Question: Suppose a firm uses both the net present value (NPV) technique and the internal rate of return (IRR) technique to evaluate two mutually exclusive capital

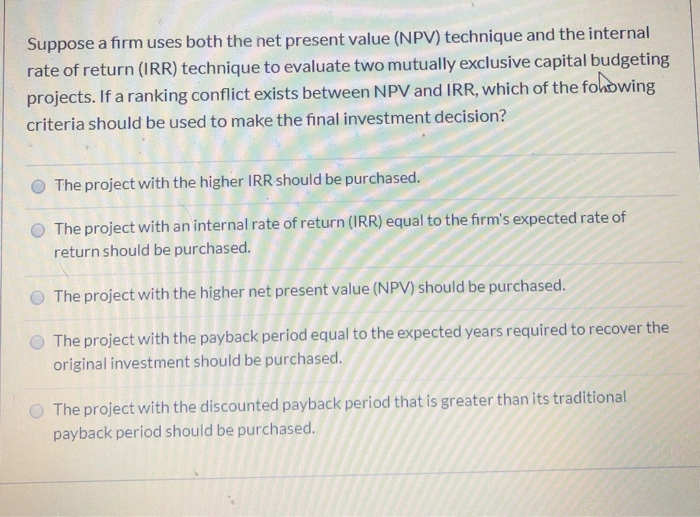

Suppose a firm uses both the net present value (NPV) technique and the internal rate of return (IRR) technique to evaluate two mutually exclusive capital budgeting projects. If a ranking conflict exists between NPV and IRR, which of the fohowing criteria should be used to make the final investment decision? The project with the higher IRR should be purchased. The project with an internal rate of return (IRR) equal to the firm's expected rate of return should be purchased. The project with the higher net present value (NPV) should be purchased. The project with the payback period equal to the expected years required to recover the original investment should be purchased. The project with the discounted payback period that is greater than its traditional payback period should be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts