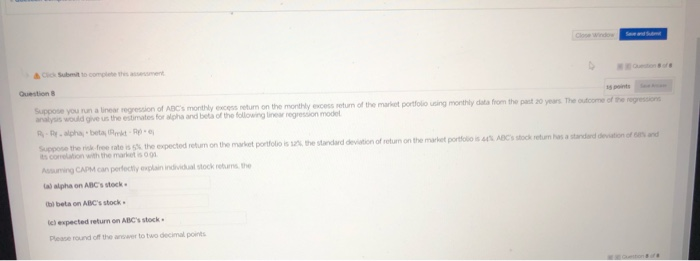

Question: Subto comm e nt Questions Supore you run a linear regression of ABC's monthly exc e turn on the monthly excess return of the market

Subto comm e nt Questions Supore you run a linear regression of ABC's monthly exc e turn on the monthly excess return of the market portfolio using monthly data from the past 20 years. The outcome of the regression analys would us the estimates for Woha and beta of the following linear regression model B.Br. alphabeta Brooks Rp.ej. Suppose the risk froe rate is 5% the expected retum on the market portfolio is in the standard deviation of rotum on the market portfolio is un ABC's stock return has a standard deviation of an and A the in individual stocks G CAFM can perfectly alpha on ABCs stock obeta on ABC's stock Ich expected return on ABC's stock. Please round of the swer to two decimal points Question Completion Status: Close Window Save and Suomi Question 8 of 8 > Click Submit to complete this assessment Question 8 15 points Suppose you run a linear regression of ABC's monthly excess return on the monthly excess return of the market portfolio using monthly data from the past 20 years. The outcome of the regressions analysis would give us the estimates for alpha and beta of the following linear regression model Ri- Rp. alphabeta (Rmkt - Rp.ej Suppose the risk free rate is 5% the expected return on the market portfolio is 12%, the standard deviation of return on the market portfolio is 44%. ABC's stock return has a standard deviation of 68% and its correlation with the market is 091. Assuming CAPM can perfectly explain individual stock returns the (a) alpha on ABC's stock (b) beta on ABC's stock (c) expected return on ABC's stock Please round off the answer to two decimal points Question of 8 > Click Submit to complete this assessment Close Window Save and Our 3 Solutions.pdf A Witachments. Solutions.pdf Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts