Question: Suppose that a two - factor ( Factor X and Factor Y ) model describes the return generating processes of all securities in the market

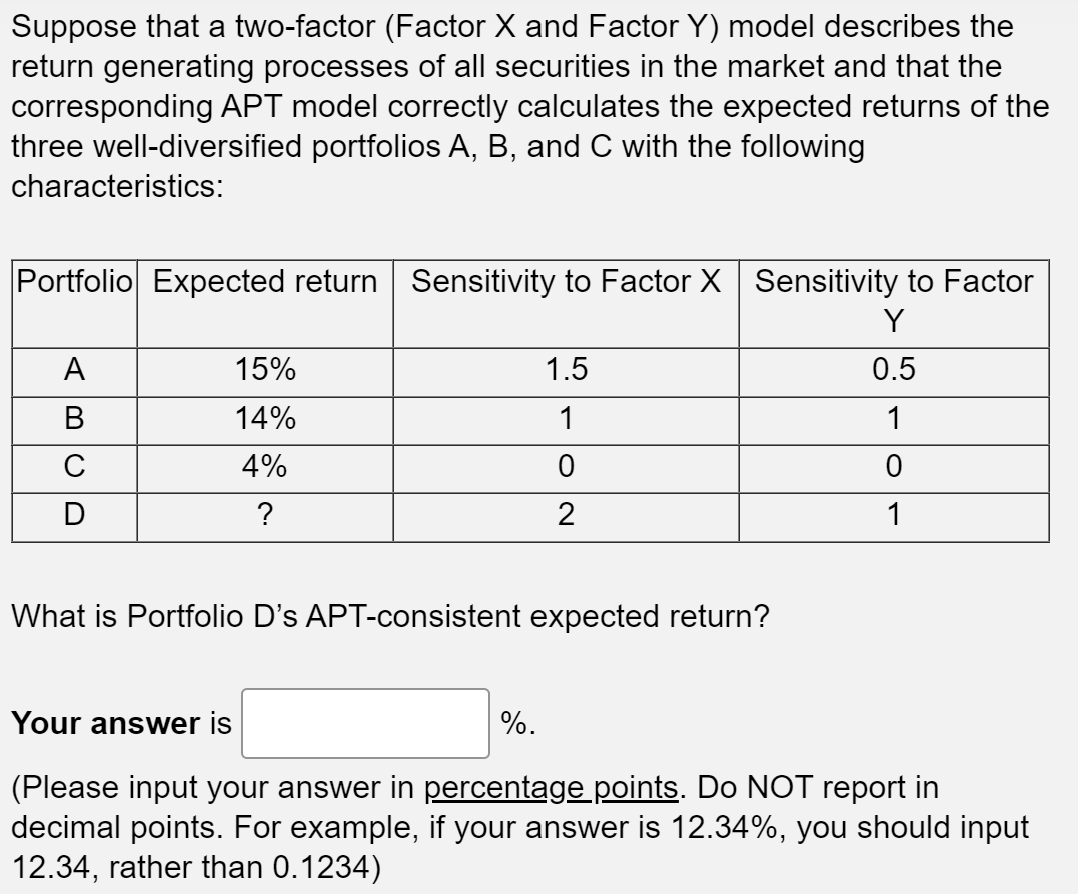

Suppose that a twofactor Factor X and Factor Y model describes the return generating processes of all securities in the market and that the corresponding APT model correctly calculates the expected returns of the three welldiversified portfolios A B and C with the following characteristics:

Portfolio

Expected return

Sensitivity to Factor X

Sensitivity to Factor Y

A

B

C

D

What is Portfolio Ds APTconsistent expected return?

Suppose that a twofactor Factor and Factor model describes the return generating processes of all securities in the market and that the corresponding APT model correctly calculates the expected returns of the three welldiversified portfolios and with the following characteristics:

tablePortfolioExpected return,Sensitivity to Factor xtableSensitivity to FactorYABCD

What is Portfolio Ds APTconsistent expected return?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock