Question: Suppose a binomial tree model for a stock where price can go up (u = 1.2) or down (d = 0.7). The riskless interest

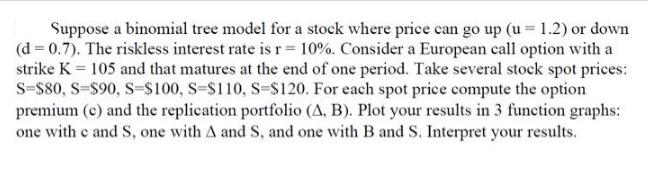

Suppose a binomial tree model for a stock where price can go up (u = 1.2) or down (d = 0.7). The riskless interest rate is r = 10%. Consider a European call option with a strike K = 105 and that matures at the end of one period. Take several stock spot prices: S=$80, S-$90, S-$100, S-$110, S-$120. For each spot price compute the option premium (c) and the replication portfolio (A, B). Plot your results in 3 function graphs: one with c and S, one with A and S, and one with B and S. Interpret your results.

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

To compute the option premium c and the replication portfolio A B for a European call option using the binomial tree model we need to follow these ste... View full answer

Get step-by-step solutions from verified subject matter experts