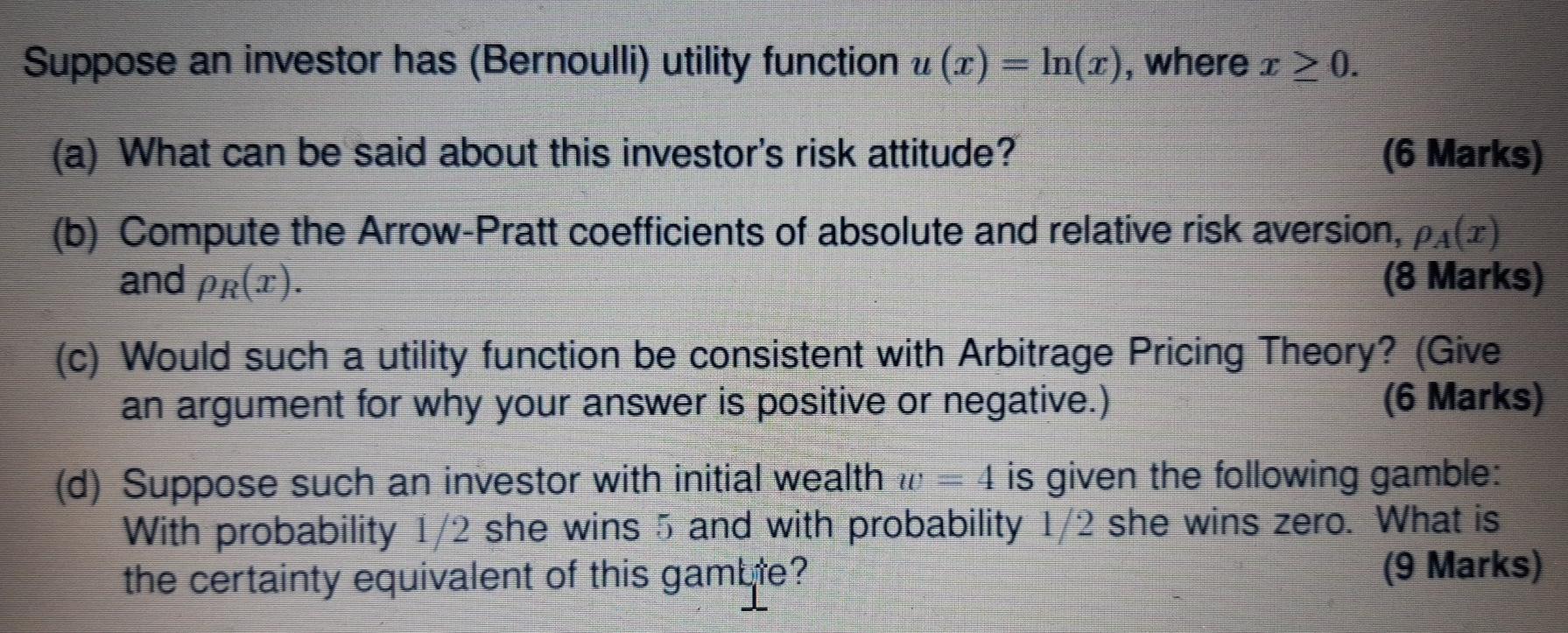

Question: Suppose an investor has (Bernoulli) utility function u (c) = In(), where x > 0. (a) What can be said about this investor's risk attitude?

Suppose an investor has (Bernoulli) utility function u (c) = In(), where x > 0. (a) What can be said about this investor's risk attitude? (6 Marks) (b) Compute the Arrow-Pratt coefficients of absolute and relative risk aversion, par) and pr(r). (8 Marks) (C) Would such a utility function be consistent with Arbitrage Pricing Theory? (Give an argument for why your answer is positive or negative.) (6 Marks) (d) Suppose such an investor with initial wealth w = 4 is given the following gamble: With probability 1/2 she wins 5 and with probability 1/2 she wins zero. What is the certainty equivalent of this gamlyte? (9 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts