Question: Steve Bono is valuing the equity of Petroleo Brasileiro (nYSe: PBr), commonly known as Petrobras, by using the single-stage (constant-growth) FCFE model. The current

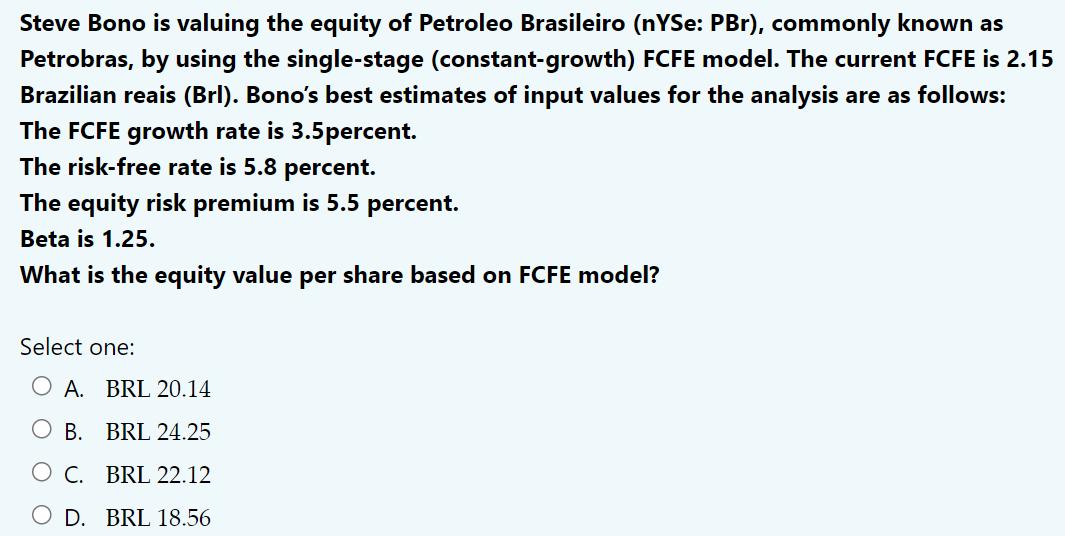

Steve Bono is valuing the equity of Petroleo Brasileiro (nYSe: PBr), commonly known as Petrobras, by using the single-stage (constant-growth) FCFE model. The current FCFE is 2.15 Brazilian reais (Brl). Bono's best estimates of input values for the analysis are as follows: The FCFE growth rate is 3.5percent. The risk-free rate is 5.8 percent. The equity risk premium is 5.5 percent. Beta is 1.25. What is the equity value per share based on FCFE model? Select one: A. BRL 20.14 OB. BRL 24.25 C. BRL 22.12 D. BRL 18.56

Step by Step Solution

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step 11 As per CAPM model Cost of Equity Risk free Rate ... View full answer

Get step-by-step solutions from verified subject matter experts