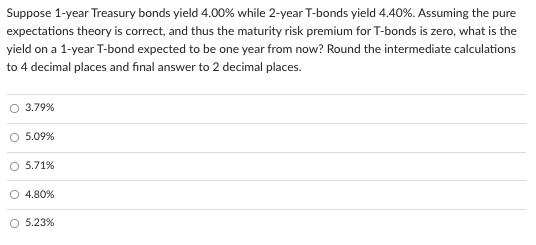

Question: Suppose 1-year Treasury bonds yield 4.00% while 2-year T-bonds yield 4.40%. Assuming the pure expectations theory is correct, and thus the maturity risk premium for

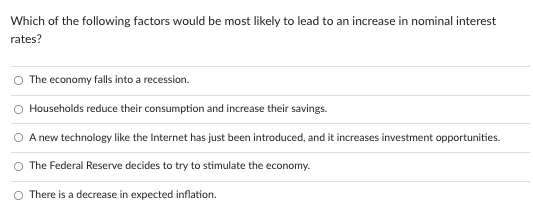

Suppose 1-year Treasury bonds yield 4.00% while 2-year T-bonds yield 4.40%. Assuming the pure expectations theory is correct, and thus the maturity risk premium for T-bonds is zero, what is the yield on a 1-year T-bond expected to be one year from now? Round the intermediate calculations to 4 decimal places and final answer to 2 decimal places. O 3.79% O 5.09% O 5.71% O 4.80% O 5.23% Which of the following factors would be most likely to lead to an increase in nominal interest rates? The economy falls into a recession. O Households reduce their consumption and increase their savings. A new technology like the Internet has just been introduced, and it increases investment opportunities. The Federal Reserve decides to try to stimulate the economy. There is a decrease in expected inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts