Question: Suppose a company will issue new 2 5 - year debt with a par value of $ 1 , 0 0 0 and a coupon

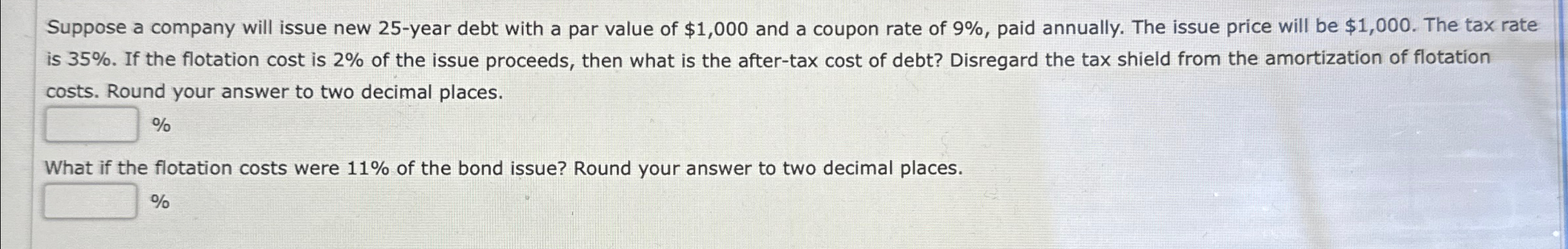

Suppose a company will issue new year debt with a par value of $ and a coupon rate of paid annually. The issue price will be $ The tax rate is If the flotation cost is of the issue proceeds, then what is the aftertax cost of debt? Disregard the tax shield from the amortization of flotation costs. Round your answer to two decimal places.

What if the flotation costs were of the bond issue? Round your answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock