Question: Subject: Global Financial Statement Analysis Inventory conversion from LIFO to FIFO Required: Using the financial data below related to Caterpillar , convert the data from

Subject: Global Financial Statement Analysis

Inventory conversion from LIFO to FIFO

Required:

Using the financial data below related to Caterpillar, convert the data from LIFO to FIFO and compute the following for 2019:

Assume a tax rate of 30%

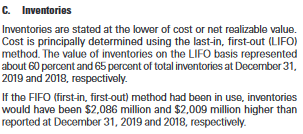

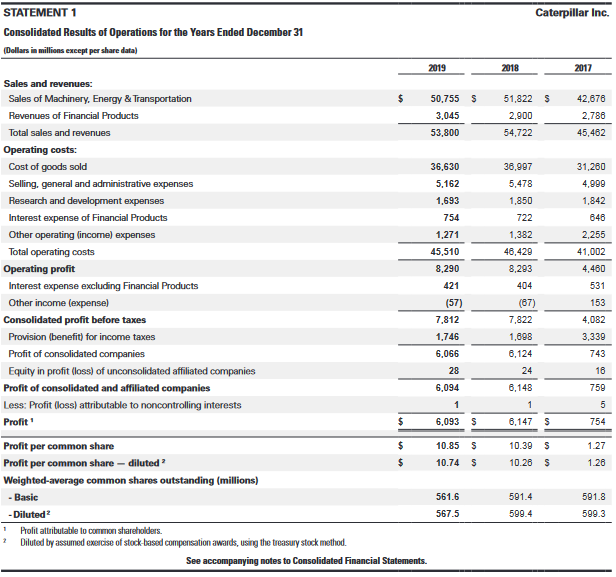

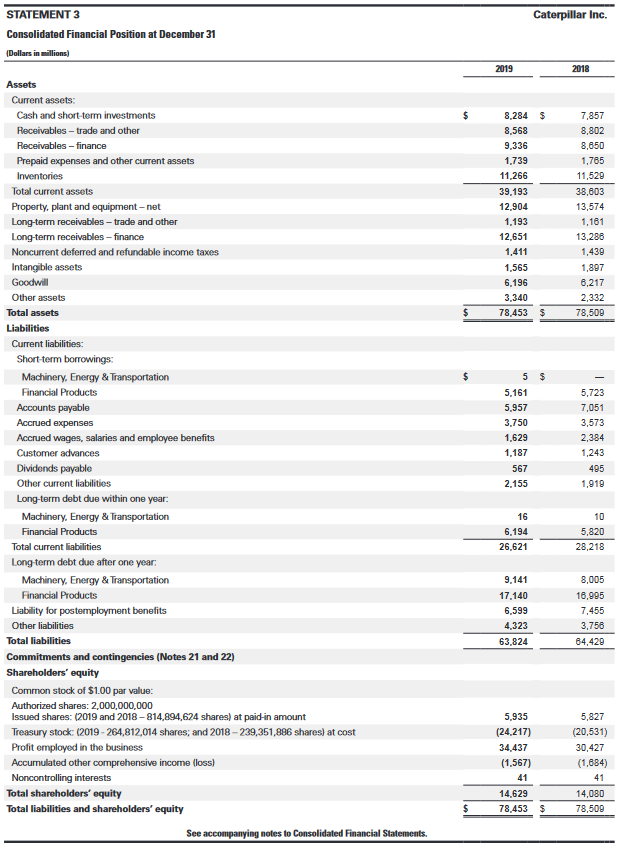

C. Inventories Inventories are stated at the lower of cost or not realizable value. Cost is principally determined using the last-in, first-out (LIFO) method. The value of inventories on the LIFO basis represented about 60 percent and 65 percent of total inventories at December 31, 2019 and 2018, respectively. If the FIFO (first-in, first-out) method had been in use, inventories would have been $2,086 million and $2,009 million higher than reported at December 31, 2019 and 2018, respectively.STATEMENT 1 Caterpillar Inc. Consolidated Results of Operations for the Years Ended December 31 (Dollars in millions except per share data) 2019 2018 2017 Sales and revenues: Sales of Machinery, Energy & Transportation $ 50,755 5 51,822 S 42.678 Revenues of Financial Products 3.045 2,900 2,786 Total sales and revenues 53,800 54,722 45,462 Operating costs: Cost of goods sold 36.630 36,907 31,260 Selling, general and administrative expenses 5,162 5,478 4,808 Research and development expenses 1.693 1,850 1,842 Interest expense of Financial Products 754 722 Other operating (income) expenses 1,271 1,382 2.255 Total operating costs 45,510 46,420 41,002 Operating profit 8.290 8,203 4,460 Interest expense excluding Financial Products 421 404 531 Other income (expense) (57) (87) 153 Consolidated profit before taxes 7,812 7,822 4,082 Provision (benefit) for income taxes 1,746 1,608 3,330 Profit of consolidated companies 6.066 8,124 743 Equity in profit (loss) of unconsolidated affiliated companies 28 24 16 Profit of consolidated and affiliated companies 6,094 8,148 75 Less: Profit (loss) attributable to noncontrolling interests 5 Profit " 6,093 6,147 5 754 Profit per common share 10.85 S 10.39 1.27 Profit per common share - diluted ? 10.74 10.26 1.26 Weighted-average common shares outstanding (millions) - Basic 561.6 501.4 501.8 - Diluted ? 567.5 509.4 599.3 Prolit attributable to common shareholders. Diluted by assumed exercise of stock-based compensation awards, using the treasury stock method. See accompanying notes to Consolidated Financial Statements.STATEMENT 3 Caterpillar Inc. Consolidated Financial Position at December 31 [Dollars in millions) 2019 2018 Assets Current assets: Cash and short-term investments 8.284 $ 7,857 Receivables - trade and other 8.568 8,802 Receivables - finance 9.336 8,850 Prepaid expenses and other current assets 1.739 1,765 Inventories 11.266 11,520 Total current assets 39.193 38,803 Property, plant and equipment - net 12.904 13,574 Long-term receivables - trade and other 1,193 1,181 Long-term receivables - finance 12,651 13,286 Noncurrent deferred and refundable income taxes 1,411 1,438 Intangible assets 1.565 1,897 Goodwill 6.196 6,217 Other assets 3.340 2,332 Total assets $ 78,453 $ 78,508 Liabilities Current liabilities: Short-term borrowings: Machinery, Energy & Transportation 5 $ Financial Products 5,161 5,723 Accounts payable 5,957 7,051 Accrued expenses 3,750 3,573 Accrued wages, salaries and employee benefits 1.629 2,384 Customer advances 1,187 1,243 Dividends payable 567 405 Other current liabilities 2.155 1.918 Long-term debt due within one year. Machinery, Energy & Transportation 16 10 Financial Products 6.194 5,820 Total current liabilities 26,621 28,218 Long-term debt due after one year. Machinery, Energy & Transportation 9.141 8,005 Financial Products 17.140 16,905 Liability for postemployment benefits 6,599 7,455 Other liabilities 4,323 3,756 Total liabilities 63.824 84.420 Commitments and contingencies (Notes 21 and 22) Shareholders' equity Common stock of $1.00 par value: Authorized shares: 2,000,000,000 Issued shares: (2019 and 2018 - 814,894,624 shares) at paid-in amount 5,935 5,827 Treasury stock: (2019 - 264,812,014 shares; and 2018 - 239,351,886 shares) at cost (24.217) (20,531) Profit employed in the business 34,437 30,427 Accumulated other comprehensive income (loss) (1.567) (1,684) Noncontrolling interests 41 41 Total shareholders' equity 14.629 14,080 Total liabilities and shareholders' equity 78.453 78,508 See accompanying notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts