Question: Suggest possible reasons for the difference in the operating working capital turnover of Gmart and DJ, relating your reasons to the primary components of working

- Suggest possible reasons for the difference in the operating working capital turnover of Gmart and DJ, relating your reasons to the primary components of working capital.

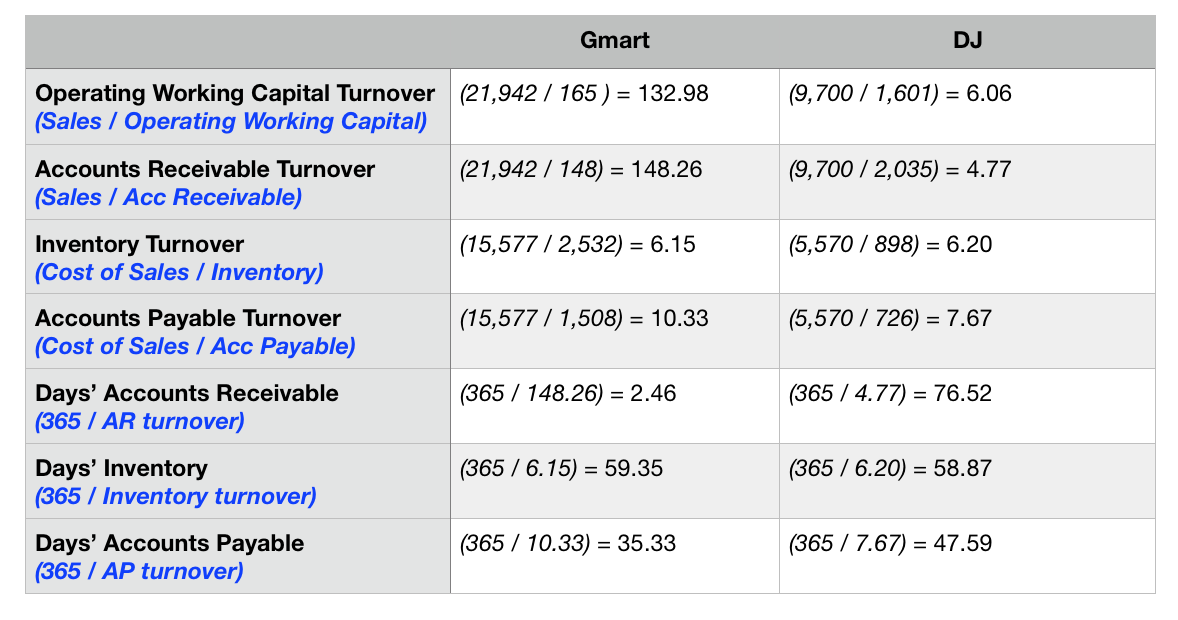

Gmart DJ Operating Working Capital Turnover (21,942/ 165) (Sales/Operating Working Capital) (9,700 1,601) = 6.06 132.98 (21,942/ 148) = 148.26 Accounts Receivable Turnover (9,700 / 2,035) = 4.77 (Sales/Acc Receivable) Inventory Turnover (Cost of Sales / Inventory) (5,570/ 898) = 6.20 (15,577/2,532) = 6.15 (15,577/1,508) = 10.33 (5,570/ 726) = 7.67 Accounts Payable Turnover (Cost of Sales / Acc Payable) Days' Accounts Receivable (365/ AR turnover) (365 148.26) = 2.46 (365 / 4.77) 76.52 = (365 / 6.20) 58.87 Days' Inventory (365/Inventory turnover) (365/6.15) = 59.35 = (365 10.33) 35.33 (365 7.67) 47.59 Days' Accounts Payable (365/ AP turnover)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts