Question: Subsequent ( Post - Balance - Sheet ) Events Settlement of federal tax case at a cost considerably in excess of the amount expected at

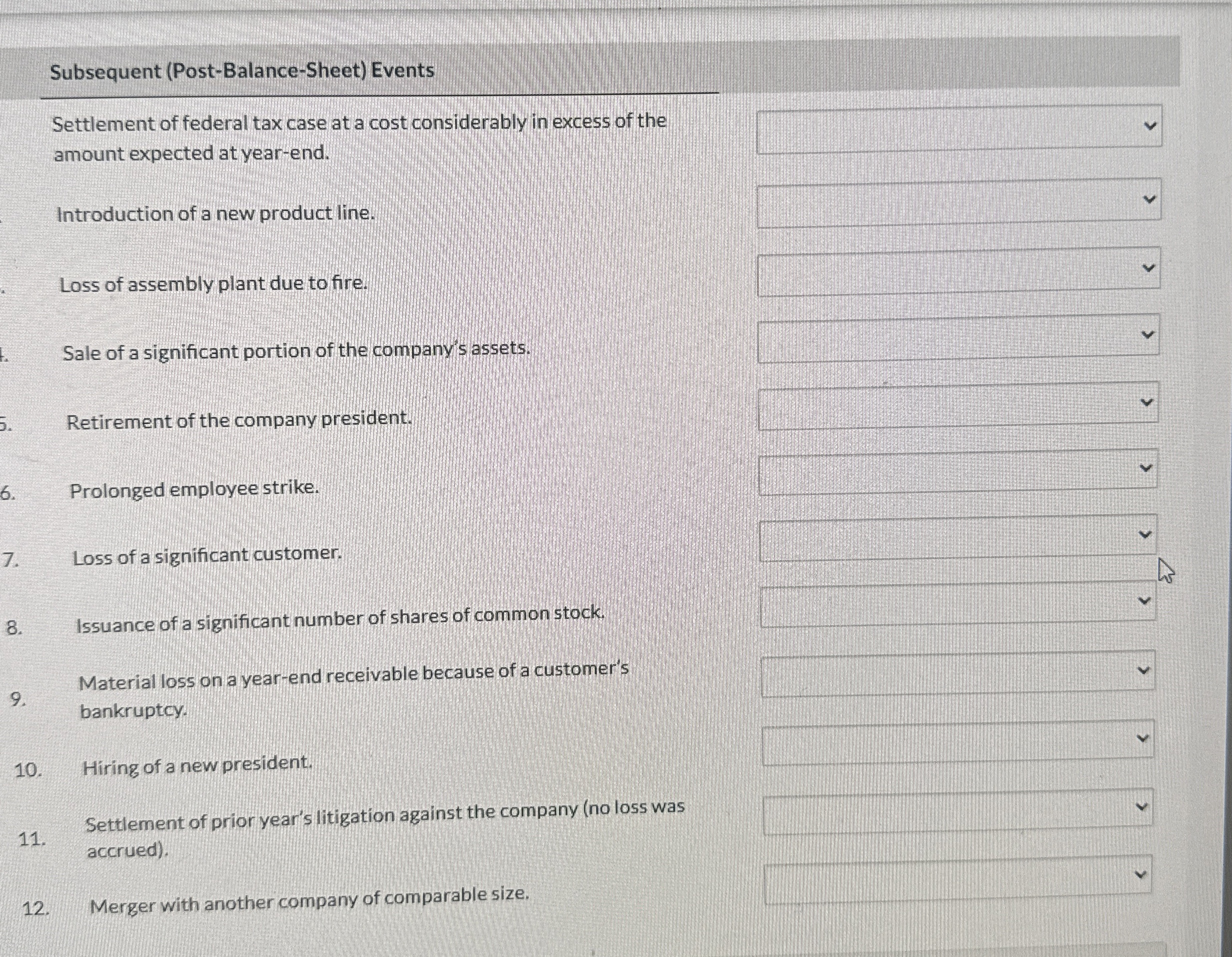

Subsequent PostBalanceSheet Events

Settlement of federal tax case at a cost considerably in excess of the amount expected at yearend.

Introduction of a new product line.

Loss of assembly plant due to fire.

Sale of a significant portion of the company's assets.

Prolonged employee strike.

Loss of a significant customer.

Issuance of a significant number of shares of common stock.

Material loss on a yearend receivable because of a customer's bankruptcy.

Hiring of a new president.

Settlement of prior year's litigation against the company no loss was accrued

Merger with another company of comparable size.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock