Question: Suppose a $1 excise or commodity tax is placed on the purchasers of cans of soda. Use the graph to illustrate the impact this tax

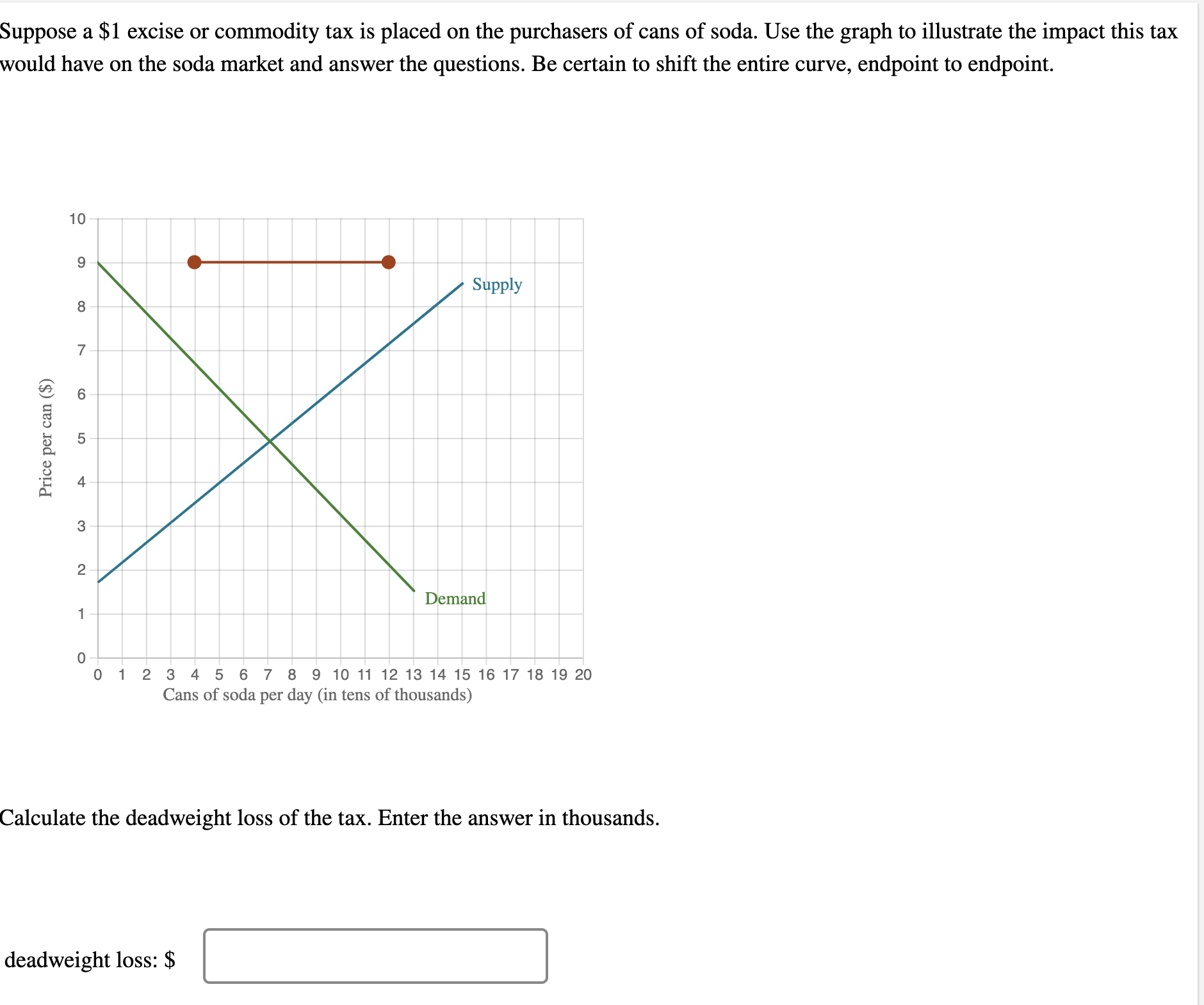

Suppose a $1 excise or commodity tax is placed on the purchasers of cans of soda. Use the graph to illustrate the impact this tax would have on the soda market and answer the questions. Be certain to shift the entire curve, endpoint to endpoint. 10 9 o Supply 8 7 6 8 Q 5 5 a, 8 '04 ~ 3 2 Demand 0123 456 7 8 91011121314 151617 18 19 20 Cans of soda per day (in tens of thousands) Calculate the deadweight loss of the tax. Enter the answer in thousands. Choose the answer that best describes the impact this tax would have on a household's economic income and whether it would cause a large change in the household's consumption of soda. This sort of change in behavior is called tax shifting. The tax would affect a household's () uses side, but tax shifting is not likely to occur. () sources side, but tax shifting is likely to occur. () sources side, but tax shifting is not likely to occur. () uses side, but tax shifting is likely to occur

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts