Question: Suppose that a firm has a project that was started last year, and it is expected to earn less than its cost of capital if

Suppose that a firm has a project that was started last year, and it is expected to earn less than its cost of capital if left unchanged. Management comes up with these suggestions.(a) Invest in a debottlenecking project that will raise economic profit, but not up to the cost of capital.(b) Cut operating costs but not enough to earn the cost of capital.(c) Sell the unprofitable business unit for a premium over its book value.Some numbers are given in Table Q13.2.

Value each alternative and compare them in terms of value creation.

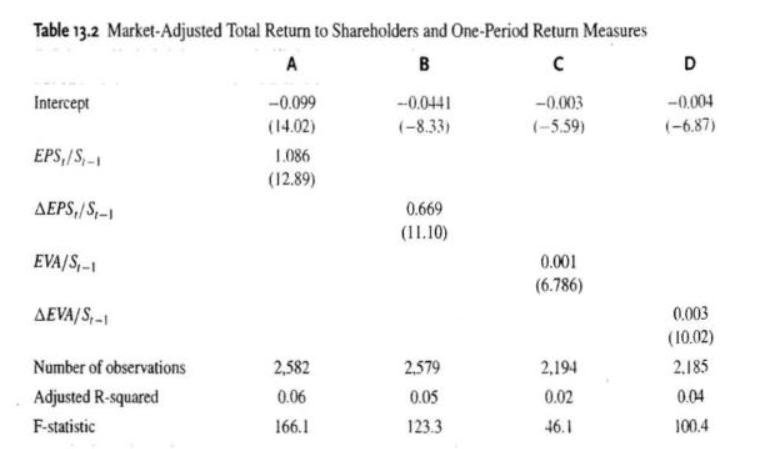

Table 13.2 Market-Adjusted Total Return to Shareholders and One-Period Return Measures A B Intercept EPS,/S-1 AEPS,/St-1 EVA/S-1 AEVA/S-1 Number of observations Adjusted R-squared F-statistic -0.099 (14.02) 1.086 (12.89) 2,582 0.06 166.1 -0.0441 (-8.33) 0.669 (11.10) 2,579 0.05 123.3 -0.003 (-5.59) 0.001 (6.786) 2,194 0.02 46.1 D -0.004 (-6.87) 0.003 (10.02) 2,185 0.04 100.4

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

The value of each alternative can be determined by calculating the marketadjusted to... View full answer

Get step-by-step solutions from verified subject matter experts