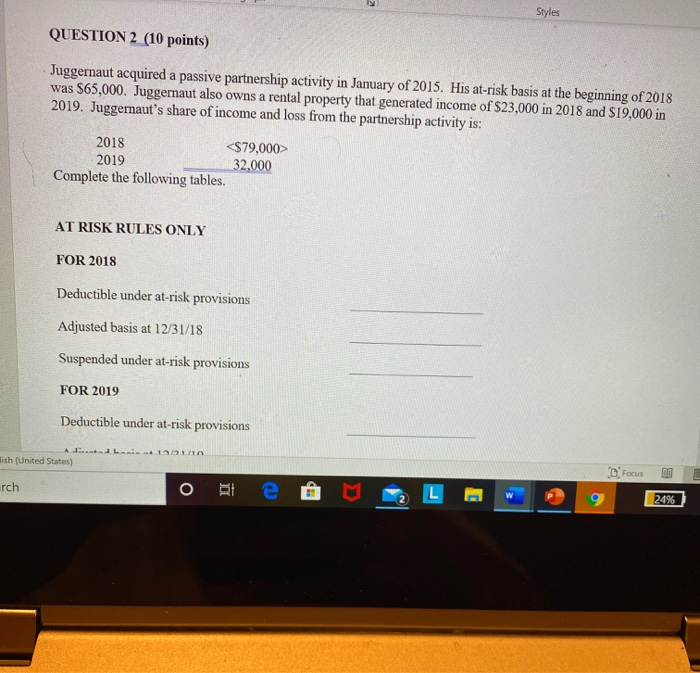

Question: Styles QUESTION 2 (10 points) Juggernaut acquired a passive partnership activity in January of 2015. His at-risk basis at the beginning of 2018 was $65,000.

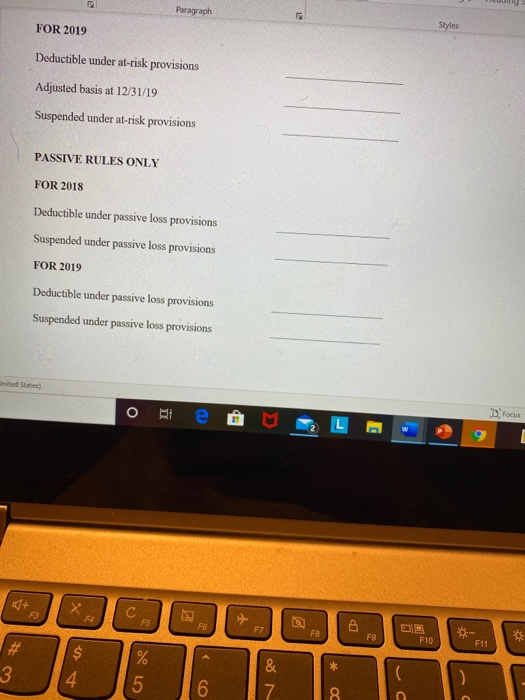

Styles QUESTION 2 (10 points) Juggernaut acquired a passive partnership activity in January of 2015. His at-risk basis at the beginning of 2018 was $65,000. Juggernaut also owns a rental property that generated income of $23,000 in 2018 and $19,000 in 2019. Juggernaut's share of income and loss from the partnership activity is: 2018 2019 32,000 Complete the following tables. AT RISK RULES ONLY FOR 2018 Deductible under at-risk provisions Adjusted basis at 12/31/18 Suspended under at-risk provisions FOR 2019 Deductible under at-risk provisions lish (United States) D. Focus E urch 'o e M P2 L 24%) Paragraph Styles FOR 2019 Deductible under at-risk provisions Adjusted basis at 12/31/19 Suspended under at-risk provisions PASSIVE RULES ONLY FOR 2018 Deductible under passive loss provisions Suspended under passive loss provisions FOR 2019 Deductible under passive loss provisions Suspended under passive loss provisions ited States) opie M 2 L OOOOOOOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts