Question: Suppose Boeing imported a Rolls-Royce jet engine for 5 million payable in one year. Market condition is summarized as follows: The U.S. interest rate:

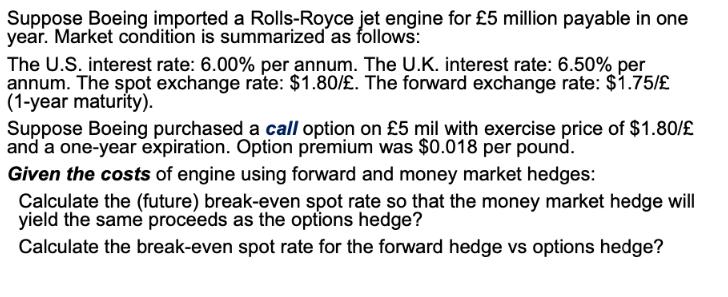

Suppose Boeing imported a Rolls-Royce jet engine for 5 million payable in one year. Market condition is summarized as follows: The U.S. interest rate: 6.00% per annum. The U.K. interest rate: 6.50% per annum. The spot exchange rate: $1.80/. The forward exchange rate: $1.75/ (1-year maturity). Suppose Boeing purchased a call option on 5 mil with exercise price of $1.80/ and a one-year expiration. Option premium was $0.018 per pound. Given the costs of engine using forward and money market hedges: Calculate the (future) break-even spot rate so that the money market hedge will yield the same proceeds as the options hedge? Calculate the break-even spot rate for the forward hedge vs options hedge?

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Lets break this down stepbystep 1 Money market hedge Boeing borrows 9 million 5 million GBP 180 spot ... View full answer

Get step-by-step solutions from verified subject matter experts