Question: Suppose a risk-free security pays a 6% return, and a market portfolio has an expected return of 10%. What is the expected return on

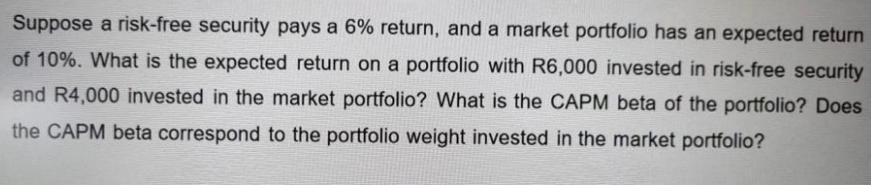

Suppose a risk-free security pays a 6% return, and a market portfolio has an expected return of 10%. What is the expected return on a portfolio with R6,000 invested in risk-free security and R4,000 invested in the market portfolio? What is the CAPM beta of the portfolio? Does the CAPM beta correspond to the portfolio weight invested in the market portfolio?

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

To calculate the expected return of a portfolio with investments in a riskfree security and the mark... View full answer

Get step-by-step solutions from verified subject matter experts