Question: SuperStore reported the following financial data for the most recent year end. Sales, $180,000; operating expenses $150,000; average operating assets, $150,000; total liabilities, $98,000. The

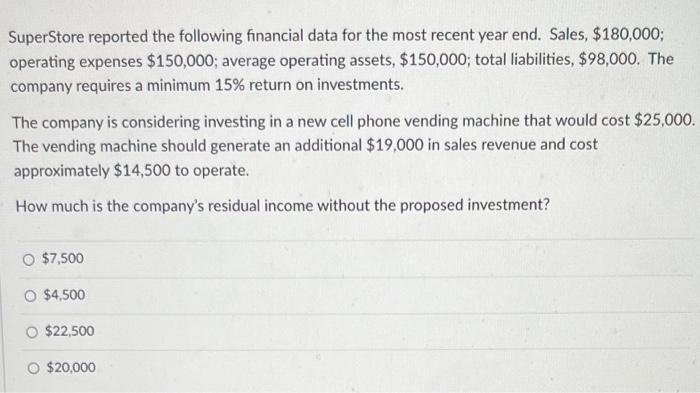

SuperStore reported the following financial data for the most recent year end. Sales, $180,000; operating expenses $150,000; average operating assets, $150,000; total liabilities, $98,000. The company requires a minimum 15% return on investments. The company is considering investing in a new cell phone vending machine that would cost $25,000. The vending machine should generate an additional $19,000 in sales revenue and cost approximately $14,500 to operate. How much is the company's residual income without the proposed investment? $7,500$4,500$22,500$20,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock