Question: Suppose my utility function for asset position x is given by u(x)=ln(x). a. Am I risk-averse, risk-neutral, or risk-seeking? b. I now have $20,000 and

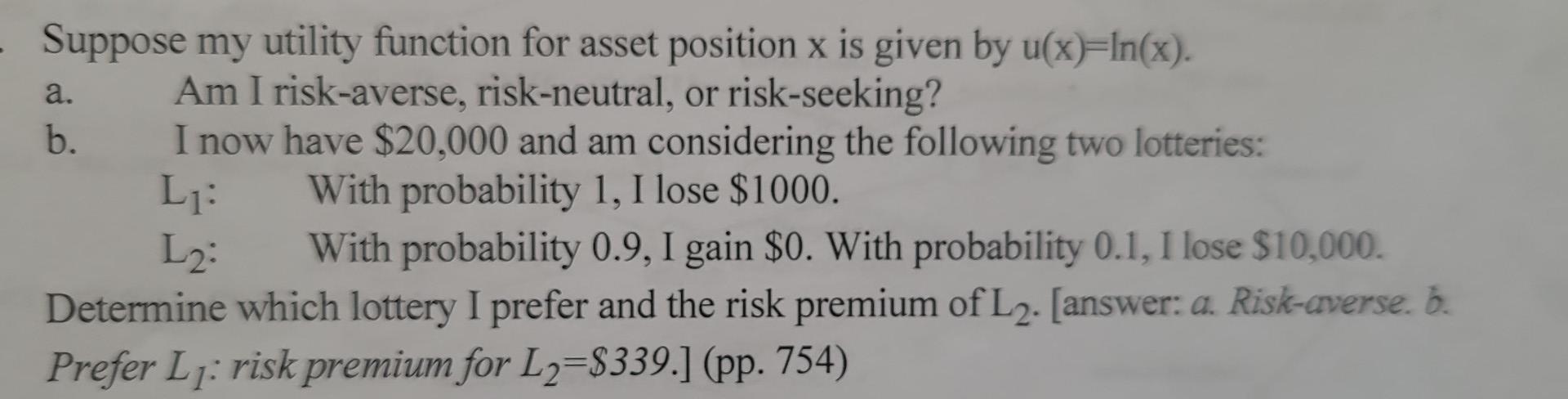

Suppose my utility function for asset position x is given by u(x)=ln(x). a. Am I risk-averse, risk-neutral, or risk-seeking? b. I now have $20,000 and am considering the following two lotteries: L1: With probability 1 , I lose $1000. L2 : With probability 0.9 , I gain $0. With probability 0.1 , I lose $10,000. Determine which lottery I prefer and the risk premium of L2. [answer: a. Risk-averse. b. Prefer L1: risk premium for L2=$339.] (pp. 754)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts