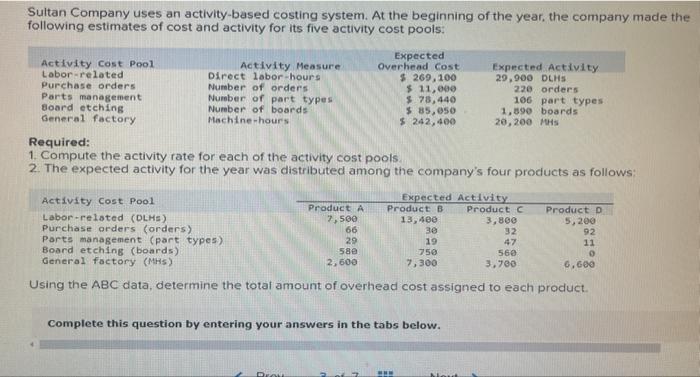

Question: Sultan Company uses an activity-based costing system. At the beginning of the year, the company made the following estimates of cost and activity for

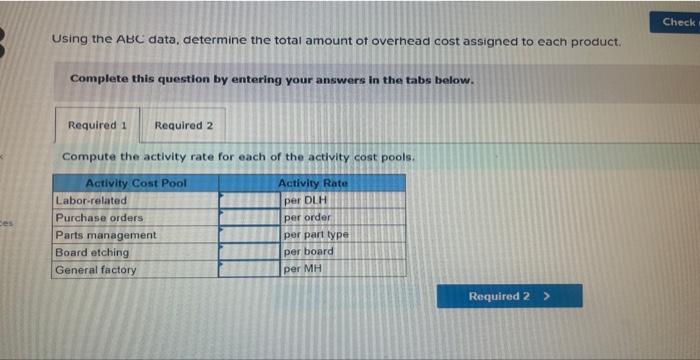

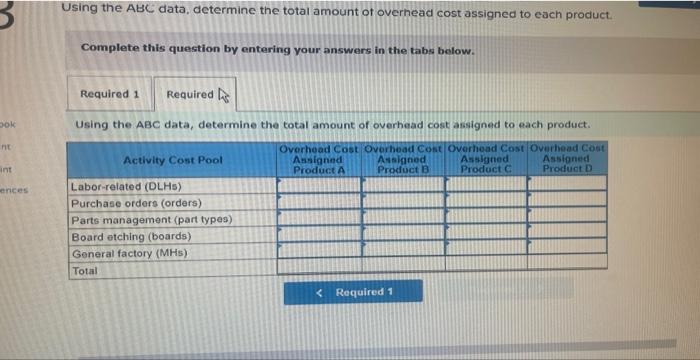

Sultan Company uses an activity-based costing system. At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools: Activity Cost Pool Labor-related Purchase orders. Parts management Board etching General factory Activity Measure Direct labor-hours Number of orders. Number of part types Number of boards Machine-hours Activity Cost Pool Labor-related (DLHS) Purchase orders (orders) Parts management (part types) Board etching (boards). General factory (MHS): Expected Overhead Cost $ 269,100 $ 11,000 $ 78,440 $ 85,050 $ 242,400 Product A 7,500 66 29 580 2,600 Required: 1. Compute the activity rate for each of the activity cost pools. 2. The expected activity for the year was distributed among the company's four products as follows: Prow Product B 13,400 Expected Activity 30 19 Complete this question by entering your answers in the tabs below. www Expected Activity 29,900 DLHS 220 orders 106 part types. 1,590 boards 20,200 MHS bout 750 7,300 Using the ABC data, determine the total amount of overhead cost assigned to each product. Product C 3,800 32 47 560 3,700 Product D 5,200 92 11 0 6,600 Ces Using the ABC data, determine the total amount of overhead cost assigned to each product. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the activity rate for each of the activity cost pools. Activity Cost Pool Activity Rate per DLH per order per part type per board per MH Labor-related Purchase orders Parts management Board etching General factory Required 2 > Check 31 Dok int int ences Using the ABC data, determine the total amount of overhead cost assigned to each product. Complete this question by entering your answers in the tabs below. Required 1 Required Using the ABC data, determine the total amount of overhead cost assigned to each product. Overhead Cost Overhead Cost Overhead Cost Overhead Cost Assigned Product A Activity Cost Pool Labor-related (DLHS) Purchase orders (orders) Parts management (part types) Board etching (boards) General factory (MHs) Total Assigned Product B < Required 1 Assigned Product C Assigned Product D

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

1 Compute the activity rate for each activity cost pools are shown below Therefore Activity rate for labor related is 6 per labor activity rate for pu... View full answer

Get step-by-step solutions from verified subject matter experts