Question: SUGGESTED STUDY QUESTIONS CASE THE SUPER PROJECT What are the relevant cash flows for General Foods to use in evaluating the Super Project? In

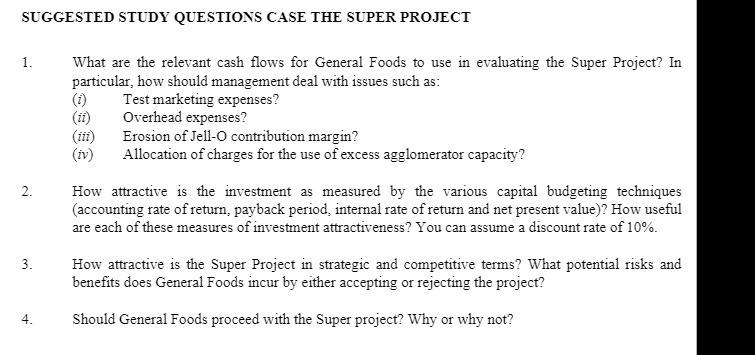

SUGGESTED STUDY QUESTIONS CASE THE SUPER PROJECT What are the relevant cash flows for General Foods to use in evaluating the Super Project? In particular, how should management deal with issues such as: Test marketing expenses? 1. (i) (ii) Overhead expenses? (iii) Erosion of Jell-O contribution margin? (iv) 2. 3. Allocation of charges for the use of excess agglomerator capacity? How attractive is the investment as measured by the various capital budgeting techniques (accounting rate of return, payback period, internal rate of return and net present value)? How useful are each of these measures of investment attractiveness? You can assume a discount rate of 10%. How attractive is the Super Project in strategic and competitive terms? What potential risks and benefits does General Foods incur by either accepting or rejecting the project? 4. Should General Foods proceed with the Super project? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Relevant Cash Flows for Evaluating the Super Project To evaluate the Super Project General Foods should consider only incremental cash flows cash flows that occur directly because of the project Heres ... View full answer

Get step-by-step solutions from verified subject matter experts