Question: Support department cost allocation-reciprocal services method Davis Snowflake & Co. produces Christmas stockings in its Cutting and Sewing departments. The Maintenance and Security departments support

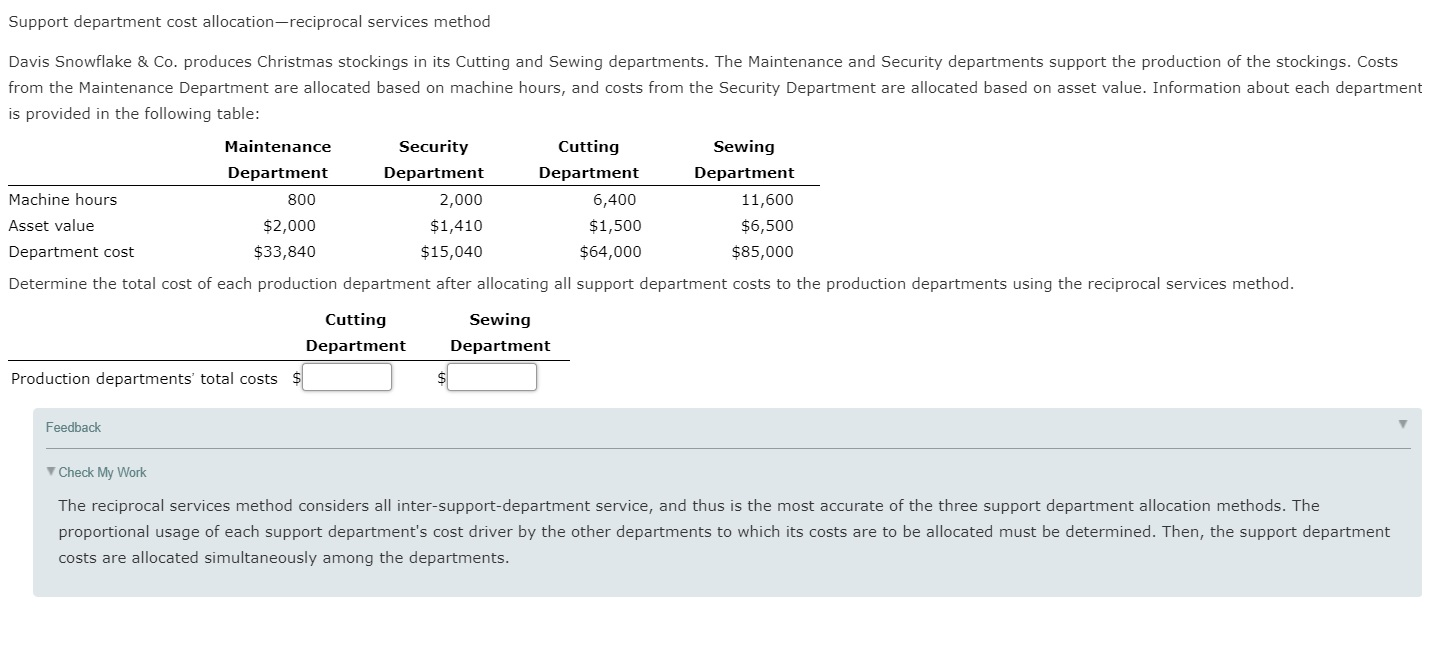

Support department cost allocation-reciprocal services method Davis Snowflake & Co. produces Christmas stockings in its Cutting and Sewing departments. The Maintenance and Security departments support the production of the stockings. Costs from the Maintenance Department are allocated based on machine hours, and costs from the Security Department are allocated based on asset value. Information about each department is provided in the following table: Maintenance Security Cutting Sewing Department Department Department Department Machine hours 800 2,000 6,400 11,600 Asset value $2,000 $1,410 $1,500 $6,500 Department cost $33,840 $15,040 $64,000 $85,000 Determine the total cost of each production department after allocating all support department costs to the production departments using the reciprocal services method. Cutting Department Sewing Department Production departments' total costs Feedback Check My Work The reciprocal services method considers all inter-support-department service, and thus is the most accurate of the three support department allocation methods. The proportional usage of each support department's cost driver by the other departments to which its costs are to be allocated must be determined. Then, the support department costs are allocated simultaneously among the departments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts