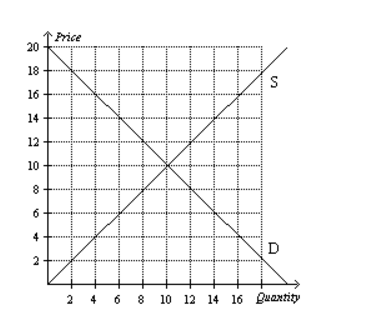

Suppose a $3 per-unit tax is imposed on the sellers of this good. How much is the

Fantastic news! We've Found the answer you've been seeking!

Question:

Suppose a $3 per-unit tax is imposed on the sellers of this good. How much is the burden of this tax on the buyers in this market?

Suppose a $3 per-unit tax is imposed on the sellers of this good. What price will buyers pay for the good after the tax is imposed?

Suppose a $3 per-unit tax is imposed on the sellers of this good. What is the effective price that sellers will receive for the good after the tax is imposed?

Suppose a $3 per-unit tax is imposed on the sellers of this good. How much is the burden of this tax on the sellers in this market?

Related Book For

Posted Date: