Question: Suppose a distribution center is considering three options for expansion ( 1 ) to expand into a new plant, ( 2 ) to add on

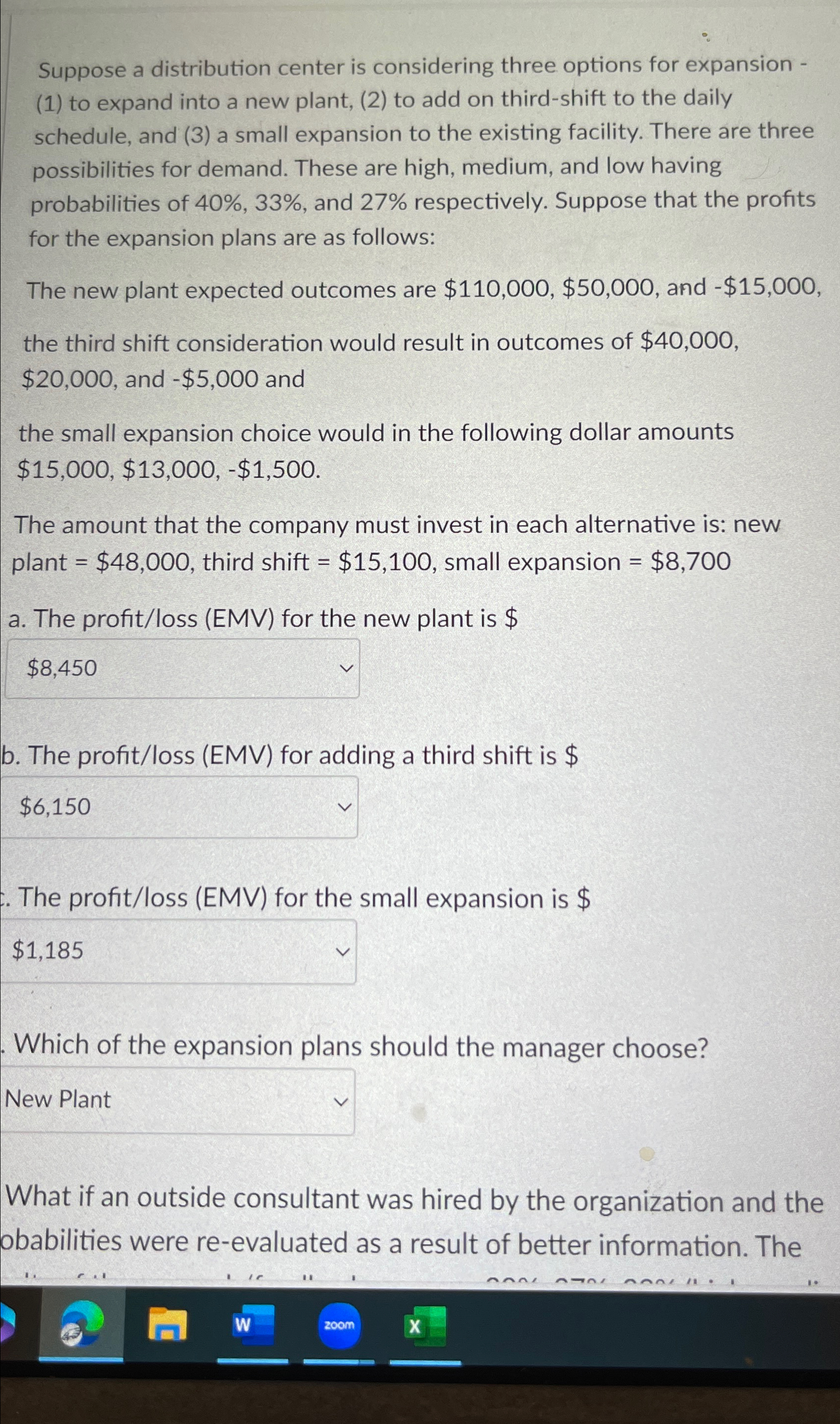

Suppose a distribution center is considering three options for expansion to expand into a new plant, to add on thirdshift to the daily schedule, and a small expansion to the existing facility. There are three possibilities for demand. These are high, medium, and low having probabilities of and respectively. Suppose that the profits for the expansion plans are as follows:

The new plant expected outcomes are $$ and $ the third shift consideration would result in outcomes of $ $ and $ and the small expansion choice would in the following dollar amounts $$$

The amount that the company must invest in each alternative is: new plant $ third shift $ small expansion $

a The profitloss EMV for the new plant is $

b The profitloss EMV for adding a third shift is $

The profitloss EMV for the small expansion is $

Which of the expansion plans should the manager choose?

What if an outside consultant was hired by the organization and the obabilities were reevaluated as a result of better information. The

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock