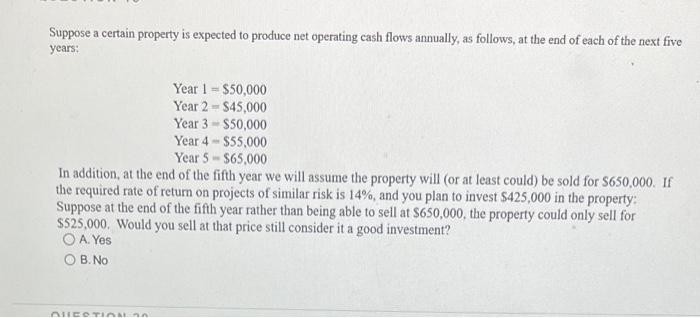

Question: Suppose a certain property is expected to produce net operating cash flows annually, as follows, at the end of each of the next five years:

Suppose a certain property is expected to produce net operating cash flows annually, as follows, at the end of each of the next five years: Year1=$50,000Year2=$45,000Year3=$50,000Year4=$55,000Year5=$65,000 In addition, at the end of the fifth year we will assume the property will (or at least could) be sold for 5650,000 . If the required rate of retum on projects of similar risk is 14%, and you plan to invest $425,000 in the property: Suppose at the end of the fifth year rather than being able to sell at $650,000, the property could only sell for $525,000. Would you sell at that price still consider it a good investment? A. Yes B. No

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock