Question: Suppose Microsoft has mean 7% and standard deviation 10%, and GameStop has mean 23%. The risk-free rate is 5%. Alice and Bob have mean-variance utility.

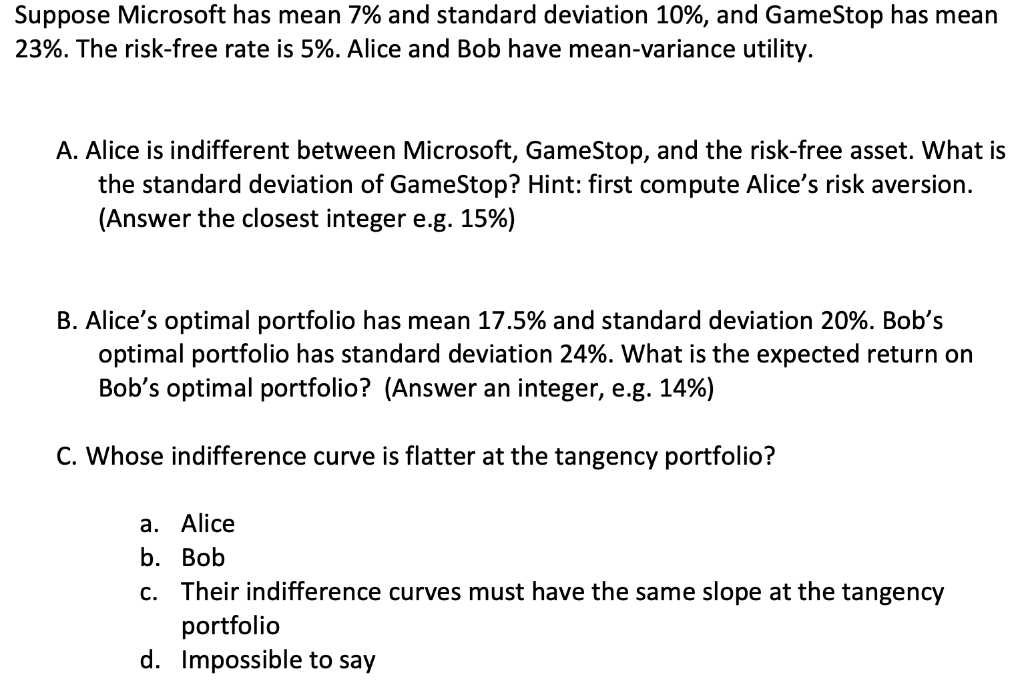

Suppose Microsoft has mean 7% and standard deviation 10%, and GameStop has mean 23%. The risk-free rate is 5%. Alice and Bob have mean-variance utility. A. Alice is indifferent between Microsoft, GameStop, and the risk-free asset. What is the standard deviation of GameStop? Hint: first compute Alice's risk aversion. (Answer the closest integer e.g. 15%) B. Alice's optimal portfolio has mean 17.5% and standard deviation 20%. Bob's optimal portfolio has standard deviation 24%. What is the expected return on Bob's optimal portfolio? (Answer an integer, e.g. 14%) C. Whose indifference curve is flatter at the tangency portfolio? a. Alice b. Bob c. Their indifference curves must have the same slope at the tangency portfolio d. Impossible to say

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts