Question: SuperStores, Inc is considering expanding retail operations. Project X involves opening a new store in a nearby city, while Project Y involves upgrading the

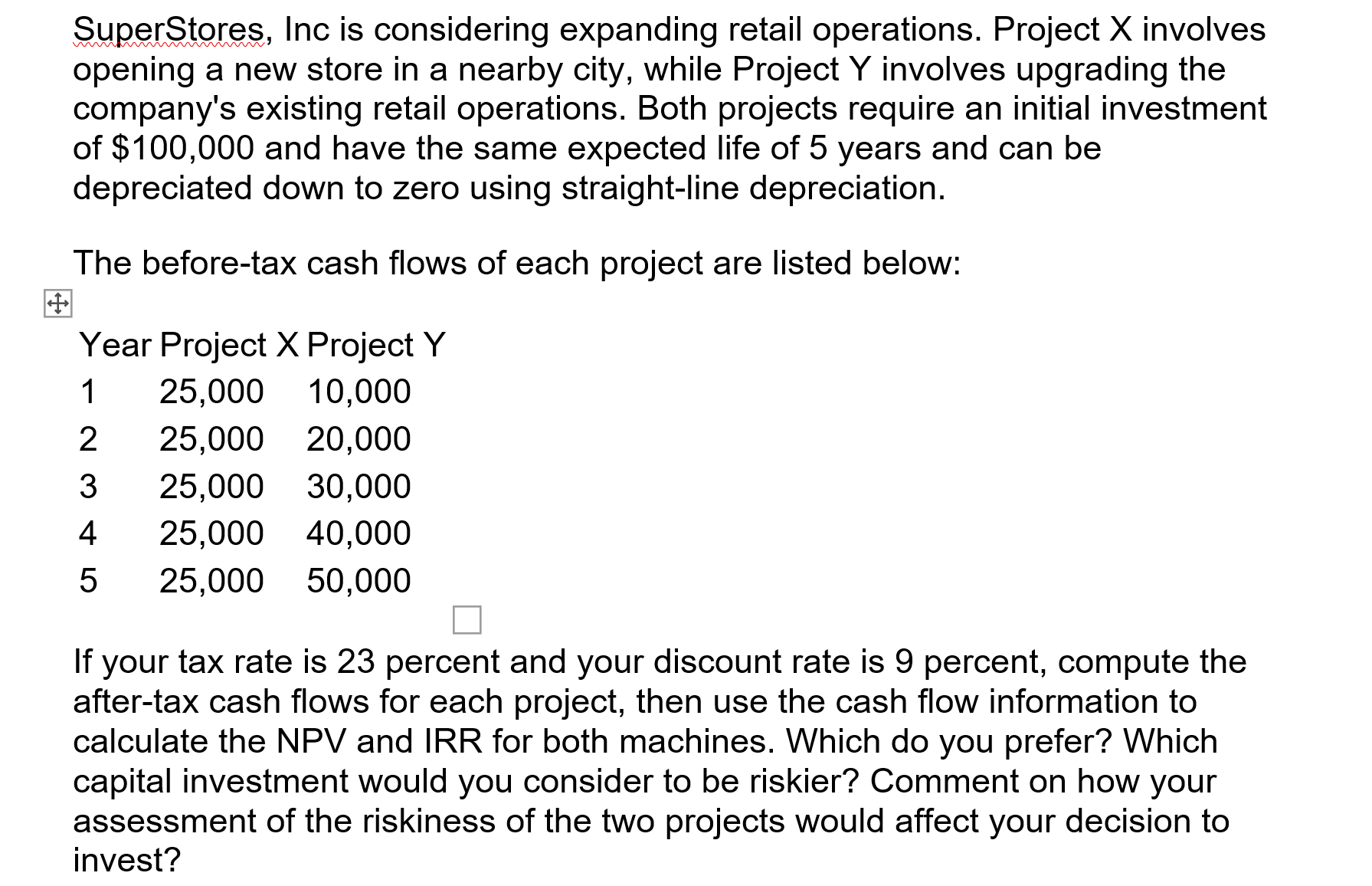

SuperStores, Inc is considering expanding retail operations. Project X involves opening a new store in a nearby city, while Project Y involves upgrading the company's existing retail operations. Both projects require an initial investment of $100,000 and have the same expected life of 5 years and can be depreciated down to zero using straight-line depreciation. The before-tax cash flows of each project are listed below: Year Project X Project Y 25,000 10,000 25,000 20,000 25,000 30,000 25,000 40,000 25,000 50,000 1 2 3 4 5 0 If your tax rate is 23 percent and your discount rate is 9 percent, compute the after-tax cash flows for each project, then use the cash flow information to calculate the NPV and IRR for both machines. Which do you prefer? Which capital investment would you consider to be riskier? Comment on how your assessment of the riskiness of the two projects would affect your decision to invest?

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

To calculate the aftertax cash flows for each project we need to apply the tax rate of 23 percent to ... View full answer

Get step-by-step solutions from verified subject matter experts