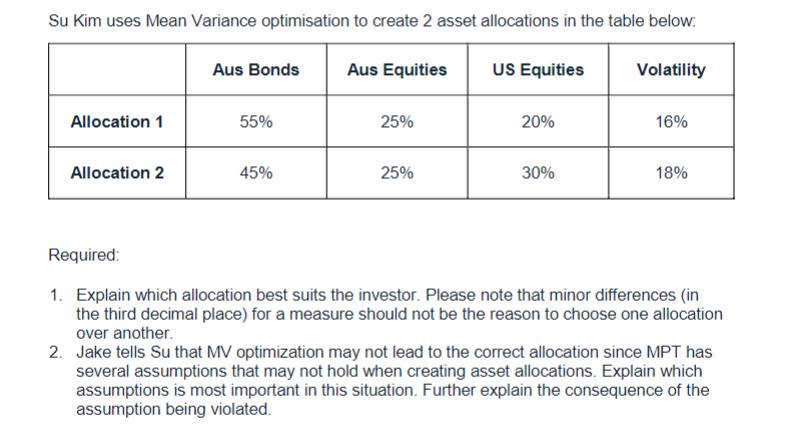

Question: Su Kim uses Mean Variance optimisation to create 2 asset allocations in the table below: Allocation 1 Allocation 2 Aus Bonds 55% 45% Aus

Su Kim uses Mean Variance optimisation to create 2 asset allocations in the table below: Allocation 1 Allocation 2 Aus Bonds 55% 45% Aus Equities 25% 25% US Equities 20% 30% Volatility 16% 18% Required: 1. Explain which allocation best suits the investor. Please note that minor differences (in the third decimal place) for a measure should not be the reason to choose one allocation over another. 2. Jake tells Su that MV optimization may not lead to the correct allocation since MPT has several assumptions that may not hold when creating asset allocations. Explain which assumptions is most important in this situation. Further explain the consequence of the assumption being violated.

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

1 To determine which allocation best suits the investor we need to consider their risk preferences and investment goals Allocation 1 has a higher allo... View full answer

Get step-by-step solutions from verified subject matter experts