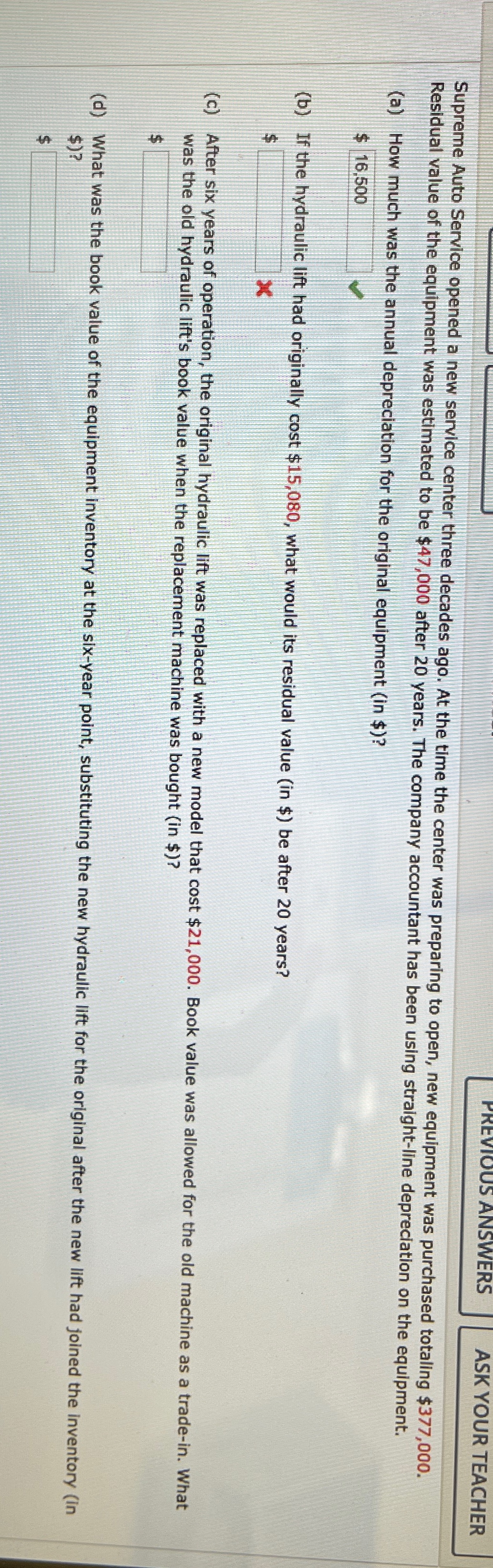

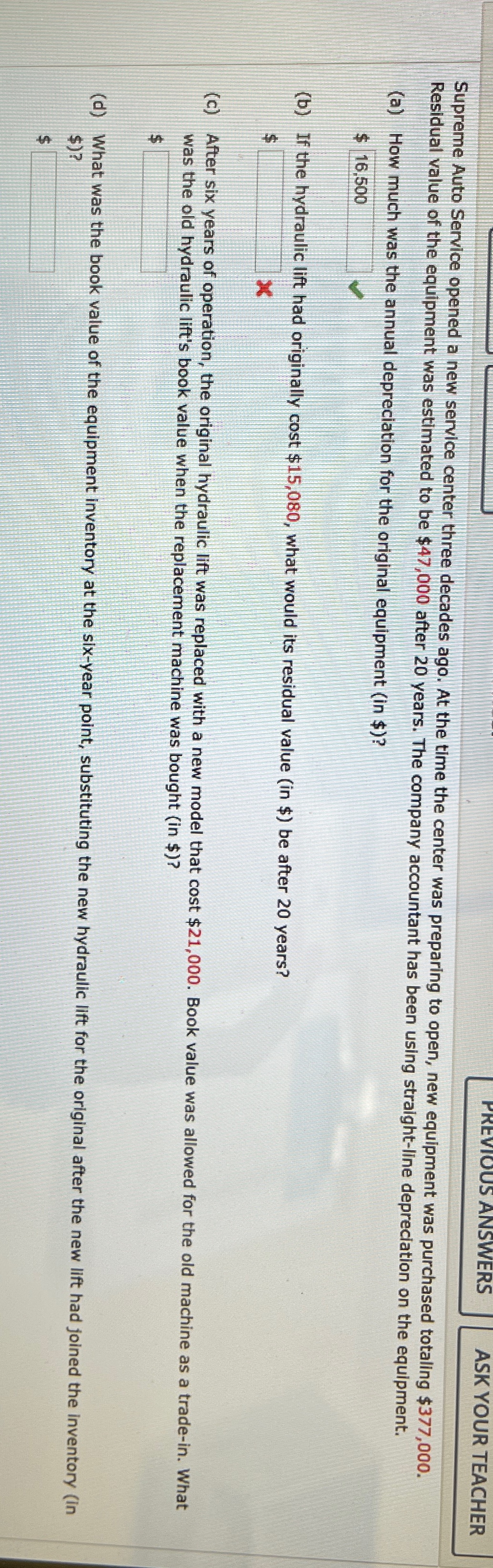

Question: Suppose a computer software developer for a certain company purchased a computer system for $ 7 5 , 0 0 0 on April 2 7

Suppose a computer software developer for a certain company purchased a computer system for $ on April The computer system is used for business of the time. The accountant for the company elected to take a $ Section deduction, and the asset qualified for a special depreciation allowance.

a What was the basis for depreciation in $ of the computer system? See Table

$

b What was the amount in $ of the first year's depreciation using MACRS? See Table and Table

$

TABLE

Special Depreciation Allowance

Certain Qualified

tableAsset Placed into Service,Special AllowanceSeptember May

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock