Question: Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can

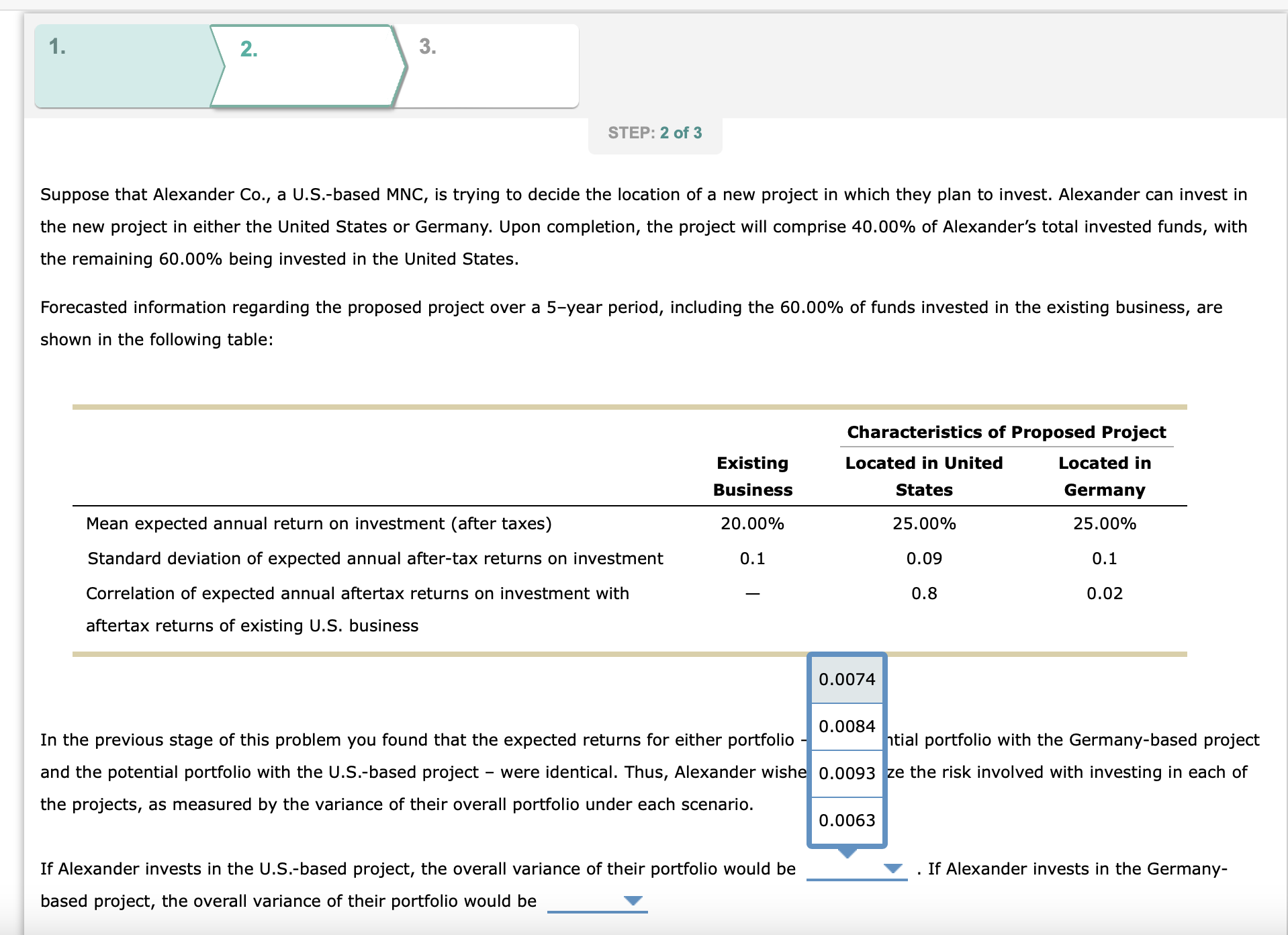

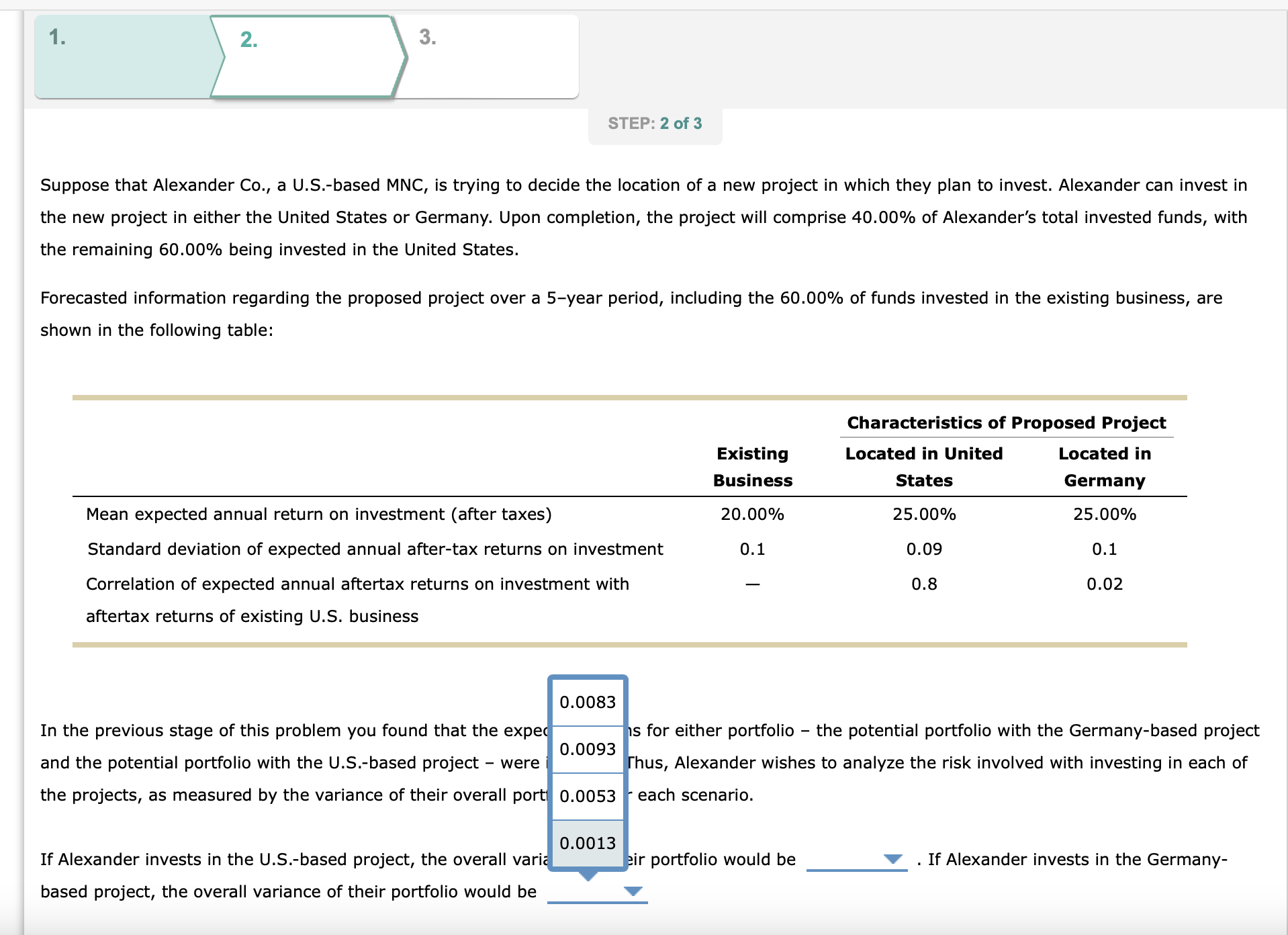

Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany. Upon completion, the project will comprise 40.00% of Alexander's total invested funds, with the remaining 60.00% being invested in the United States. Forecasted information regarding the proposed project over a 5-year period, including the 60.00% of funds invested in the existing business, are shown in the following table: If Alexander invests in the U.S.-based project, the overall variance of their portfolio would be . If Alexander invests in the Germanybased project, the overall variance of their portfolio would be Suppose that Alexander Co., a U.S.-based MNC, is trying to decide the location of a new project in which they plan to invest. Alexander can invest in the new project in either the United States or Germany. Upon completion, the project will comprise 40.00% of Alexander's total invested funds, with the remaining 60.00% being invested in the United States. Forecasted information regarding the proposed project over a 5-year period, including the 60.00% of funds invested in the existing business, are shown in the following table: In the previous stage of this problem you found that the expec and the potential portfolio with the U.S.-based project - were the projects, as measured by the variance of their overall port the based project, the overall variance of their portfolio would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts