Question: According to the article FamilyMart:Internet Plus Strategy provided below, please answer the following questions in detail: a. What is the best plan of action if

According to the article "FamilyMart:Internet Plus Strategy" provided below, please answer the following questions in detail:

a. What is the best plan of action if FamilyMart is to engage in online development? b. How should FamilyMart implement your chosen plan from (part a)?

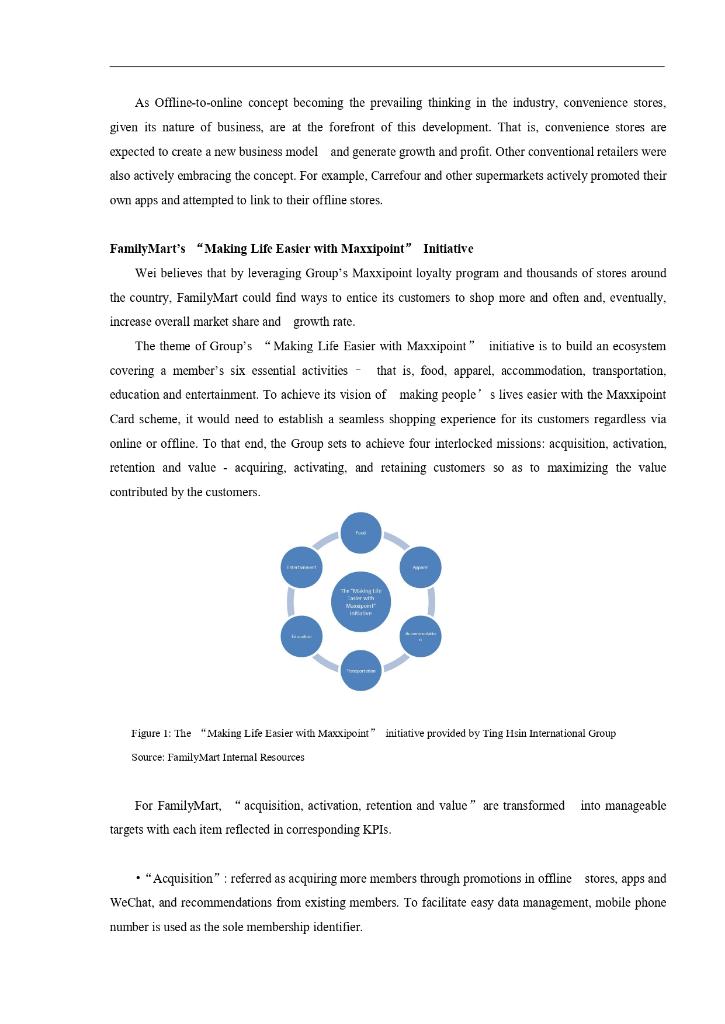

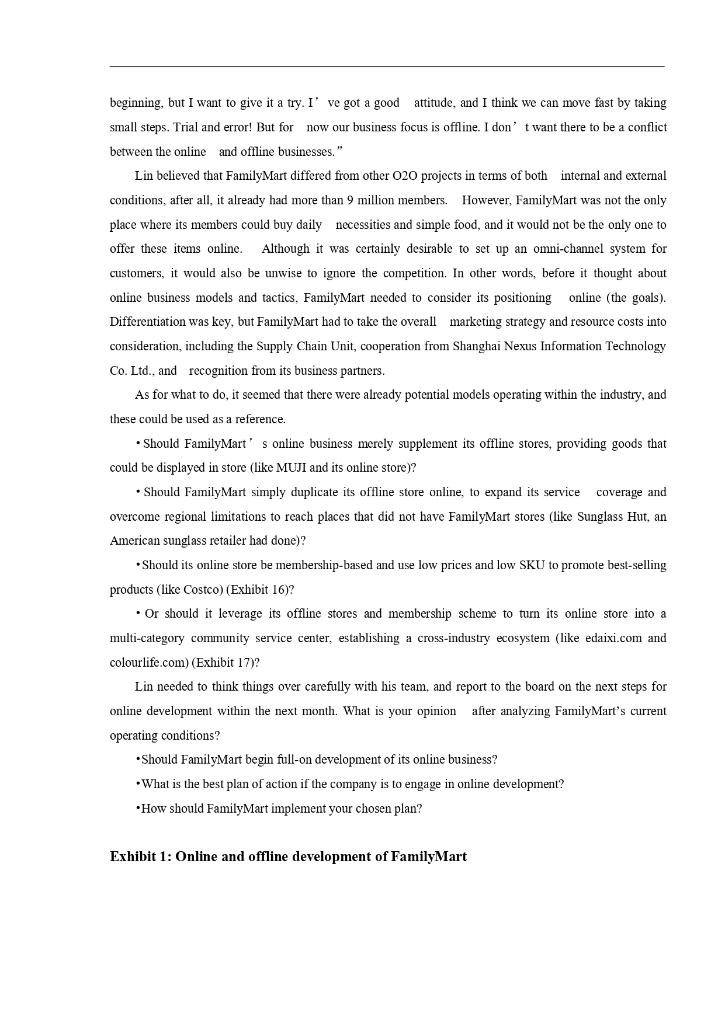

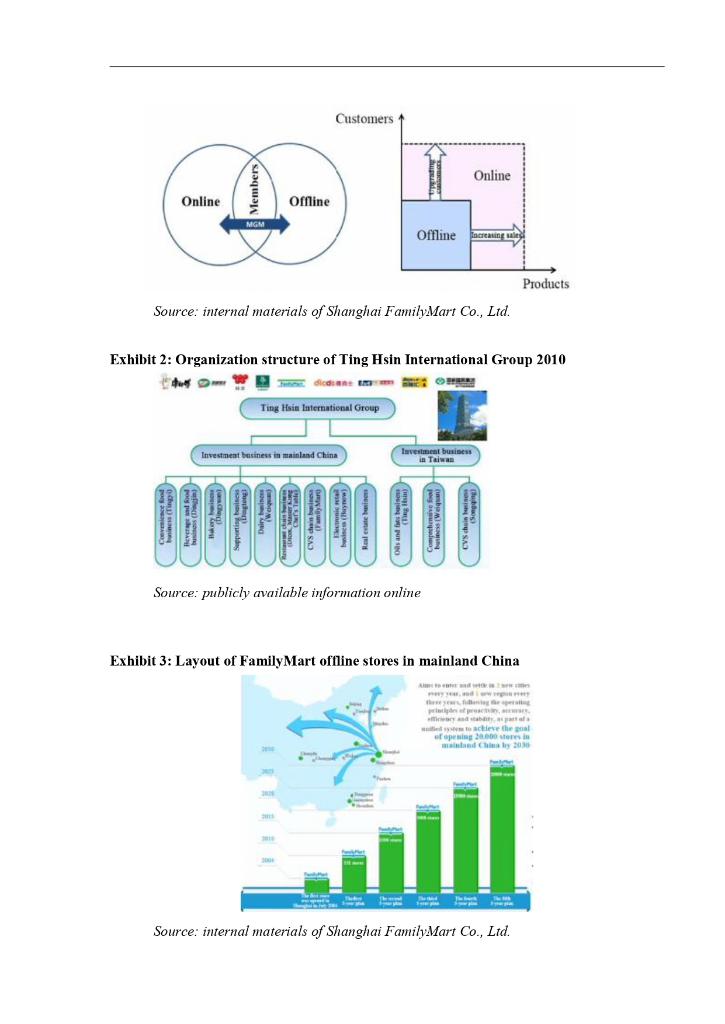

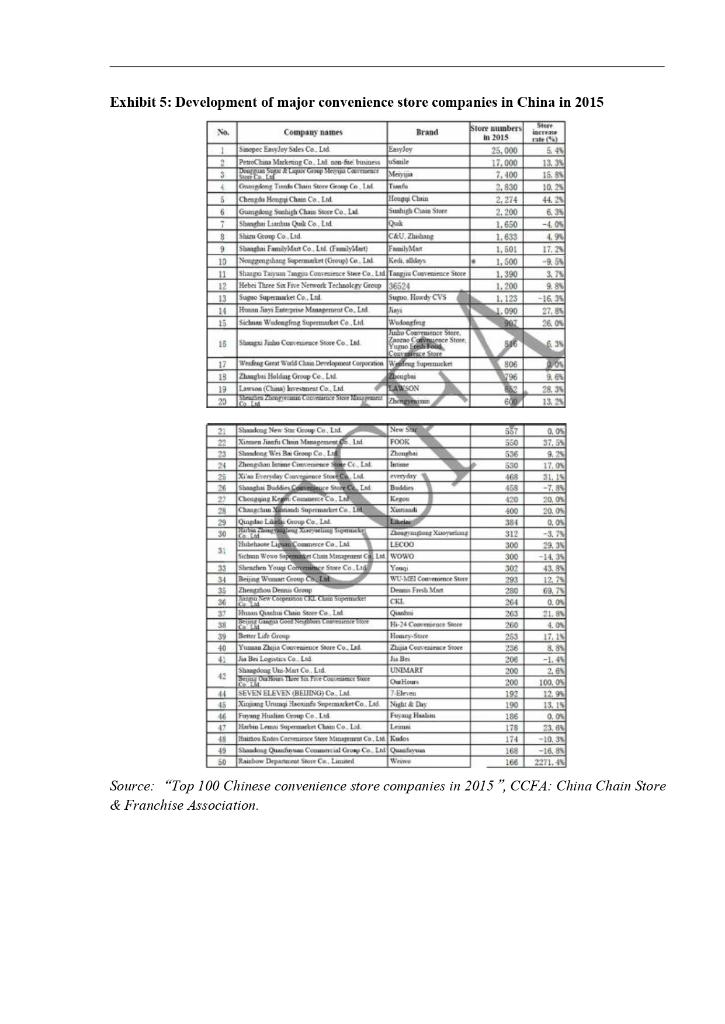

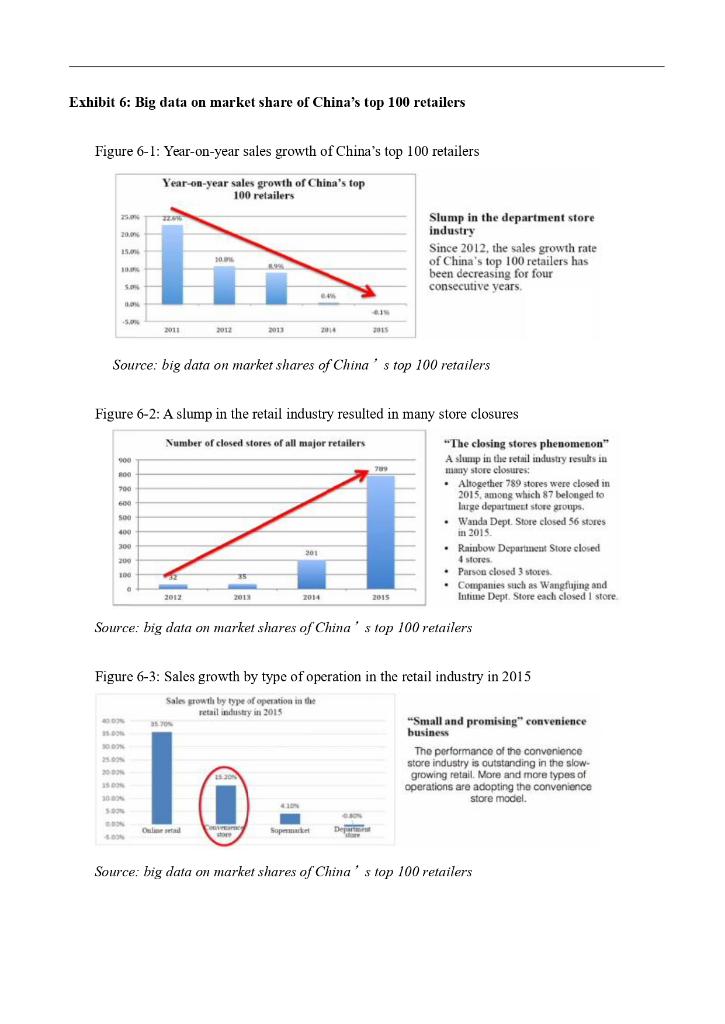

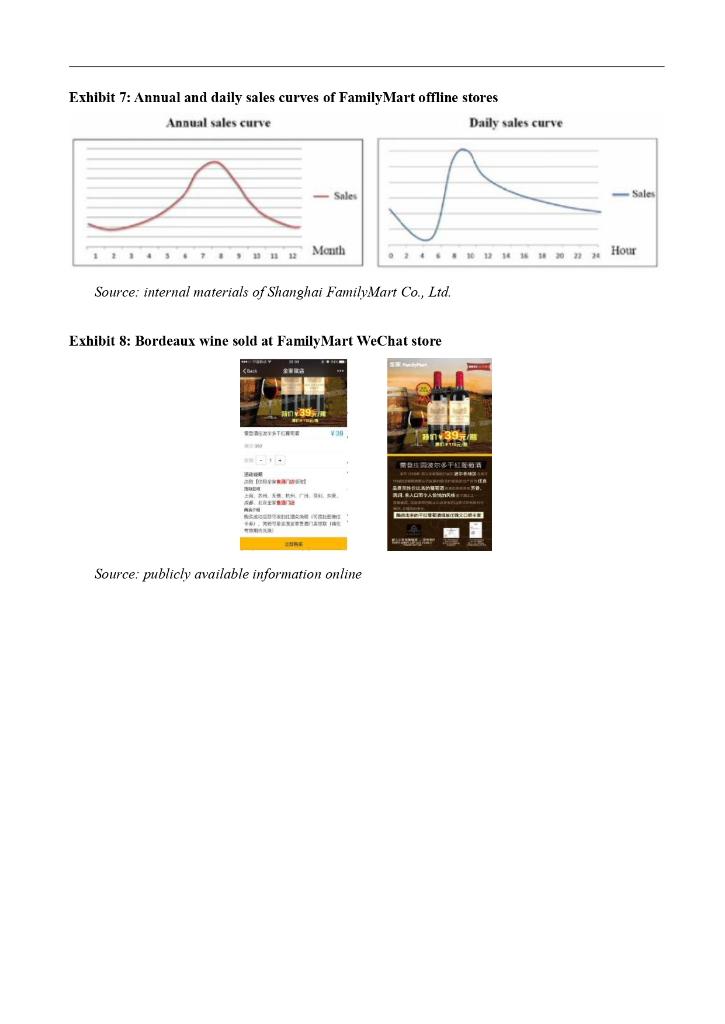

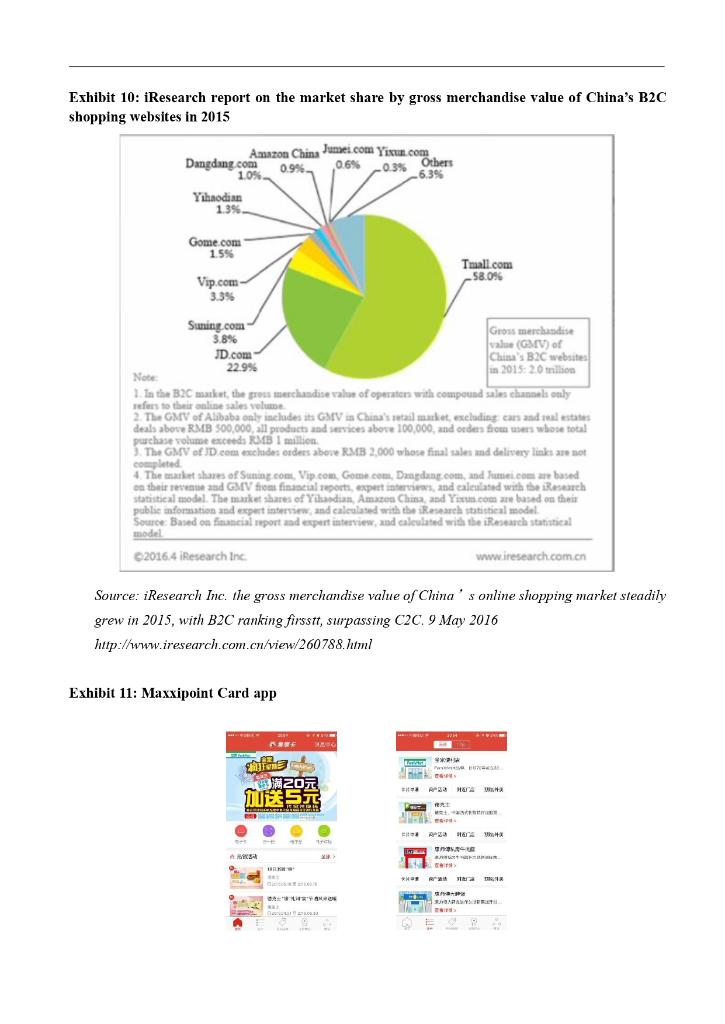

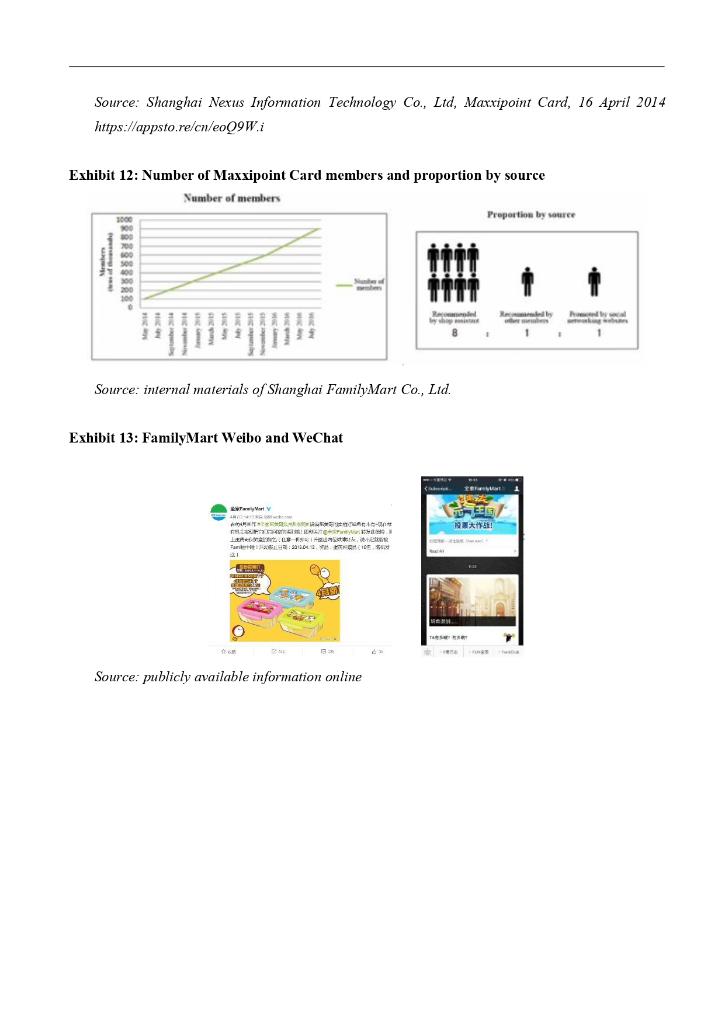

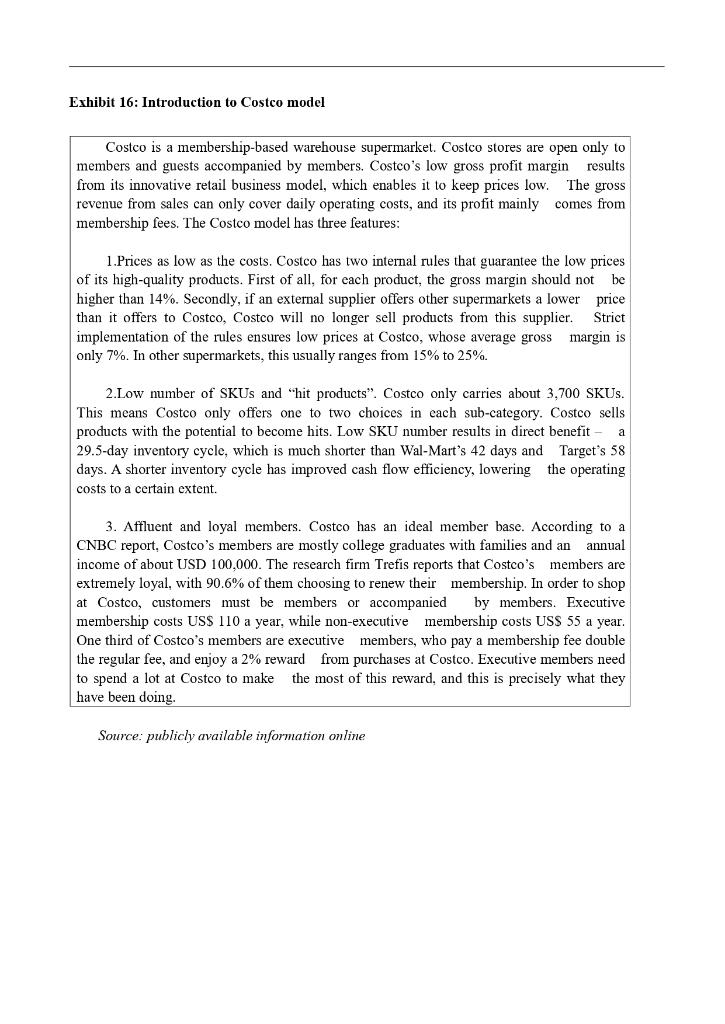

The O2O (Online-to-Offline) era began in China in 2014, a year in which both capital frenzy and consumer enthusiasm drove la rapid rise in " Internet Plus"/O2O development. 'As Nations' Internet fever gradually cooled down, the market became more rational the following year. China's slowing economic growth also affected retail. A report released by Nielsen showed that the growth rate of fast-moving consumer goods (FMCG) in China dropped from 60% in 2014 to 20% in 2015, while online and offline combined sales maintained a stable growth rate of 15%2 Industry giants began to expand and reorganize their online and offline activities. For example, e-commerce giant Alibaba invested in leading Chinese retailer Suning Commerce Group; JD.com acquired Yonghui Superstores, Wal-Mart expanded its online channel in China with the e-commerce platform yhd.com, and Wanda developed its own The case was developed by e-commerce channel. Even Alibaba founder Jack Ma, who was once Assistant Professor Chen LIN, asked by Wanda head Wang Jianlin to make an RMB 100 million bet of China Europe International Business School. The case that "e-commerce will outgrow bricks-and-mortar retailers", admitted was developed to provide the at the Computing Conference in October 2016 that "pure e-commerce basis of classroom discussion rather than to illustrate is dying out, and in a decade or two, the term 'e-commerce' will have effective or ineffective been replaced by 'new retail'. Thus, in order to create a true 'new handling of a management situation. retail' environment, we must focus on integrating online 3and offline Copyright (C) 2017 by CEIBS retail and logistics." " With Internet, there seems to be great potential (China Europe International for traditional companies to reach more customers and provide more Business School). No part of this publication may be products or services. reproduced, stored in a Ting Hsin International Group is not immune from the impact. In retrieval system, or transmitted in any form or by August 2016, the Group's Chairman, Wei Yingxing, received the worst any means - electronic, Q2 report in a decade that company' s instant noodle subsidiary, Master mechanical,photocopying, recording or otherwise - Kong, suffered an 87% drop in net profit. 4 Staring at the report, Wei without the permission of wondered: is this the beginning of a new era for Ting Hsin International CEIBS. Group that it can no longer count on Master Kong to sustain the growth? Among all of its subsidiaries, the brightest spot is FamilyMart, the convenience store chain, which had shown steady performances over years with number of stores and sales revenues both increased even in this tough year. Growth through store expansion sounds sensible, but is that not enough? Should FamilyMart expand its business scope and consider e-Commerce as well? Wei bounced the idea to FamilyMart CEO, Lin Jianhong. As integrating offline and online businesses is a trend, maybe FamilyMart should develop its online business by leveraging its offline competency, particularly enticing its sizable registered members of loyalty program (Maxxipoint Card) to shop online (see Exhibit 1). In fact, Lin had been quietly experimented the online idea. In 2015, FamilyMart had used social media channels such as WeChat and Weibo to sell limited product offers (not available in stores) to its members and seen some encouraging results. However, even with the promising figures, Lin has yet to be convinced that FamilyMart should go full throttle on online retailing. More careful assessments are needed but he must act fast because Lawson, one of FamilyMart's main competitors, was considering developing its online businesses soon. After finishing the conversation with wei, Lin quickly wrote down a few questions: Should FamilyMart go ahead with this online idea? If yes, what should the plan be? How should it be implemented? Familymart Background Founded in 1972 in Japan, FamilyMart has expanded its business in US, Taiwan, Thailand, Vietnam, Indonesia, the Philippines and more. In total, it has operated more than 18,000 stores globally as of today. FamilyMart (China) was a subsidiary of Ting Hsin International Group, a Taiwan-based food manufacturer and distributor that owns a wide range of popular brands including Master Kong, Dicos, Wei-Chuan, and FamilyMart. Ting Hsin Group also operates various businesses such as grain and oil, and real estate. The conglomerate has an extensive presence in Taiwan and Mainland China (see Exhibit 2 ) with annual sales of more than RMB 500 billion. FamilyMart entered China in 2004 and has shrived to become China' s largest convenience store chain, aiming to operate 20,000 stores in Mainland China by 2030 (see Exhibit 3). By the end of 2015, Familymart operated around 1,500 stores in Mainland China, achieving annual growth-in-store numbers of 20%, which is equivalent to the rate of opening a new store per day in 2015. Stores appeared in nine Chinese cities, thus far - Shanghai, Suzhou, Hangzhou, Wuxi, Guangzhou, Shenzhen, Dongguan. Chengdu and Beijing - with about 60% of its stores located in Shanghai alone. In Japan, where the total population numbered around 120 million people, one in three people visited FamilyMart every day, making it virtually a "second home" for Japanese people. In Japan and Taiwan, one FamilyMart store covers about 2,300 customers; in Shanghai, about 5,000 people; and in Beijing. nearly 10,000 people. FamilyMart, therefore, still had enormous growth potential in Mainland China. With its slogan "FamilyMart, where you" re part of the family", FamilyMart is dedicated to provide consumers with a friendly, warm, and convenient shopping place, 24 hours a day, seven days a week. With stores in residential communities, commercial districts, educational institutions, hospitals, factories, airports, metro stations, and other similar areas, FamilyMart provides its customers with daily necessities and services. Some stores allow customers to pay utility bills, do photocopying, photo printing, and ticket booking and even collect packages (see Exhibit 4 ). Company's COO Zhu Hongtao noted that FamilyMart's care for its customers could be seen in many small details in a store - proper height of shelves, wide and brightly lit aisles, rounded corners of check-out counter to avoid possible injuries to children, additional space to accommodate customers in wheelchairs. FamilyMart boasted a low complaint rate of 3.6 per 1 million customers, and its customer service center generally deals with customers' complaints within 48 hours. Such strong brand positioning, combined with careful and attentive operations helped FamilyMart to secure its success. "The Development of Major Convenience Store Chain Brands in China in 2015" report, released by the China Chain Store \& Franchise Association (CCFA), ranks FamilyMart ninth, with 2015 sales revenue of RMB 4.94 billion after tax. In contrast, Lawson and 7-Eleven, FamilyMart' s strong competitors, were ranked 19th and 44 , respectively (see Exhibit 5). In addition to this excellent performance, FamilyMart has over 9 million members registered through offline channels (60% of which were registered in East China) as of August 2016, and was ranked first in Nielsen's report on the convenience store industry. The Omni-Channel Transformation of China' s Retail Industry According to the latest report on China's Top 100 Major Retailers released in 2015, retail sales revenues showed negative growth for the first time, around 70% of the 30 department stores surveyed saw a significant drop in their business. As growth declined, competition intensified, and the costs of labor and rent continued to increase, every retailer must focus on optimizing management, transforming business, or re-inventing operations. (See Exhibit 6). E-commerce and online retail channels have created unprecedented opportunities for China's retail industry. Data from China's Ministry of Commerce shows that in 23015 , the total transaction value of e-commerce in China expanded at a rate of over 5%, which is five times as much as the country's GDP growth. Moreover, the online retail growth rate was 20.9% higher than that of the total retail sales of consumer goods. This business environment led many retailers to explore a shift to omni-channel operation. According to the "CEO Viewpoint 2016: The Journey to Profitable Omni-Channel Commerce" released in April 2016 by PwC and JDA Software, 98% of Chinese retail business CEOs surveyed said that in 2015 they increased their investment in omni-channel development to 45% of their total investments . As Offline-to-online concept becoming the prevailing thinking in the industry, convenience stores, given its nature of business, are at the forefront of this development. That is, convenience stores are expected to create a new business model and generate growth and profit. Other conventional retailers were also actively embracing the concept. For example, Carrefour and other supermarkets actively promoted their own apps and attempted to link to their offline stores. FamilyMart's "Making Life Easier with Maxsipoint" Initiative Wei believes that by leveraging Group's Maxxipoint loyalty program and thousands of stores around the country, Familymart could find ways to entice its customers to shop more and often and, eventually, increase overall market share and growth rate. The theme of Group's "Making Life Easier with Maxxipoint" initiative is to build an ecosystem covering a member's six essential activities - that is, food, apparel, accommodation, transportation, education and entertainment. To achieve its vision of making people' s lives easier with the Maxxipoint Card scheme, it would need to establish a seamless shopping experience for its customers regardless via online or offline. To that end, the Group sets to achieve four interlocked missions: acquisition, activation, retention and value - acquiring, activating, and retaining customers so as to maximizing the value contributed by the customers. Figure 1: The "Making Life Easier with Maxxipoint" initiative provided by Ting Hsin International Group Source: FamilyMart Intemal Resources For FamilyMart, "acquisition, activation, retention and value" are transformed into manageable targets with each item reflected in corresponding KPIs. - "Acquisition" : referred as acquiring more members through promotions in offline stores, apps and WeChat, and recommendations from existing members. To facilitate easy data management, mobile phone number is used as the sole membership identifier. - "Activation" : referred as members pay at least one visit in a month. This reflects how often and "alive" a customer shop at FamilyMart. - "Retention" : referred as the loyalty of a member based on his/her transaction records (continuous purchase patterns for three consecutive months). For instance, FamilyMart would increase interactions with customers by providing them with coupons or asking them to leave feedback, and encouraging them to "buy more, shop more frequently, and stay longer". - "Value": referred as average revenue per user (ARPU). Loyal customers may spend over RMB 100 cumulatively. Products: from Offline to Online 24/7 convenience stores were an essential part of life for modern urban residents, especially young people. Retail industry experts estimated that during the 22 years of a person' s life between the ages of 18 and 40 , he/she can spend over RMB 70,000 in a convenience stores. A standard FamilyMart store usually offered around 3,000 stock keeping units (SKU) in nearly 50 categories, including products directly provided by Master Kong and Wei-Chuan, both subsidiaries of the same parent company as FamilyMart, Ting Hsin International Group. FamilyMart replaced about 100 items with new goods every two weeks, and removed roughly 1,000 items from the shelves every year. In addition, FamilyMart customized its store design and goods selection based on each store's sgeographic location, the features of the surrounding commercial district, and the shopping habits of local residents. For example, 700 stores had ice cream machines, and each store could sell 100 ice creams on average during the hottest summer days, making them the biggest ice cream sellers. FamilyMart's wide range of fresh food such as bentos and odens were the most competitive items in the retail industry. Safe, delicious, and costing as little as RMB 10, FamilyMart's bentos were a consumer favorite. Among the ten types of bentos offered, the Cheese \& Curry Pork with Rice was the most popular dish, reaching daily sales of 10 meals per store on average. Every store sold more than 400 odens per day on average. Drinks, bentos and breakfasts were the most popular items in FamilyMart, and together they accounted for 50% of the total sales revenue. FamilyMart had established seven bento factories in China. Produced in clean and hygienic factories, 300,000 bentos were sold every day. The brand had been called Mainland China's biggest "canteen". Many of these bentos were also popular on Elema, a major online food delivery service provider in China. In the first half of 2016, FamilyMart's sales revenue reached RMB 29.38 billion, a 4.7% year-on-year increase, and its net profit was RMB 618 million, expanding at an annual rate of 14.24%, with earnings per share reaching RMB 2.77. The growth of FamilyMart's net profit was driven by the increased sales revenues from existing stores and fresh food. Items in FamilyMart were sold at roughly a 35% mark-up, while this figure was only around 28% in other convenience stores. (See Exhibit 7). Although FamilyMart had decades of experience in offline retailing, it was a new player in the world of online sales. Lin had some critical questions to consider: What should we sell? How should we sell it? And who will we sell it to? Ting Hsin International Group' 5 Chairman Wei had recently acquired a wine chteau in Bordeaux, France, and Lin believed that FamilyMart could also leverage wine sales. Since China had joined the WTO in 2001, wine imports into the country had increased, and its customer base was continuing to expand. Wine was now a beverage enjoyed by the middle class, not just something for the very wealthy. Statistics showed that in 2015 , FamilyMart sold more than 400,000 bottles of wine priced between RMB 100 and 300 . Among the wines it sold, there was one particular type which was ordered more than 30,000 bottles and the price was less than half of other online retailers. Lin said that: "People rarely think of FamilyMart as a wine supplier, yet we sold hundreds of thousands of bottles without strong marketing. So I think that wine is a category that FamilyMart can manage." "If FamilyMart moves to online operations, it will need to participate in price wars in order to win purchases. We have to provide goods with good value, not just low price! For instance, this particular kind of Bordeaux wine can be sold online for just RMB 39. How does that sound? I can take advantage of goods with low prices and high quality to attract customers to visit FamilyMart' s online sales channel (see Exhibit 8)." Apart from wine, Lin also thought about using a cross-border e-commerce service to provide other types of high-quality products from abroad, such as infant and maternal supply products, and imported snacks. He believed that as long as online products and prices were well managed, FamilyMart' s online sales channel could attract customers, which was similar to the "Making Life Easier with Maxxipoint" initiative launched by Wei. Industry Competition FamilyMart had gained a strong foothold against fierce competition from other convenience stores in the offline market. However, when developing its online business, it faced a different competitive landscape. Online supermarket operators included e-commerce giants (Tmall and JD.com operated online supermarkets) and the online sales chanmels of traditional ofline supermarkets (yhd.com, which had been acquired by Wal-Mart, and feiniu.com, which was operated by RT-MART), not just FamilyMart's traditional competitors such as 7-Eleven, Lawson, Kedi and alldays (operated by Shanghai Nong Gong Shang Supermarket Co., Ltd), and Quik (operated by Lianhua Supermarket Holdings Co., Ltd) (see Exhibit 9). Among the online supermarket operators in the B2C market, Tmall Supermarket ranked first with a market share of 58.0%, followed by JD.com with 22.9%, while yhd.com only accounted for 1.3% (see Exhibit 10). In addition, traditional e-commerce companies and Internet start-ups were also actively developing offline operations, such as daojia.jd.com and Hema Fresh Food, to win traditional customers. In an online market dominated by the Tmall supermarket, and with hundreds of other players gathering momentum, FamilyMart faced unprecedented challenges. Target Customers FamilyMart had mainly targeted white-collar workers, as well as elementary, high school and college students. Research showed that women made up 60% of FamilyMart's customers. Based on consumer behavior, FamilyMart did not emphasize the low-price of its goods, instead it highlighted that its products and services made customers' lives more convenient. The most appealing products were those with attractive packaging, or those that were intriguing, trendy or new. More specifically, FamilyMart defined its market segmentation in mainland China as follows: Geography: - Cities: FamilyMart tended to prioritize densely-populated first-tier cities (e.g. Shanghai and Beijing) when opening its first stores. - Locations: Stores were mainly located in residential communities, office buildings, residential communities with office buildings, hospitals, airports and railway stations. Generally speaking, sales revenues were highest in busy areas, such as hospitals, airports and railway stations. Demographics: - Age: FamilyMart's main customer group was under 30 years old. This group was quick to accept new things, had a high disposable income, and liked trendy products. - Occupation: Familymart mainly targeted students and white-collar workers, as their convenience store consumption needs were high. Behavior: - Timings of purchase: As FamilyMart mainly sold daily necessities, a consumer may visit a store more than once a day. - Customer objectives: Target customers valued convenience, speed and service above all else, and these were the defining features of FamilyMart. Membership Management Through the Maxxipoint Card scheme, Ting Hsin International Group had grown and integrated the members of all its subsidiaries. As of January 2016, the Maxxipoint Card scheme had more than 10 million members, with a network spanning 544 Chinese cities. The Maxxipoint Card app brought together the latest event information and advertisements for different shops, as well as the balances, cross-store points and consumption information of members. Customers could sign up for the Maxxipoint Card scheme for free in any FamilyMart, Dicos or Master Kong Chef' s Table store, earn points, and enjoy discounts (see Exhibit 11). Cashiers would ask every customer: "Do you have a Maxxipoint Card?" during the checkout process. The monthly percentage of customers signing up for membership had leveled off, at about 1%, down from 10%15% during the initial rollout of the scheme. Zhang Tinghao, who was charge of the scheme, said that, "To be honest, even though the Maxxipoint Card Scheme has provided Ting Hsin International Group with its strongest offline customer resources and largest amount of basic membership statistics, we are still held back by technology bottlenecks. Take the information system for example. The biggest challenge we face here is the integration of members and the fine-tuning of user labels." As of August 2016, FamilyMart had registered 9 million members in its bricks-and-mortar stores (see Exhibit 12). Their average age was about 30 , the ratio of male to female members was 45:55, the average shopping frequency was six times per month, with an average spend per visit of RMB 18. In comparison, the average shopping frequency of ordinary, non-member customers was 4.5 times per month, with an average per-visit spend of RMB 12 (based on estimates of ordinary members' consumption in the initial rollout period). In more densely populated areas, each convenience store saw a daily customer flow of about 1,000 visitors. Among these visitors, 63% were registered members. Social Media With 1.26 million followers on Weibo and over one million followers on WeChat, FamilyMart interacted with consumers through various social media (see Exhibit 13). For example, FamilyMart held lucky draws on Weibo to encourage followers to forward their comments and tag their friends, giving the brand's events greater visibility and getting more followers involved. More importantly, the friends that were tagged represent potential members that FamilyMart hoped to win over through its Member Get Member (MGM) scheme. In March 2016, FamilyMart launched its first self-developed mobile game on WeChat, where customers could win coupons or points to be used in FamilyMart stores (see Exhibit 14). The game was played by over 300,000 WeChat users. After observing the popularity of the mobile game Pokmon GO with young people around the world, Lin wondered whether FamilyMart could deploy mobile games to promote FamilyMart-based consumption with customers, and develop their consumption habits in order to increase sales. Games were designed to closely involve products in FamilyMart stores. Combining games with FMCG could not only familiarize customers with the products, but also increase customer loyalty by rewarding participants with coupons and points. If the mobile game can be designed to serve as a portal to FamilyMart's online sales channel, when customers share the game with friends and invite them to get involved, the game would not only entertain people, but would contribute to membership growth via the MGM (Member Get Member) system. Supply Chains When FamilyMart planned the launch of its online business across China, it faced considerable challenges to its supply chain. The brand had been working to address the challenge of "last-mile" delivery. The Ting Hsin International Group' s supply chains were all managed by the Supply Chain Unit which was founded in 2015, and included three food production companies and a logistics company specializing in fresh food production, warehouse storage, and logistics. Lin preferred to develop FamilyMart's online business by following JD.com's model, and gradually build up its delivery capacities for different categories and transit methods, from "click and collect" to home delivery. Customers could now place an order through FamilyMart's official WeChat account and pick up their goods at nearby FamilyMart stores. However, FamilyMart' s logistics system did not yet support home delivery, so it may need to cooperate with a third party for this. In terms of logistics, Lin had several questions: "Once we start to operate online services, what should we do if we are bombarded with surprising demand? Let' s say a customer based in Chengdu orders 100 boxes of diapers. Should we deliver them? Where will they be stored? How do we deliver them?" He asked the supply chain department to prepare a list of the logistics obstacles that they foresaw when developing the O2O model in order to determine FamilyMart's weak points and develop effective solutions (see Exhibit 15). Considerations FamilyMart hoped to leverage its offline advantages to create a platform for the Maxxipoint program with an O2O omni-channel approach. Apart from that, the O2O business had been developing according to plan. FamilyMart planned to launch its online campaign in the second half of 2016 with the support of resources and cooperation from different departments in the Group. Turning to O2O seemed to be a natural choice - in step with the times, but in 2015, news reports of several major O2O projects going bankrupt were generating lots of discussion, and the industry had become more pessimistic and wary of it. For instance, feiniu,com, the online platform of RT-Mart, had cost more than RMB 1 billion since its official launch in January, 2014, but had racked up losses of over RMB 300 million, and its parent company had seen an RMB 49.5 billion drop in its market value. As FamilyMart CEO Lin admitted, "every penny spent online will influence the offline 9business and stock price." If the investment was too large and the operation became overwhelming at the initial stage, the company's main business would be adversely affected. Lin had the cost control and prudent mindset as a Taiwanese manager, but also remarkable assessment skills, developed through years of experience in mainland China. "It won' t be easy at the beginning, but I want to give it a try. I' ve got a good attitude, and I think we can move fast by taking small steps. Trial and error! But for now our business focus is offline. I don' t want there to be a conflict between the online and offline businesses." Lin believed that FamilyMart differed from other O2O projects in terms of both internal and external conditions, after all, it already had more than 9 million members. However, FamilyMart was not the only place where its members could buy daily necessities and simple food, and it would not be the only one to offer these items online. Although it was certainly desirable to set up an omni-channel system for customers, it would also be unwise to ignore the competition. In other words, before it thought about online business models and tactics, FamilyMart needed to consider its positioning online (the goals). Differentiation was key, but FamilyMart had to take the overall marketing strategy and resource costs into consideration, including the Supply Chain Unit, cooperation from Shanghai Nexus Information Technology Co. Ltd., and recognition from its business partners. As for what to do, it seemed that there were already potential models operating within the industry, and these could be used as a reference. - Should FamilyMart 's online business merely supplement its offline stores, providing goods that could be displayed in store (like MUJI and its online store)? - Should FamilyMart simply duplicate its offline store online, to expand its service coverage and overcome regional limitations to reach places that did not have FamilyMart stores (like Sunglass Hut, an American sunglass retailer had done)? - Should its online store be membership-based and use low prices and low SKU to promote best-selling products (like Costco) (Exhibit 16)? - Or should it leverage its offline stores and membership scheme to turn its online store into a multi-category community service center, establishing a cross-industry ecosystem (like edaixi.com and colourlife.com) (Exhibit 17)? Lin needed to think things over carefully with his team, and report to the board on the next steps for online development within the next month. What is your opinion after analyzing FamilyMart's current operating conditions? - Should FamilyMart begin full-on development of its online business? - What is the best plan of action if the company is to engage in online development? - How should FamilyMart implement your chosen plan? Exhibit 1: Online and offline development of FamilyMart Source: internal materials of Shanghai FamilyMart Co., Ltd. Exhibit 2: Organization structure of Ting Hsin International Group 2010 Source: publicly available information online Exhibit 3: Layout of FamilyMart offline stores in mainland China Source: internal materials of Shanghai FamilyMart Co., Ltd. Exhibit 4: Introduction to FamilyMart and its brand positioning Exhibit 4-1: Exterior/interior of a FamilyMart store Source: official website of FamilyMart and dianping.com Exhibit 4-2: FamilyMart's slogan and goals Source: internal materials of Shanghai FamilyMart Co., Ltd. Exhibit 4-3: FamilyMart's strengths Source: official website of FamilyMart Exhibit 5: Development of major convenience store companies in China in 2015 Source: "Top 100 Chinese convenience store companies in 2015", CCFA: China Chain Store \& Franchise Association. Exhibit 6: Big data on market share of China's top 100 retailers Figure 6-1: Year-on-year sales growth of China's top 100 retailers Slump in the department store industry Since 2012 , the sales growth rate of China's top 100 retailers has been decreasing for four consecutive years. Source: big data on market shares of China's top 100 retailers Figure 6-2: A slump in the retail industry resulted in many store closures "The closing stores phenomenon" A slump in the retail industry results in many store closures: - Altogether 789 stores were closed in 2015 , among which 87 belonged to lagge departmeat store groups. - Wanda Dept. Store closed 56 stores in 2015. - Rainbow Depariment Store closed 4 stores. - Parson closed 3 stotes. - Companies such as Wangfijing and Intime Dept. Store each closed 1 store. Source: big data on market shares of China' s top 100 retailers Figure 6-3: Sales growth by type of operation in the retail industry in 2015 "Small and promising" convenience business The performance of the convenience store industry is outstanding in the slowgrowing retail. More and more types of operations are adopting the convenience store model. Source: big data on market shares of China's stop 100 retailers Exhibit 7: Annual and daily sales curves of FamilyMart offline stores Annual sales curve Source: internal materials of Shanghai FamilyMart Co., Ltd. Exhibit 8: Bordeaux wine sold at FamilyMart WeChat store Source: publicly available information online Exhibit 9: Comparison and analysis of FamilyMart's major offline competitors Source: public information online and information collected by the author Exhibit 10: iResearch report on the market share by gross merchandise value of China's B2C shopping websites in 2015 Source: iResearch Inc. the gross merchandise value of China' s online shopping market steadily grew in 2015, with B2C ranking firsstt, surpassing C2C. 9 May 2016 http.//www.iresearch.com.cn/view/260788.html Exhibit 11: Maxxipoint Card app Source: Shanghai Nexus Information Technology Co., Ltd, Maxxipoint Card, 16 April 2014 https://appsto.re/cn/eoQ9W.i Exhibit 12: Number of Maxxipoint Card members and proportion by source Number of members Source: internal materials of Shanghai FamilyMart Co., Ltd. Exhibit 13: FamilyMart Weibo and WeChat Source: publicly available information online Exhibit 14: FamilvMart mobile game on WeChat Source: publicly available information online Exhibit 15: Outline of FamilyMart's supply chain Source: internal materials of Shanghai FamilyMart Co., Ltd. Costco is a membership-based warehouse supermarket. Costco stores are open only to members and guests accompanied by members. Costco's low gross profit margin results from its innovative retail business model, which enables it to keep prices low. The gross revenue from sales can only cover daily operating costs, and its profit mainly comes from membership fees. The Costco model has three features: 1.Prices as low as the costs. Costco has two internal rules that guarantee the low prices of its high-quality products. First of all, for each product, the gross margin should not be higher than 14%. Secondly, if an external supplier offers other supermarkets a lower price than it offers to Costco, Costco will no longer sell products from this supplier. Strict implementation of the rules ensures low prices at Costco, whose average gross margin is only 7%. In other supermarkets, this usually ranges from 15% to 25%. 2.Low number of SKUs and "hit products". Costco only carries about 3,700 SKUs. This means Costco only offers one to two choices in each sub-category. Costco sells products with the potential to become hits. Low SKU number results in direct benefit - a 29.5-day inventory cycle, which is much shorter than Wal-Mart's 42 days and Target's 58 days. A shorter inventory cycle has improved cash flow efficiency, lowering the operating costs to a certain extent. 3. Affluent and loyal members. Costco has an ideal member base. According to a CNBC report, Costco's members are mostly college graduates with families and an annual income of about USD 100,000. The research firm Trefis reports that Costco's members are extremely loyal, with 90.6% of them choosing to renew their membership. In order to shop at Costco, customers must be members or accompanied by members. Executive membership costs US\$ 110 a year, while non-executive membership costs US\$ 55 a year. One third of Costco's members are executive members, who pay a membership fee double the regular fee, and enjoy a 2% reward from purchases at Costco. Executive members need to spend a lot at Costco to make the most of this reward, and this is precisely what they have been doing. Source: publicly available information online Exhibit 17: Introduction to e-Laundry and Colour Life \begin{tabular}{|l|l|} \hline \end{tabular} Source: publicly available information online Endnotes: 1 Linc, C., "Internet Plus: Can Mobile Commerce Fuel China's Economy?" Forbes, 27 March 2015http://www.forbes.com/sites/ceibs/2015/03/27/internet-plus-can-mobile-commerce-fuel-chinas-e conomy/\#3078793d 2257 2 Nielsen, "Insights of China' s FMCG Market in 2016" 3 TECH2IPO, "Computing Conference 2016: Jack Ma says E-commerce will Disappear , zol.com.cn, 13 October 2016, http:/ews.zol.com.cn/608/6086594.html. 4 Yuan Yutong, "Master Kong Submitted the Worst Q2 Report in the Last Decade: Net Profit Reduced 87\% 1 , finance.ifeng.com, August 2016, http://finance.ifeng.com/a/20160831/14837507_0.shtml 5 Hou Ruizhi, "Conglomerate Ting Hsin: 500billion RMB Annual Sales, 90% in China ", 21 October, 014,http://finance.ifeng.com/a/20141021/13202608_0.shtml 6 "Key Data of 'China E-Commerce Report 2015' Shows Total Transaction Value of RMB 20.8 Trillion, " China Finance, 30 June 016, http://finance.china.com.cn/roll/20160630/3792176.shtml 7 "CEO Viewpoint 2016: The Journey to Profitable Omni-Channel Commerce," JDA Software \& PwC, 5 April 2016, http://www.useit.com.cn/thread-11801-1-1.html 8 Chen Hua, '28 business details of FamilyMart: 60\% customers are female', The Paper, 17 August 2016, www.thepaper.cnewsDetail_forward_1467813. 9 Li Duo,Sun Qixiang, "How long can feiniu.com, the online platform of RT-Mart, carry on: RMB 1 billion investment with RMB 00 million loss , Beijing Business Today, 23 March 2016, http://www.bbtnews.com.cn/2016/0323/142866.shtml

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts