Question: Suppose So = 100, = 7%, r = 2%, o = 20%, T = 0.5, A = 1/52 and t = i, i =

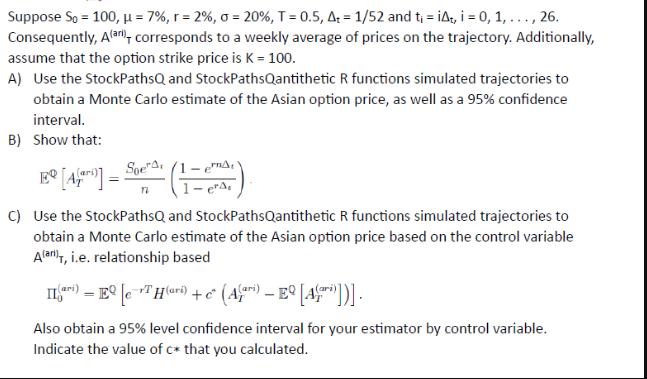

Suppose So = 100, = 7%, r = 2%, o = 20%, T = 0.5, A = 1/52 and t = i, i = 0, 1,..., 26. Consequently, A(ar), corresponds to a weekly average of prices on the trajectory. Additionally, assume that the option strike price is K = 100. A) Use the StockPathsQ and StockPathsQantithetic R functions simulated trajectories to obtain a Monte Carlo estimate of the Asian option price, as well as a 95% confidence interval. B) Show that: 129 [A] = Soe", 17 1- eA C) Use the StockPathsQ and StockPathsQantithetic R functions simulated trajectories to obtain a Monte Carlo estimate of the Asian option price based on the control variable Alar), i.e. relationship based ari II) EQ eTH(ari) + (A) -EQ [4])]. Also obtain a 95% level confidence interval for your estimator by control variable. Indicate the value of c* that you calculated.

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

A Use the StockPathsQ and StockPathsQantithetic R functi... View full answer

Get step-by-step solutions from verified subject matter experts