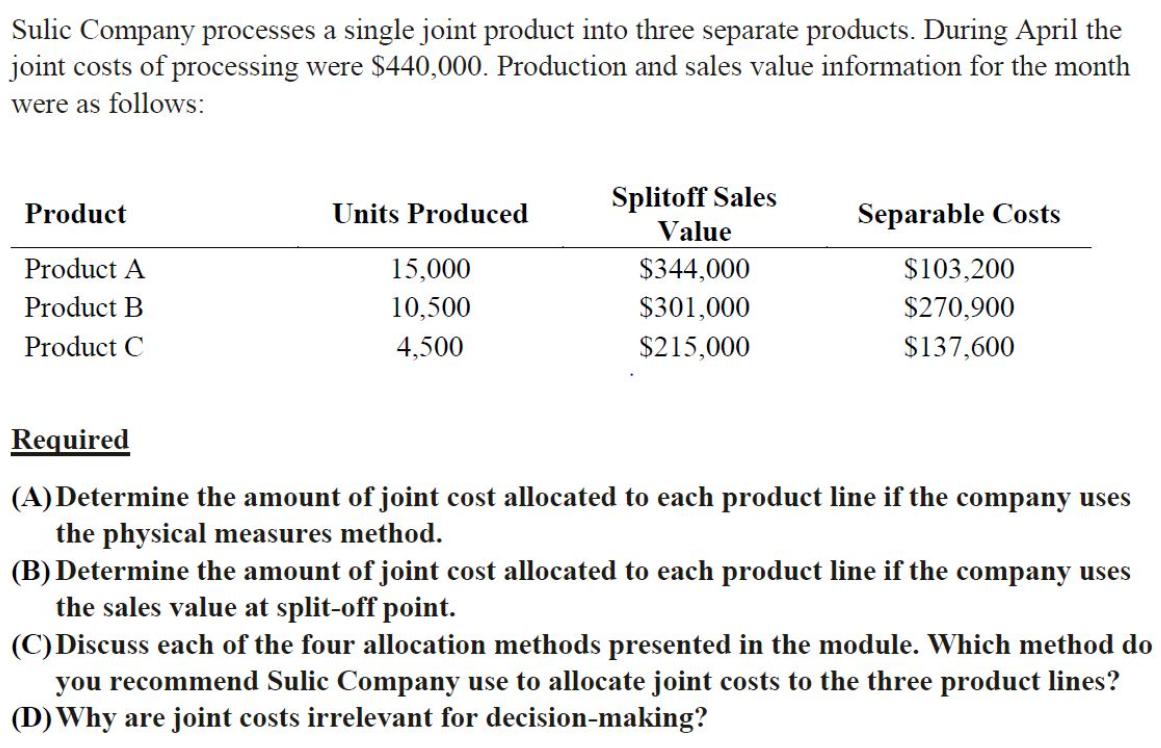

Question: Sulic Company processes a single joint product into three separate products. During April the joint costs of processing were $440,000. Production and sales value

Sulic Company processes a single joint product into three separate products. During April the joint costs of processing were $440,000. Production and sales value information for the month were as follows: Splitoff Sales Product Units Produced Separable Costs Value Product A 15,000 $344,000 $103,200 Product B Product C 10,500 $301,000 $270,900 4,500 $215,000 $137,600 Required (A) Determine the amount of joint cost allocated to each product line if the company uses the physical measures method. (B) Determine the amount of joint cost allocated to each product line if the company uses the sales value at split-off point. (C) Discuss each of the four allocation methods presented in the module. Which method do you recommend Sulic Company use to allocate joint costs to the three product lines? (D) Why are joint costs irrelevant for decision-making?

Step by Step Solution

There are 3 Steps involved in it

A Physical measures method In this method the joint cost of 440000 will be allocated among 3 product... View full answer

Get step-by-step solutions from verified subject matter experts