Question: subject: financial statement analysis ( Act 450). QUESTION 4) (30 pts) Below tables are 2020 annual balance sheet and income statement of a company listed

subject: financial statement analysis ( Act 450).

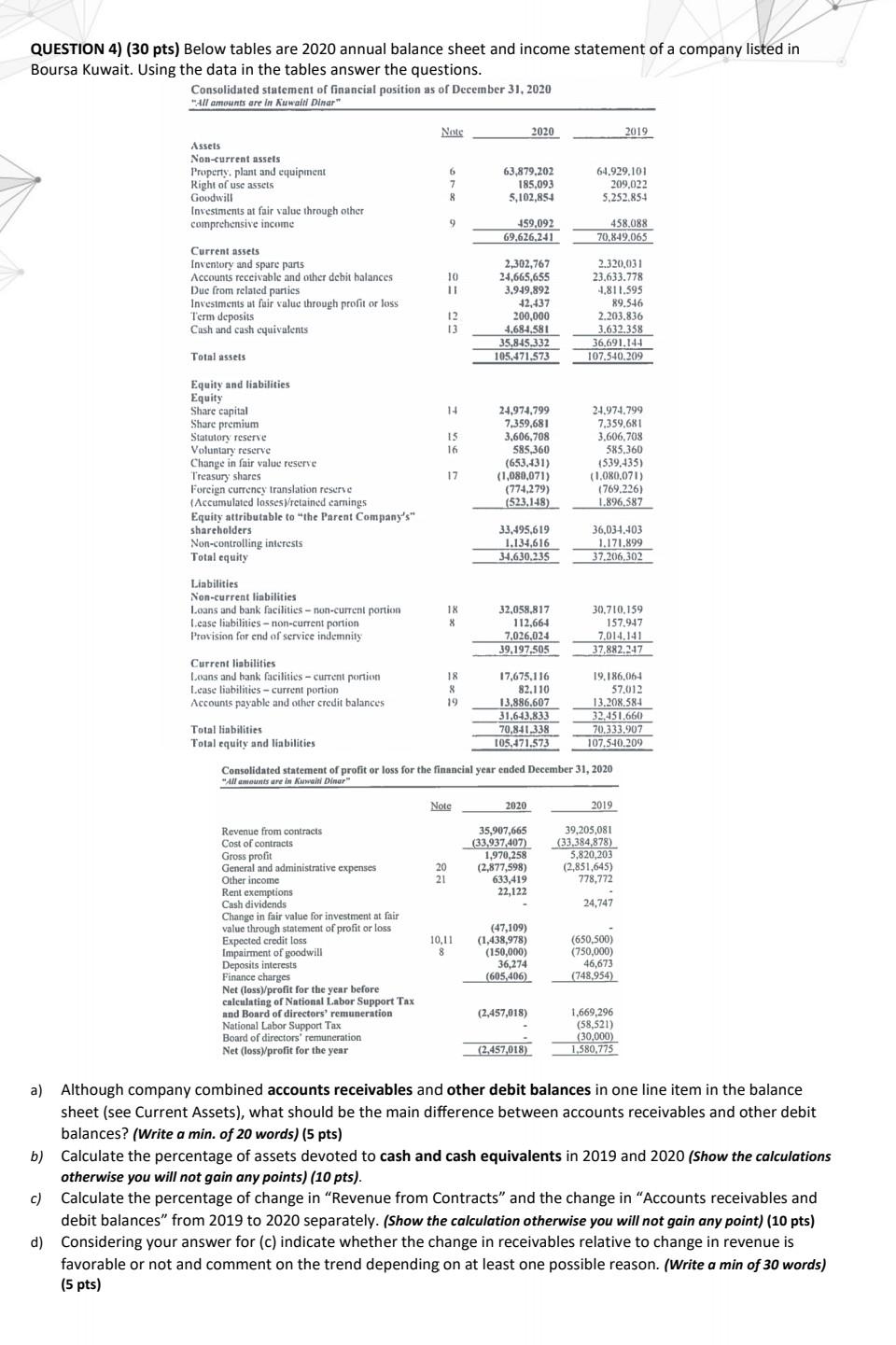

QUESTION 4) (30 pts) Below tables are 2020 annual balance sheet and income statement of a company listed in Boursa Kuwait. Using the data in the tables answer the questions. Consolidated statement of financial position as of December 31, 2020 all amounts are in Kuwait Dinar" Note 2020 2019 Assets Non-current assets Property, plant and equipment Right of use assets Goodwill Investments at fair value through other comprehensive income 6 7 8 63,879.202 185,093 5,102,854 64.929.101 209,022 5.252.854 9 459,092 69,626,241 458,088 70,849.065 10 11 Current assets Inventory and spare parts Accounts receivable and other debit balances Due from related parties Investments at lair value through profit or loss Term deposits Cash and cash equivalents Total assets 2,302,767 24,665,655 3.949.892 12,437 200,000 4.684,581 35.8-45.332 105.471,573 12 13 2.320,031 23,633.778 1,811.595 89.546 2.203.836 3.632.358 36.691.144 107.540.209 14 15 16 Equity and liabilities Equity Share capital Share premium Statutory reserve Voluntary reserve Change in fair value reserve T'reasury shares Foreign currency translation reserva (Accumulated losses retained earnings Equity attributable to "the Parent Company's** shareholders Non-controlling interests Total equity 24,974,799 7,359,681 3,606,708 585,360 (653,431) (1,080,071) (774,279) (523,148) 24.974.799 7,359,681 3,606,708 585,360 4539.435) (1,080,071) (769,226) 1.896,587 17 33,495,619 1.134,616 34.630.235 36,034,403 1.171.899 37.206,302 Liabilities Non-current liabilities Loans and bank facilities - non-current portion Lease liabilities -non-current portion Provision for end of service indemnity 18 8 32,058,817 112,664 7,026,024 39,197,505 30,710.159 157,947 7.014.141 37,882.247 Current liabilities Loans and bank facilities - current portion Lease liabilities - current portion Accounts payable and other credit balances 18 8 19 17,675,116 82.110 13.886.607 31,6-43.833 70,841,338 105,471.573 19,186,064 57,012 13.208.584 32.451.660 70.333.907 107.540.209 Total liabilities Total equity and liabilities Consolidated statement of profit or loss for the financial year ended December 31, 2020 "All amounts are in Kuwain Dinar" Note 2020 2019 35,907,665 (33.937,407) 1,970,258 (2,877,598) 633,419 22,122 39,205,081 (33,384,878) 5,820,203 (2,851,645) 778,772 20 21 24,747 Revenue from contracts Cost of contracts Gross profit General and administrative expenses Other income Rent exemptions Cash dividends Change in fair value for investment at fair value through statement of profit or loss Expected credit loss Impairment of goodwill Deposits interests Finance charges Net (loss)/profit for the year before calculating of National Labor Support Tax and Board of directors' remuneration National Labor Support Tax Board of directors' remuneration Net (loss)profit for the year 10,11 8 (47,109) (1,438,978) (150,000) 36,274 (605,406) (650,500) (750,000) 46,673 (748,954) (2,457,018) 1,669,296 (58,521) (30,000) 1,580,775 (2.457,018) a) Although company combined accounts receivables and other debit balances in one line item in the balance sheet (see Current Assets), what should be the main difference between accounts receivables and other debit balances? (Write a min. of 20 words) (5 pts) b) Calculate the percentage of assets devoted to cash and cash equivalents in 2019 and 2020 (Show the calculations otherwise you will not gain any points) (10 pts). c) Calculate the percentage of change in "Revenue from Contracts" and the change in "Accounts receivables and debit balances" from 2019 to 2020 separately. (Show the calculation otherwise you will not gain any point) (10 pts) d) Considering your answer for (c) indicate whether the change in receivables relative to change in revenue is favorable or not and comment on the trend depending on at least one possible reason. (Write a min of 30 words) (5 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts