Interest Rates and Yields US Treasury Securities Noli Bonde 3-month 6-month 3-year 10 year 2000 5.85% 5.92% 6.22% 6.03 2001 3.45% 3.39% 4.09% 5.02% 2002 1.62% 1.69% 3.10% 4.61% 2003 1.02% 1.06% 2.10% 4.01% 2004 1.38% 1.58% 2.78% 4.27% 2005 3.16% 3.40% 2.93% 4.29% 2006.Jan 4.20% 4.30% 4.35% 4.42% Feb 4.41% 4.51% 4.64% 4.57% Mar 451% 461% 4.74% 4.72% Apr 4.59% 4.72% 4.89% 4.99% May 4.72% 4.81% 4.97% 5.11% June 4.79% 4.95% 5.09% 5.11% July 496% 5.09% 5.07% 5.09% Aug 4.98% 4,99% 4.85% 4 88% Sept 4.82 4 90% 4,69% 4.7290 Oct 4.89 491% 4.72% 4.733 495 4.96% 4.64% 4.60% De 4.85% 4888 4.58% 4.56% 2007 496% 494 4.79% 4764 Fel 5.02% 497% 4.75% 4.72% Mar 4.97% 4.9016 4519 456 Api 4B8% 4.87% 4.60 4.69% May 4773 4.BOX 4596 4757 June 4629 4771 5.004 5.10 Sources of data Erem Corporate bonds Moody Ana 3 Baa 7.62% 8.36% 7.08% 7.95% 6.49% 7.80% 5.67% 6.77% 5.63% 6.39% 5.24% 6.06% 5.29% 6.24% 5.35% 6.27% 5.53% 6.41% 5.84% 6.68% 5.95% 6.75% 5.89% 6.78% 5.85% 6.76% 5.68% 6.59% 5.51% 6.433 5.51% 6.42% 5.33% 6205 5 329 6.22% 5:40 6.34% 5.390 6.28% 5.30 6:27% 5.47 6.39% 5.478 6.29% 5.79% 6.70 4.54% 4.73% 5.06% 5.20% 5.15% 5.13% 5.000 4.85% 4854 469% 4.68% 4.85% 4.82 4724 1.87 4.90 5 20% 7.38% 7.50% 7.63% 7.75% 7.889. 7.13%. 8.25% 8.25% 8.25% 8 25% 8.25% 8.25% NOM 4.68% 4.82% 4.99% 5.15% 5.23% 5.515 5.49% 5.40% 5.37% 5.2733 5 37% 5.36% 5.36 5.36 5.35% 5.26% 5.36 5.36 8.25 B.25% B.25% 8.25 8.25 82511 Styles Editing Paragraph 2. How does debt add walue to CPKY a Add the following values to the table provide in Exhibit 9 and complete it for the actual scenario and the three proposed scenarios: Market value of Debt/MV of Capital Price per share Shares repurchased (thousands) Shares outstanding thousands) Earnings per share Price to earning ratio Beta Cost of equity WACC Blevered= Bantevere [1+(1-1) D/E] Present value of tax shield using perpetuity formula = (ka* D* t&a=D XL Post-announcement share price = Pv=Pre-Announcement Price + D x t/shares outstanding. Number of shares repurchased = D/PN. Cost of Equity = Risk Free Rate(Given in Ex 8) - Beta*(MRP=5%) WACC. Use M weights and Debt Rate provided and Cost of Equity calculated B. Discuss what scenario investors would prefer and what the tradeoff is for investors as the firm adds leverage. Conclude with which scenario vou recommend and why Actu 10% 20 6.16 32.5% 30.054 0 30,054 9.755 20.290 6.16% 32.5% 30,054 1,191 28,663 9.303 19.359 Debt/Total Capital 20% 6.16% 32.5% 30.054 2.783 27.271 8.852 18.419 6.167 225% 30,054 4,174 25,880 8.400 17480 Interest rate Tax rate Earrings before income taxes and interest Interest expense Earnings before taxes Income Taxos Net income Book value Dobt Equity Total catal Market value Debra Equity Market value of capital 0 225 888 225.888 22.689 203.299 225888 45,178 180,210 225 888 67.766 158122 225 388 642772 643, 272 22.589 628.516 651.105 45,78 612 259 658427 67.766 598002 565769 Notes: ( Interest rate of CPR's credit facility with Bank of American ITBOR 0,80 Earnings before interest and taxes (EBIT) include interest income Market values of debt equal book values. Actual market valbe of equity quals the care price ($2210) lied by the current number of sures outstanding (29. 13 million Source: Case writer analysis based on CPK final data 07 30 year 5.94% 5.49% III1831 Avenge Prime Landing 9.23% 6.91% 4.67% 4.12% 4.34% 6.19% Averago UNOR 3-month 6.55% 3.63% 1.79% 1.22% 1.67% 3.63% EXHIBIT 32.8 Interest Rates and Yields US Treasury Securities Noli Bonde 3-month 6-month 3-year 10 year 2000 5.85% 5.92% 6.22% 6.03 2001 3.45% 3.39% 4.09% 5.02% 2002 1.62% 1.69% 3.10% 4.61% 2003 1.02% 1.06% 2.10% 4.01% 2004 1.38% 1.58% 2.78% 4.27% 2005 3.16% 3.40% 2.93% 4.29% 2006.Jan 4.20% 4.30% 4.35% 4.42% Feb 4.41% 4.51% 4.64% 4.57% Mar 451% 461% 4.74% 4.72% Apr 4.59% 4.72% 4.89% 4.99% May 4.72% 4.81% 4.97% 5.11% June 4.79% 4.95% 5.09% 5.11% July 496% 5.09% 5.07% 5.09% Aug 4.98% 4,99% 4.85% 4 88% Sept 4.82 4 90% 4,69% 4.7290 Oct 4.89 491% 4.72% 4.733 495 4.96% 4.64% 4.60% De 4.85% 4888 4.58% 4.56% 2007 496% 494 4.79% 4764 Fel 5.02% 497% 4.75% 4.72% Mar 4.97% 4.9016 4519 456 Api 4B8% 4.87% 4.60 4.69% May 4773 4.BOX 4596 4757 June 4629 4771 5.004 5.10 Sources of data Erem Corporate bonds Moody Ana 3 Baa 7.62% 8.36% 7.08% 7.95% 6.49% 7.80% 5.67% 6.77% 5.63% 6.39% 5.24% 6.06% 5.29% 6.24% 5.35% 6.27% 5.53% 6.41% 5.84% 6.68% 5.95% 6.75% 5.89% 6.78% 5.85% 6.76% 5.68% 6.59% 5.51% 6.433 5.51% 6.42% 5.33% 6205 5 329 6.22% 5:40 6.34% 5.390 6.28% 5.30 6:27% 5.47 6.39% 5.478 6.29% 5.79% 6.70 4.54% 4.73% 5.06% 5.20% 5.15% 5.13% 5.000 4.85% 4854 469% 4.68% 4.85% 4.82 4724 1.87 4.90 5 20% 7.38% 7.50% 7.63% 7.75% 7.889. 7.13%. 8.25% 8.25% 8.25% 8 25% 8.25% 8.25% NOM 4.68% 4.82% 4.99% 5.15% 5.23% 5.515 5.49% 5.40% 5.37% 5.2733 5 37% 5.36% 5.36 5.36 5.35% 5.26% 5.36 5.36 8.25 B.25% B.25% 8.25 8.25 82511

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts