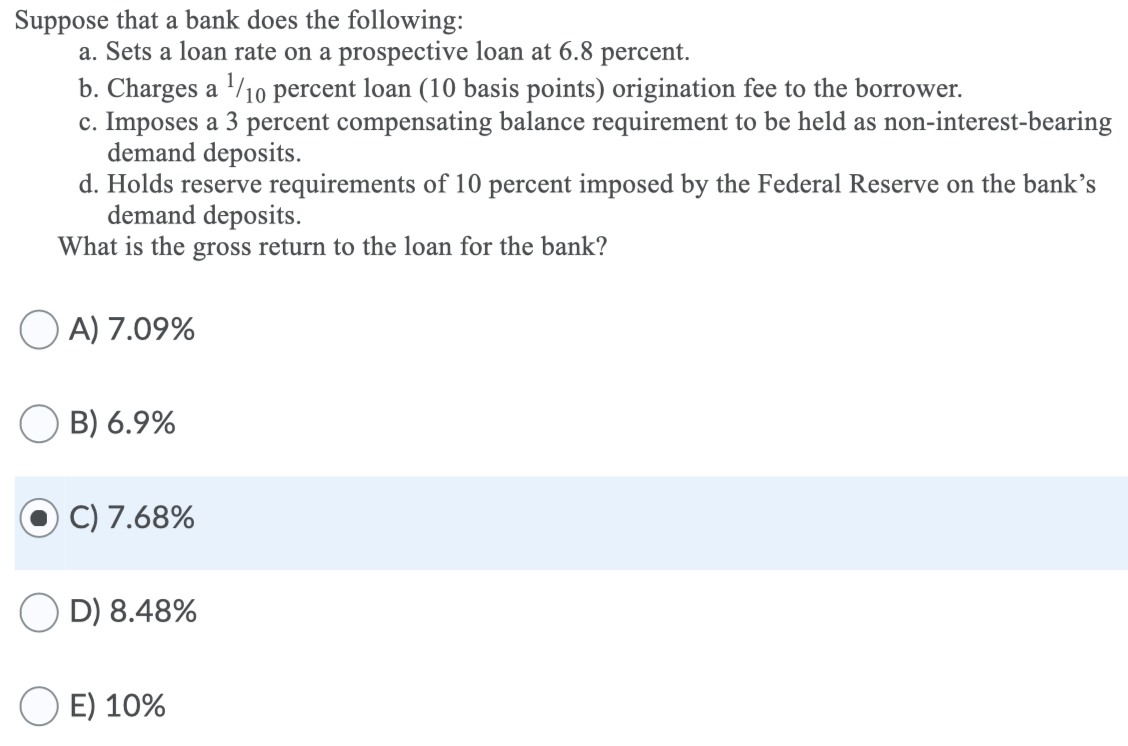

Question: Suppose that a bank does the following: a. Sets a loan rate on a prospective loan at 6.8 percent. b. Charges a 1/10 percent loan

Suppose that a bank does the following: a. Sets a loan rate on a prospective loan at 6.8 percent. b. Charges a 1/10 percent loan (10 basis points) origination fee to the borrower. c. Imposes a 3 percent compensating balance requirement to be held as non-interest-bearing demand deposits. d. Holds reserve requirements of 10 percent imposed by the Federal Reserve on the bank's demand deposits. What is the gross return to the loan for the bank? A) 7.09% B) 6.9% C) 7.68% D) 8.48% E) 10% Suppose that a bank does the following: a. Sets a loan rate on a prospective loan at 6.8 percent. b. Charges a 1/10 percent loan (10 basis points) origination fee to the borrower. c. Imposes a 3 percent compensating balance requirement to be held as non-interest-bearing demand deposits. d. Holds reserve requirements of 10 percent imposed by the Federal Reserve on the bank's demand deposits. What is the gross return to the loan for the bank? A) 7.09% B) 6.9% C) 7.68% D) 8.48% E) 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts