Question: subject : TAX ADMINISTRATION PART A A. Identify the types of assessment for the following statement: i. Assessment issued resulting in the reduction of tax

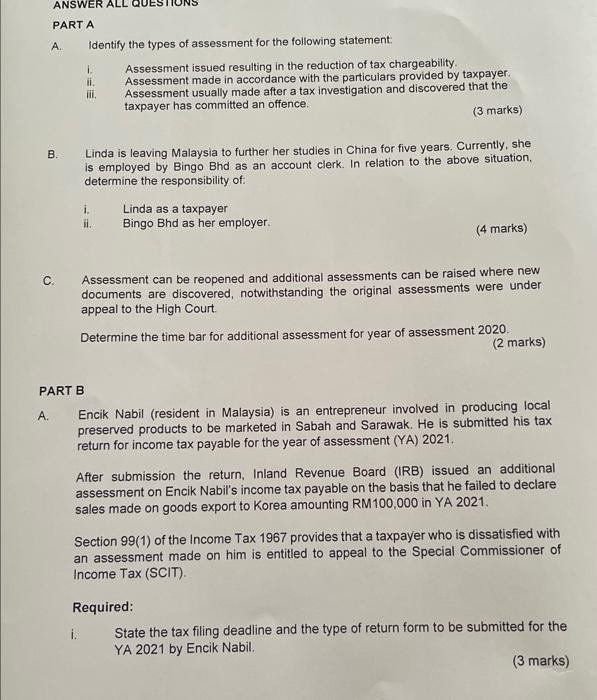

PART A A. Identify the types of assessment for the following statement: i. Assessment issued resulting in the reduction of tax chargeability. ii. Assessment made in accordance with the particulars provided by taxpayer iii. Assessment usually made after a tax investigation and discovered that the taxpayer has committed an offence. (3 marks) B. Linda is leaving Malaysia to further her studies in China for five years. Currently, she is employed by Bingo Bhd as an account clerk. In relation to the above situation. determine the responsibility of: i. Linda as a taxpayer ii. Bingo Bhd as her employer. (4 marks) C. Assessment can be reopened and additional assessments can be raised where new documents are discovered, notwithstanding the original assessments were under appeal to the High Court. Determine the time bar for additional assessment for year of assessment 2020 . (2 marks) PART B A. Encik Nabil (resident in Malaysia) is an entrepreneur involved in producing local preserved products to be marketed in Sabah and Sarawak. He is submitted his tax return for income tax payable for the year of assessment (YA) 2021. After submission the return, Inland Revenue Board (IRB) issued an additional assessment on Encik Nabil's income tax payable on the basis that he failed to declare sales made on goods export to Korea amounting RM100,000 in YA 2021. Section 99(1) of the Income Tax 1967 provides that a taxpayer who is dissatisfied with an assessment made on him is entitled to appeal to the Special Commissioner of Income Tax (SCIT). Required: i. State the tax filing deadline and the type of return form to be submitted for the YA 2021 by Encik Nabil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts