Question: Suppose that a representative consumer has a utility function that satisfies CRRA U(Ct)=1Ct1=ln(Ct)with>0,=1with=1 The representative consumer wants to MaxCt,NEt[U(Ct)+U(Ct+1)](0,1) subject to CtCt+1=C~tPtN=C~t+1+(Pt+1+Dt+1)N where C~t is

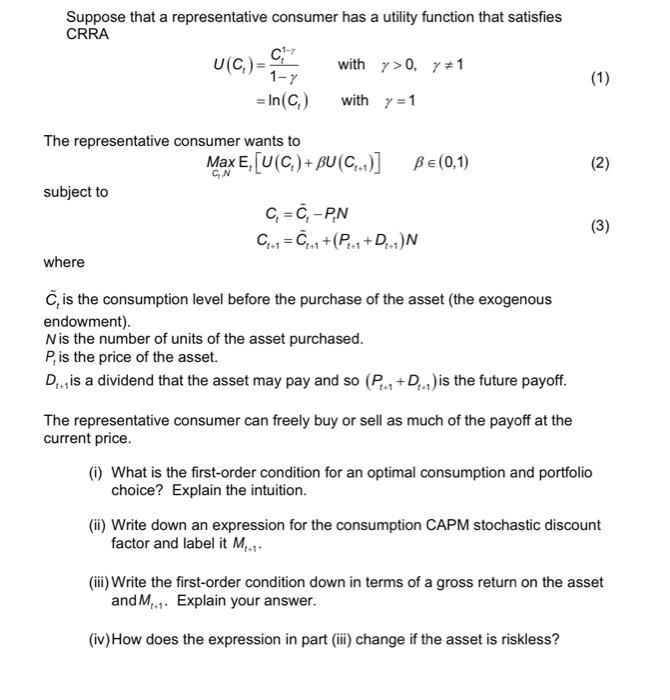

Suppose that a representative consumer has a utility function that satisfies CRRA U(Ct)=1Ct1=ln(Ct)with>0,=1with=1 The representative consumer wants to MaxCt,NEt[U(Ct)+U(Ct+1)](0,1) subject to CtCt+1=C~tPtN=C~t+1+(Pt+1+Dt+1)N where C~t is the consumption level before the purchase of the asset (the exogenous endowment). N is the number of units of the asset purchased. Pt is the price of the asset. Dt+1 is a dividend that the asset may pay and so (Pt+1+Dt+1) is the future payoff. The representative consumer can freely buy or sell as much of the payoff at the current price. (i) What is the first-order condition for an optimal consumption and portfolio choice? Explain the intuition. (ii) Write down an expression for the consumption CAPM stochastic discount factor and label it Mt+1. (iii) Write the first-order condition down in terms of a gross return on the asset and Mt+1. Explain your answer. (iv)How does the expression in part (iii) change if the asset is riskless

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts