Question: Suppose ABC Telecom Inc.'s CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, the does

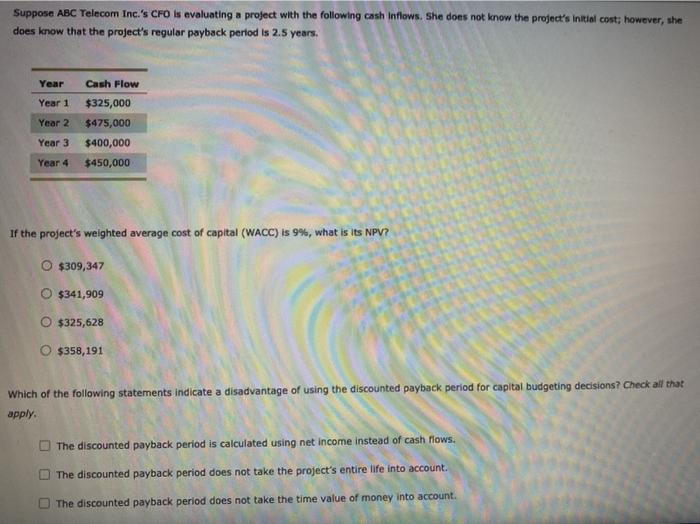

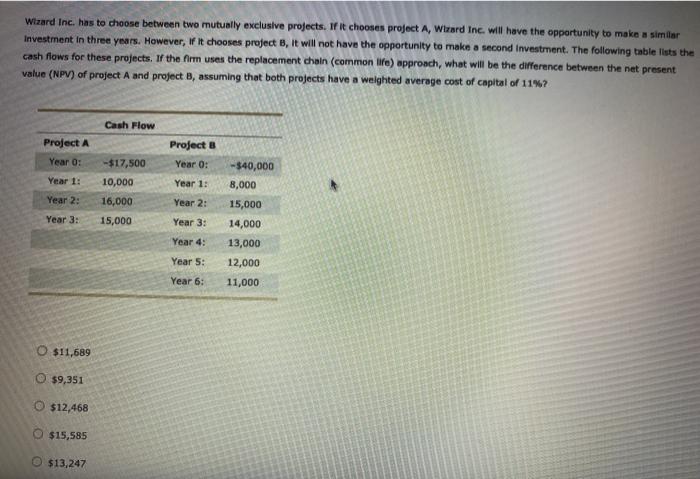

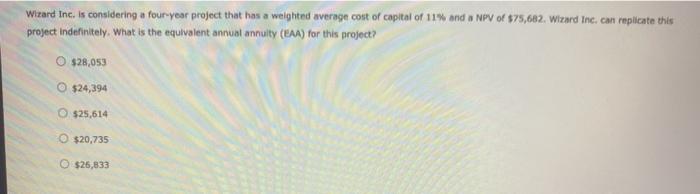

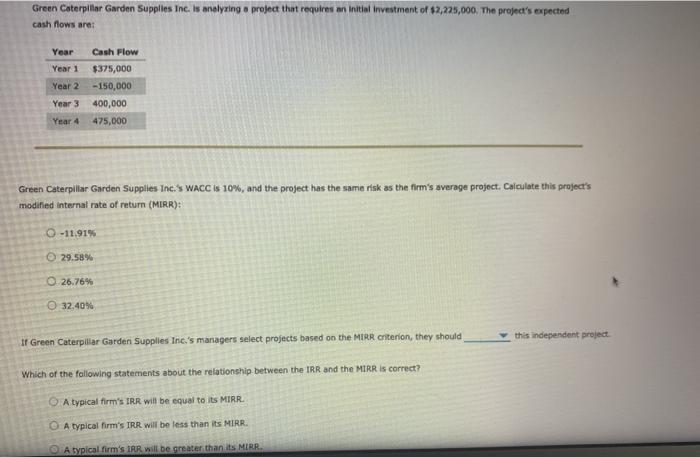

Suppose ABC Telecom Inc.'s CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, the does know that the project's regular payback period is 2.5 years. Year Year 1 Year 2 Cash Flow $325,000 $475,000 $400,000 $450,000 Year 3 Year 4 If the project's weighted average cost of capital (WACC) is 9%, what is its NPV? O $309,347 O $341,909 $325,628 $358,191 Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply The discounted payback period is calculated using net income instead of cash flows. The discounted payback period does not take the project's entire life into account. The discounted payback period does not take the time value of money into account. Wizard Inc. has to choose between two mutually exclusive projects. If it chooses project A, Wizard Inc. will have the opportunity to make a similar Investment in three years. However, it chooses project B, it will not have the opportunity to make a second Investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project 8, assuming that both projects have a weighted average cost of capital of 11%? Cash Flow Projects Project A Year 0: Year 0: Year 1: -$17,500 10,000 16,000 Year 1: - $40,000 8,000 15,000 14,000 Year 2: Year 2: Year 3: 15,000 Year 3: Year 4: Year 5: 13,000 12,000 11,000 Year 6: O $11,689 O $9,351 $12,468 $15,585 $13,247 Wizard Inc. is considering a four-year project that has a weighted average cost of capital of 11% and a NPV of $75,682. Wizard Inc. con replicate this project indefinitely. What is the equivalent annual annuity (EAA) for this project? O $28,053 $24,394 0 $25,614 $20,735 $26,833 Green Caterpillar Garden Supplies Inc. Is analyzing a project that requires an initial Investment of $2,225,000. The project's expected cash flows are: Year Year 1 Year 2 Year 3 Year 4 Cash Flow $375,000 - 150,000 400,000 475,000 Green Caterpillar Garden Supplies Inc.'s WACC IS 10%, and the project has the same risk as the firm's average project. Calculate this project's modified Internal rate of return (MIRR): 0 -11.91% 29.58% 26.76% 32,40% this independent project If Green Caterpillar Garden Supplies Inc.'s managers select projects based on the MIRR criterion, they should Which of the following statements about the relationship between the IRR and the MIRR is correct? A typical firm's IRR will be equal to its MIRR. A typical firm's TRR will be less than its MIRR. A typical firm's IRR will be greater than its MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts